Lowes Stock Rises on Strong Quarterly Earnings and $8.8 Billion Home Pros Acquisition

Lowes stock climbed after the company shared strong quarterly earnings. They also announced an $8.8 billion deal to buy Foundation Building Materials. This news boosted investor confidence in the stock market.

We see Lowes focus on growth in the pro segment. The acquisition adds over 370 locations across the US and Canada. It follows their June buy of Artisan Design Group.

These moves help Lowes compete in the stock market. Rival Home Depot made similar deals. Lowes raised its full-year sales outlook too.

Why Lowes Stock Gained Ground

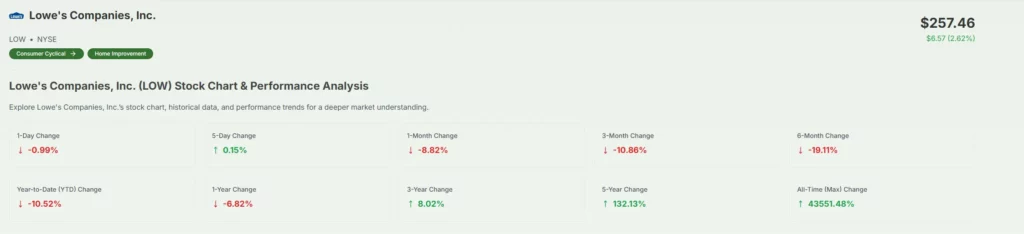

Lowes reported earnings of $4.33 per share. Revenue hit $23.96 billion for the quarter ending August 1. These numbers beat what analysts expected.

Comparable sales grew by 1.1 percent. July saw a 4.7 percent jump. This shows steady demand in home improvement.

In the stock market, such results drive share prices up. Investors like clear signs of strength. Lowes stock reflects this positive trend.

Details of the $8.8 Billion Acquisition

Lowes agreed to buy Foundation Building Materials for $8.8 billion in cash. The deal should close in the fourth quarter of 2025. Foundation had $6.5 billion in sales last year.

They run more than 370 sites in the US and Canada. This expands Lowes reach to pro customers. Pros include builders and contractors.

We note Lowes secured $9 billion in bridge financing. This covers the deal costs. It shows careful planning in the stock market.

How This Fits Lowes Strategy

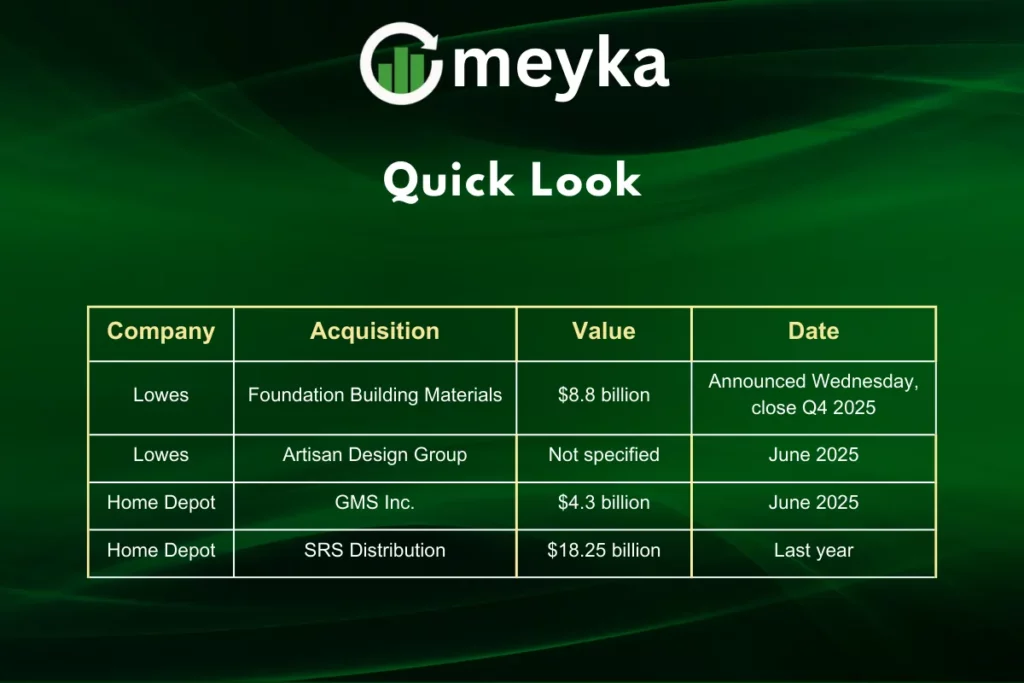

Lowes aims to grow its pro business. The Artisan Design Group buy in June helped too. Together, these strengthen their market position.

Home Depot bought GMS Inc. for $4.3 billion in June. They also got SRS Distribution for $18.25 billion last year. Competition heats up in the stock market.

Lowes responds with targeted acquisitions. This builds long-term value. Lowes stock benefits from these steps.

Updated Financial Outlook for Lowes

Lowes now expects full-year sales between $84.5 billion and $85.5 billion. Before, it was $83.5 billion to $84.5 billion. This upward change signals confidence.

They predict comparable sales flat to up 1 percent. Earlier forecasts were down 1 percent to flat. Improvements come from better pro sales.

In the stock market, outlook revisions matter. They guide investor decisions. Lowes stock rose on this news.

Key Financial Metrics

Here are some highlights from the quarter:

- Earnings per share: $4.33

- Revenue: $23.96 billion

- Comparable sales growth: 1.1%

- July sales increase: 4.7%

These figures show solid performance. We compare them to expectations. Lowes exceeded on most fronts.

Comparing Lowes and Home Depot Moves

This table shows expansion efforts. Both firms target pros. Lowes stock gains from these parallels.

What This Means for the Stock Market

Lowes actions stir interest in retail stocks. Home improvement remains key. Investors track earnings and deals.

We observe broader trends. Economic shifts affect spending. Lowes navigates them effectively.

The stock market rewards growth strategies. Lowes stock rise proves this point. Future quarters will tell more.

Final Thoughts

Lowes stock shows strength from earnings and the acquisition. This positions them well in the stock market. We look forward to more developments.

The $8.8 billion deal enhances their pro focus. Combined with raised guidance, it builds trust. Lowes stock remains a key watch.

Disclaimer:

This content is for informational purposes only and is not financial advice. Always conduct your research.