£10,000 Invested in Vodafone Shares 5 Years Ago – What’s Its Value Now?

Five years can feel like a short time in our lives, but in the stock market, it can change everything. Back in 2019, many UK investors were looking at Vodafone shares as a safe choice. It was one of the largest telecom companies in Europe, known for its strong customer base and steady dividend payouts. For long-term savers, it seemed like the kind of shares we could rely on.

But how well has that confidence paid off? If we had invested £10,000 in Vodafone shares five years ago, would we be celebrating big gains today, or would the numbers tell a different story? That is the question we explore here.

Let’s break down Vodafone’s performance, look at its share price changes, the effect of dividends, and what a £10,000 investment would be worth right now. Along the way, we also compare Vodafone with other options and ask whether the stock is still worth holding today.

Quick answer: What did £10,000 become?

- On the London listing (ticker: VOD.L), the 5-year total return shown by Yahoo Finance is about +27% as of 15 August 2025. That assumes dividends were reinvested. So £10,000 ≈ £12,713 before fees and taxes.

- Price only tells a different story. The share price today sits around the mid-80s pence per share. Recent closes in late July 2025 were ~83p-86p. Price alone has lagged, but dividends did the heavy lifting.

How has the share price moved over five years?

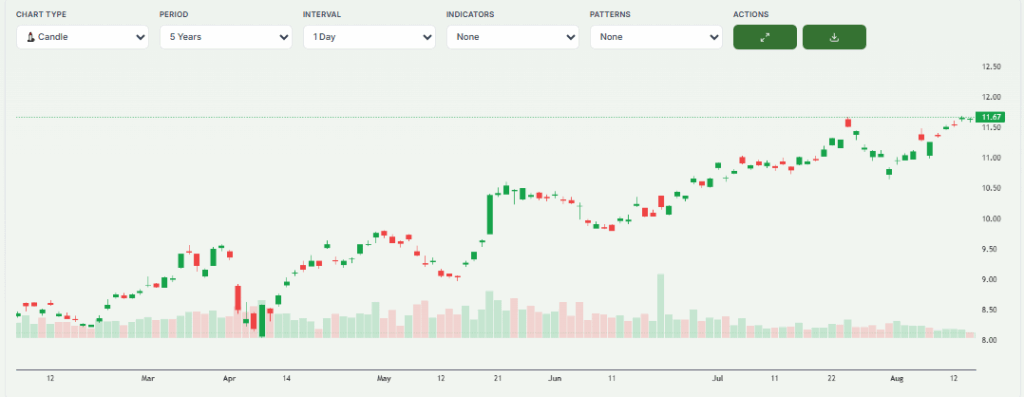

Vodafone’s price has zig-zagged. The Vodafone shares lost ground from 2020-2023 as Europe stayed competitive and Germany underperformed. It firmed up through 2024-2025 on asset sales, buybacks, and the UK merger milestone. Recent prints around ~86p show a rebound from 52-week lows near 62p.

Dividends were the difference

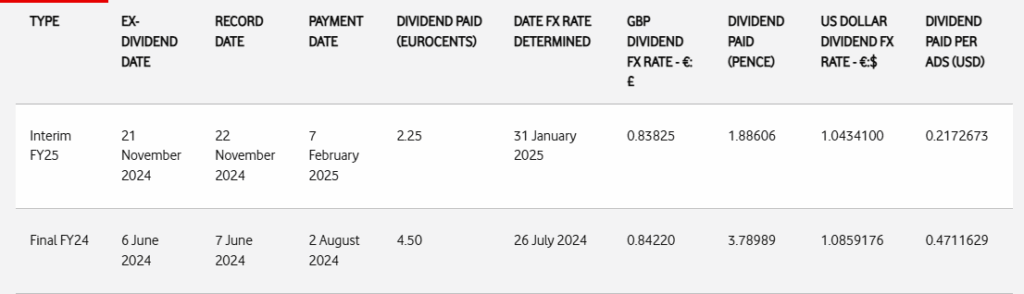

Dividends are the reason the total return beats the price return. For years, Vodafone paid €0.09 per share annually (two payments of €0.045). In FY25, management halved the payout to €0.045 total (two payments of €0.0225), reflecting a smaller group after disposals. The final FY25 dividend of 2.25 eurocents was paid on 1 August 2025.

Why the business changed (big 2024-2025 moves)

- Spain exit: Sale of Vodafone Spain to Zegona completed on 31 May 2024 for €5.0bn value. That simplified the group and added cash.

- Towers monetised: Further 10% of Vantage Towers sold in July 2024, taking total proceeds to €6.6bn and cutting debt.

- Three UK merger: UK regulators closed the inquiry with undertakings; Vodafone UK and Three UK completed their merger on 31 May 2025. This creates a larger network and is already feeding through to coverage and speed upgrades.

Two investor scenarios over 5 years

A) Reinvesting dividends: Using Yahoo Finance’s trailing five-year total return for VOD.L (includes reinvested dividends), £10,000 → ~£12,713. That matches a ~+27% gain over five years.

B) Taking dividends in cash: Capital would track the share price. With the current price in the mid-80s pence and earlier levels higher at points in 2020-2021, the price-only outcome would be far lower than the total-return figure. Cash dividends received over five years offset some of that. But the payout was cut in FY25, reducing income going forward.

Fees, FX, and taxes that change the final number

- Stamp duty on UK share purchases, broker commissions, and platform fees reduces results.

- Tax on dividends and CGT rules matter for UK investors, unless held in ISAs or SIPPs.

- Vodafone declares dividends in eurocents, then translates to GBP on the FX date. That makes sterling income vary with the euro/sterling rate. The FX €:£ for the FY25 final was 0.86853.

Risks that shaped returns

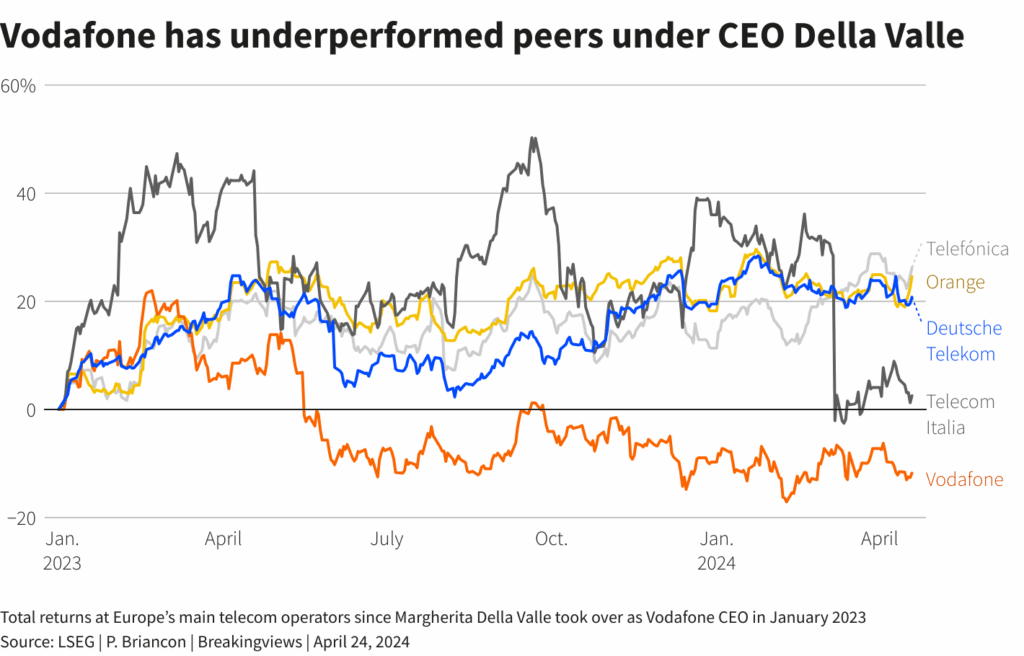

Competition in core markets kept pricing tight. Germany stayed a drag. Currency swings affect both reported results and sterling dividends. High leverage forced portfolio moves and eventually a dividend reset. Execution risk remains on UK integration and on delivering promised synergies.

How does it stack up against the FTSE 100 and peers?

- Over five years, the FTSE 100 total return is ~+84% (to mid-August 2025) on Investing.com’s total-return view. Vodafone’s ~+27% trails the index meaningfully.

- BT Group also struggled through the period, though it had a recovery in 2025. A quick check of BT’s 2025 pricing around ~210p shows recent strength, but its 5-year journey was volatile as well.

What changed in 2025 that could affect future returns?

Three things stand out.

First, the UK merger is now a done deal, with undertakings and a regulated network-investment plan. That could improve coverage and economics over time.

Second, the group is smaller but simpler after Spain’s sale and tower monetisation, with debt trimmed.

Third, the dividend is lower but more sustainable against current cash flow, and there is an active buyback programme in FY25, which can support per-share metrics.

Bottom line

A £10,000 stake bought five years ago in Vodafone shares of London would be worth about £12.7k if dividends were reinvested. Price-only holders likely saw a weaker ride, partially cushioned by cash dividends that then got halved in FY25. The story now hinges on UK merger execution, stabilising Germany, and disciplined capital returns.