Tech Stocks Tumble: Nasdaq Drops 1% on Palantir and AMD Losses

The tech sector experienced a notable downturn on Tuesday, with tech stocks leading market losses as the Nasdaq Composite fell by 1 percent. The decline was driven largely by disappointing performances from Palantir Technologies and Advanced Micro Devices (AMD), raising investor concerns about valuation pressures and cooling enthusiasm in key technology areas.

Why are tech stocks struggling despite overall market stability? Let’s have a deep look.

Palantir and AMD Lead the Tech Stock Decline

Palantir stock fell sharply amid profit-taking and renewed skepticism over its AI-related business models. Investors questioned whether the company’s rapid growth could sustain its lofty valuations. The decline in Palantir shares not only weighed on the Nasdaq but also served as a bellwether for broader tech sentiment.

Similarly, AMD shares dipped after analysts pointed to slower-than-expected revenue growth in its semiconductor division. Concerns about chip demand amid potential market saturation in the AI and cloud computing sectors added pressure.

According to a market observer on X:

“Tech Stocks are under pressure today, Palantir and AMD leading the losses, investors cautious amid AI market rotations”

Broader Nasdaq and Tech Stock Context

The Nasdaq’s 1 percent drop contrasts with the S&P 500, which posted a smaller loss of around 0.3 percent. This indicates that tech-heavy stocks were primarily responsible for the market movement rather than a widespread sell-off across all sectors.

Analysts point out that AI and semiconductor-related stocks have recently experienced significant rallies. With valuations at all-time highs for several major players, investors are now rotating out of high-growth tech names into more defensive sectors, such as utilities and consumer staples.

Short-term trading dynamics, such as heavy institutional selling, also contributed to the dip. The overall tech stock sentiment is now cautious, with traders waiting for fresh catalysts like earnings reports, new AI product releases, or regulatory updates.

Investor Sentiment and Market Psychology

Why are investors pulling back?

- Valuation concerns: High multiples in AI-driven companies have prompted analysts to reassess growth potential.

- Profit-taking: Many investors are booking gains after a strong tech rally in previous months.

- Sector rotation: Money is shifting from high-risk tech stocks to safer, dividend-paying sectors.

Social media reflects this sentiment. One X user observed:

“Nasdaq loses 1 percent as tech stocks stumble, Palantir and AMD dragging indices lower, cautious trading continues”

Such comments demonstrate that both retail and institutional investors are carefully evaluating tech stock exposure in an evolving market.

Technical Indicators and Key Levels for Tech Stocks

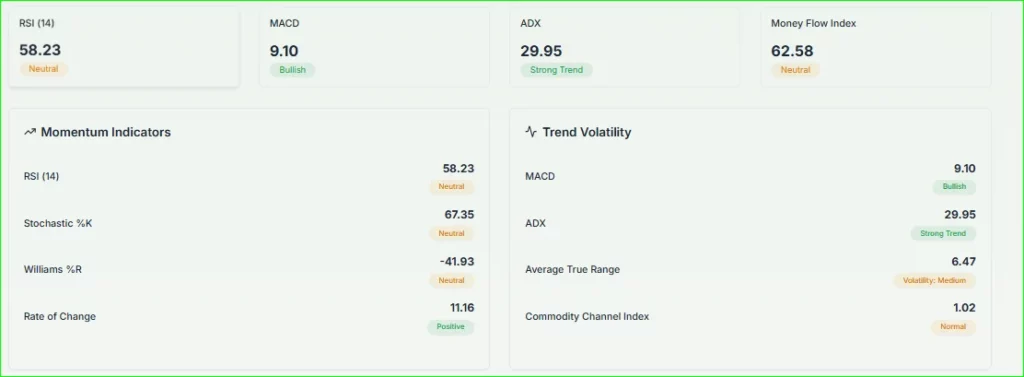

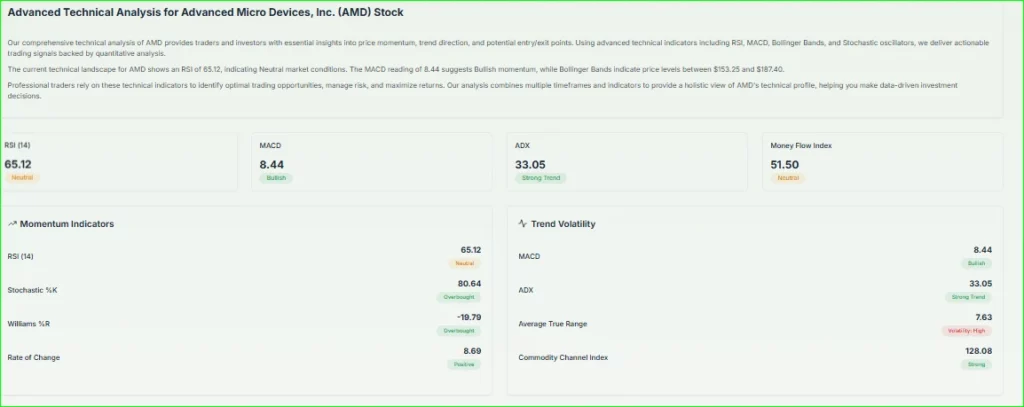

Market analysts note that Palantir and AMD have fallen below important technical levels, signaling potential for further short-term downside if selling pressure persists.

- Palantir: Momentum indicators suggest the stock may test previous support levels, while RSI points to overbought conditions being corrected.

- AMD: Technical charts show resistance near recent highs, and a correction was expected after an extended rally in semiconductor stocks.

Traders are watching moving averages, support and resistance levels, and relative strength indexes (RSI) closely to determine short-term market behavior.

The Role of AI and Semiconductors in Tech Stock Movements

Much of the recent tech rally was fueled by AI optimism, with companies like Nvidia, Palantir, and AMD benefiting from expected growth in AI adoption. However, as the market digests realistic earnings projections and adoption timelines, some investors are re-evaluating the risk-to-reward ratio.

Semiconductors are critical because they form the backbone of AI infrastructure. AMD, being a leading chipmaker, is especially sensitive to demand cycles. A slowdown in cloud data center upgrades or AI server purchases can have an immediate impact on tech stock performance.

Other Notable Tech Stocks in the Decline

While Palantir and AMD led losses, other tech companies such as Microsoft, Apple, and Nvidia also showed moderate declines. Analysts argue that tech stock volatility is not confined to a single company but reflects broader market sentiment regarding growth stocks versus value stocks.

One market commentator tweeted:

“Tech Stocks tumble again today, Nasdaq down 1%, AI-related volatility reshaping trading patterns”

These social insights show that both retail and institutional players are closely monitoring AI sector news, earnings revisions, and macroeconomic indicators.

What Could Reverse the Trend in Tech Stocks?

Market recovery for tech stocks depends on several factors:

- Earnings surprises: Stronger-than-expected quarterly results can boost investor confidence.

- New AI developments: Product announcements or partnerships may reignite growth expectations.

- Regulatory clarity: Updates on AI regulations or semiconductor trade policies could reduce uncertainty.

- Investor sentiment: Sustained buying pressure from institutional funds can stabilize tech indices.

Investors need to weigh potential opportunities against the high volatility risk that remains inherent in tech stocks.

Conclusion: Navigating Tech Stock Volatility

The recent decline in tech stocks, led by Palantir and AMD, underscores the importance of understanding market sentiment and sector-specific risks. The Nasdaq’s 1 percent drop is a reminder that even high-growth tech names are vulnerable to profit-taking and valuation concerns.

For investors, careful monitoring of earnings reports, technical indicators, and AI adoption trends is crucial. Social media sentiment, as reflected in tweets and investor chatter, also provides a real-time gauge of market psychology.

While volatility may continue in the short term, tech stocks remain central to long-term growth strategies, particularly as AI, cloud computing, and semiconductors continue to shape the future of technology.

FAQ’S

The Nasdaq dropped due to declines in major tech stocks like Palantir and AMD, profit-taking, and investor rotation from high-growth tech stocks to more defensive sectors.

The biggest losers were Palantir Technologies and AMD, which led the 1 percent Nasdaq decline amid valuation concerns and slower-than-expected growth projections.

The Rule of 40 is a benchmark for SaaS companies that balances revenue growth and profit margin. For Palantir, it indicates whether growth justifies its high valuation.

Palantir stock fluctuates daily; as of the latest trading session, it is trading around $50–$55 per share, reflecting recent losses.

Palantir stock dropped due to investor concerns about high valuation, profit-taking, and slowing growth in its AI and software contracts.

Historically, the Nasdaq’s biggest daily drops occurred during tech crashes, such as in March 2020 with pandemic-driven volatility and the 2000 dot-com bubble, with losses exceeding 7–10 percent in a single day.

The Nasdaq 100 is an index; the largest shareholders are institutional investors such as Vanguard, BlackRock, and State Street, which hold significant ETF and index fund positions.

Nvidia (NVDA) remains a strong player in AI and gaming, but it carries high valuation risk; investors should assess risk tolerance before buying.

Yes, the Nasdaq 100 is high risk due to its tech-heavy composition and sensitivity to growth stock volatility and macroeconomic shifts.

Disclaimer

This content is for informational purposes only and is not financial advice. Always conduct your research.