NSE India: Ion Exchange Declares ₹1.50 Dividend for Shareholders

Dividends are always an exciting update for investors. They reflect not just profits but also a company’s commitment to sharing value with its shareholders. Recently, Ion Exchange (NSE India) Ltd., a leading player in water treatment and environmental solutions, announced a dividend of ₹1.50 per share. Such announcements give a sense of how stable and confident a company feels about its growth.

Ion Exchange is not a new name. Over the years, it has built strong expertise in engineering, chemicals, and sustainable water management. With growing demand for clean water and stricter environmental regulations, the company’s role is becoming even more critical. When a business like this declares dividends, it signals financial strength and long-term trust in its operations.

Why was this dividend declared now? How does it compare to past payouts? And what does it tell us about the company’s direction in a competitive sector?

Let’s explore these questions while also looking at the broader market context and what it means for us as shareholders.

Company overview: Ion Exchange (India) Ltd.

Ion Exchange (India) builds water and environmental solutions. The company designs and runs plants. It also makes resins, membranes, and specialty chemicals. Its projects serve cities, factories, and homes. The stock is listed on NSE as IONEXCHANG. The firm reports to investors through a detailed IR portal that hosts results and annual reports. This shows a mature governance setup and regular disclosures.

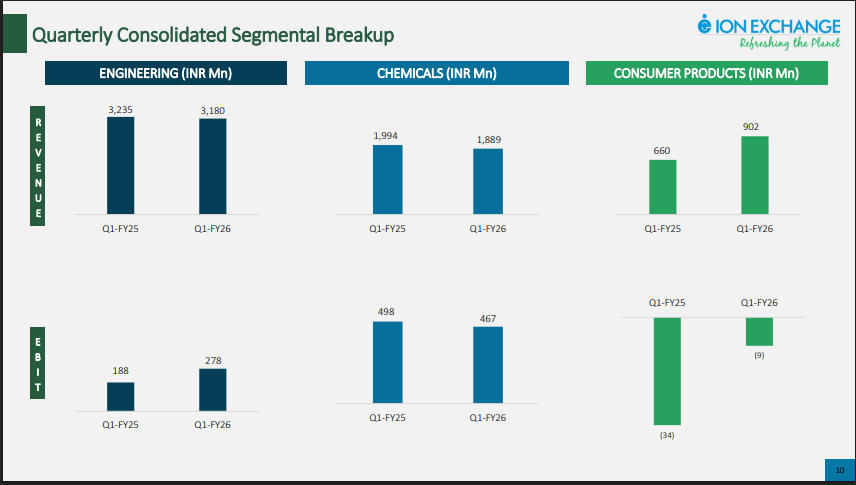

Recent filings show steady operations across engineering and chemicals. Results pages and annual reports outline revenue growth over multiple years. They also show focus on services and aftermarket work. This mix helps smooth cash flows through cycles.

Dividend announcement details

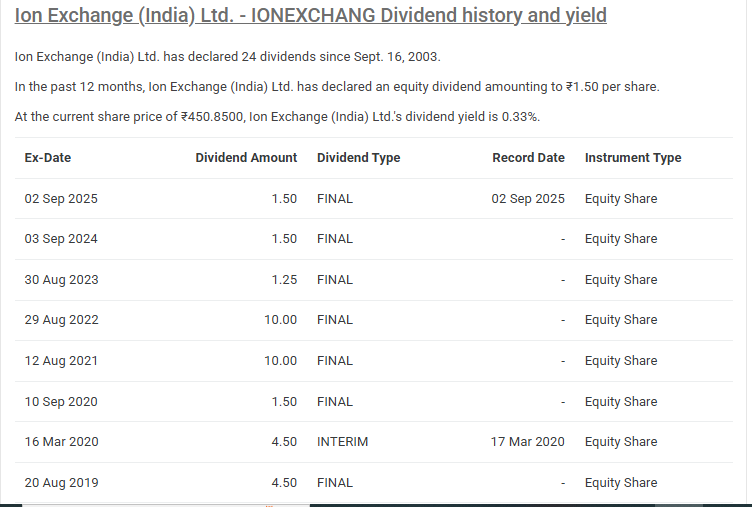

The board announced a ₹1.50 per share final dividend for FY24. Market data shows the ex-dividend date is September 2, 2025. Several trackers also list the record date as September 2, 2025. Historical tables confirm a similar ₹1.50 payout in 2024 and ₹1.25 in 2023.

Multiple sources list the expected pay date as October 9, 2025. That is in line with last year’s early-October credit. Always check the company’s final communication close to the date, as exchanges sometimes revise record dates.

At recent prices, the yield sits near 0.3-0.35%. This is a modest cash return. It signals confidence without stretching the balance sheet. Trackers reflect this range and show a once-a-year payout pattern.

What does it mean for shareholders?

A ₹1.50 final dividend rewards patient holders. The yield is small, but it adds to total return when combined with price gains. In capital goods and project businesses, steady payouts often hint at disciplined cash use. The company has kept dividends stable in recent years, which can support investor trust.

Cash dividends also create a timeline. The ex-date drives price adjustment, and the pay date sets cash arrival. Knowing these points helps plan entries and exits. It also helps income investors match payouts to personal cash needs. Public data on ex-date and pay date provides that clarity.

Financial performance and market context

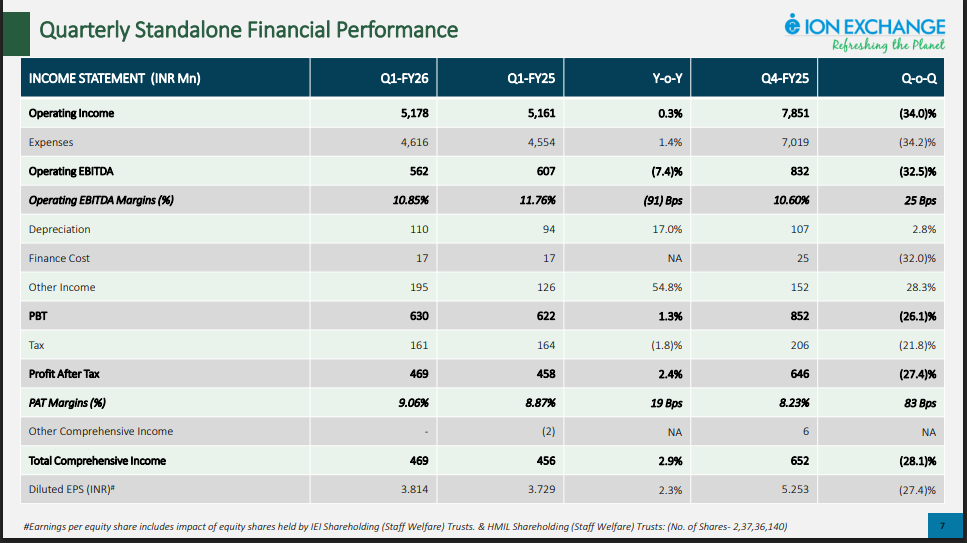

Recent numbers help explain the payout. For the quarter ended July 31, 2025, coverage shows EPS of ₹4.11. Moneycontrol’s dashboard lists Q1 FY24-25 revenue at ₹583 crore and net profit at ₹47 crore with year-on-year growth. This shows resilient demand and cost control.

Share performance matters too. The stock trades well off its 52-week high, according to market sites. Lower prices can lift the implied dividend yield a bit, even when the rupee payout stays the same. That said, price can be volatile around corporate actions. Track the NSE quote page for live ticks and adjustments on the ex-date.

Peers in industrial solutions like engineering and process players also report steady order books. That gives context for Ion Exchange’s project pipeline and service revenues. Comparative dashboards place the company among notable capital goods names, though each has different end markets.

Broader market and sector outlook

India’s push for safe drinking water is a long-term driver. The Jal Jeevan Mission has taken tap water coverage to over 15.4 crore rural households by early 2025. This scale supports treatment plants, distribution networks, and ongoing O&M. Those needs align with Ion Exchange’s offerings.

Policy focus is shifting from build-out to reliable service delivery. That means more attention to operations, upgrades, and sustainability. Industry observers point to long-term maintenance and citizen-centric service as the next phase. This favors companies with chemicals, membranes, and service stacks, not just EPC.

Local news also shows steady urban and state projects under national programs. New plants and 24×7 water pilots continue to roll out. This supports a multi-year capex cycle for water treatment, reuse, and sludge handling.

Analyst and expert signals

Market trackers note a consistent payout record and small yield. They frame the dividend as sustainable given earnings, with a low payout ratio flagged on some dashboards. Screens also mark key dates like AGM, book closure, and earnings calls, which help investors plan.

News summaries add that the company “will pay” the ₹1.50 dividend, aligning with the ex-date and expected pay timeline. Such coverage is useful for cross-checking dates and seeing market reaction. Still, the company site and exchange filings remain the final word on timing.

NSE India: Investor takeaways

The ₹1.50 dividend is modest but steady. It suits investors who value consistency over high yield. Earnings trends and a growing water market back the case. Project cycles can affect quarters, so cash planning matters. Watching order inflows, working capital, and service revenue mix can help judge future payouts. Public dashboards and the IR site provide the needed data.

Key dates are simple. Ex-date September 2, 2025. Expected pay date October 9, 2025. Record checks should be done on the exchange page and new company notices, in case of revisions.

Final Words

The dividend confirms management’s confidence while keeping cash for growth. India’s water programs point to long-term demand. Ongoing O&M needs deepen the market and reduce lumpiness. For now, the payout is a signal of discipline more than income. Track quarterly results, project wins, and policy updates for the next leg. Use the official IR page and NSE India link for any last-mile date changes.

Frequently Asked Questions (FAQs)

Ion Exchange has set October 9, 2025, as the expected payment date. Shareholders whose names are on record will receive the dividend directly in their accounts.

The company fixed September 2, 2025, as the record date. Only shareholders holding Ion Exchange shares in their accounts on this date will qualify for the dividend.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.