JD Sports Faces US Consumer Weakness as Shareholders Seek Growth

JD Sports stands at a crossroads in the stock market. The company deals with tough times in the US. Weak consumer sentiment and US tariffs hurt sales there.

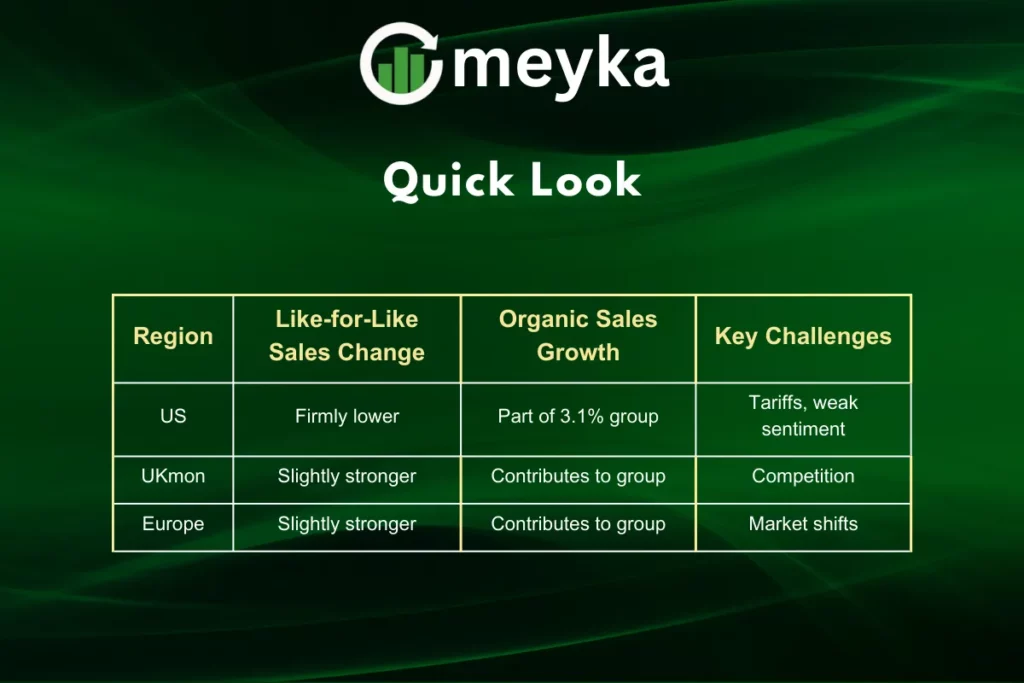

In the first quarter to May 1, US sales dropped a lot. This led to a 2% dip in like-for-like sales overall. Yet, organic sales grew by 3.1% thanks to new stores.

UK and Europe showed slight strength. Shares fell over the past year after a January profit warning. But they rose a bit in the last six months.

Challenges for JD Sports in the US Market

JD Sports faces big hurdles in the US. Weak consumer sentiment slows buys. US tariffs add costs to goods.

Sales in the US fell hard in quarter one. This hurt the firm’s total results. New stores helped boost organic growth to 3.1%.

The stock market watches these issues close. Investors worry about profit outlooks. Half-year update comes on August 27.

Impact of US Tariffs on JD Sports Operations

US tariffs raise import costs for JD Sports. This squeezes profit margins. The firm sells many sports brands from abroad.

Weak sentiment means less spending on sneakers and clothes. JD Sports must adapt fast. They open more stores to fight this.

In the stock market, these factors drag shares down. Profit warning in January shook trust. Recovery seems slow but steady.

JD Sports Performance in UK and Europe

UK sales held up better for JD Sports. Europe also showed some gains. This offsets US weakness a bit.

Like-for-like sales dipped 2% group-wide. But UK and Europe were stronger spots. New openings drove organic growth.

Stock market investors seek signs of turnaround. Half-year results will show more. Profits may hit £890 million this year.

Stock Market Trends for JD Sports Shares

JD Sports shares dropped over the past year. January’s profit warning caused this slide. Yet, they gained a touch in six months.

The stock market reacts to US issues. Weak Nike momentum adds pressure. Brands like On and Hoka compete hard.

Investors eye the August 27 update. US performance stays a key watch. Profit outlook will guide stock moves.

Key Factors Affecting JD Sports Stock

Several elements shape JD Sports in the stock market.

- US consumer weakness cuts demand.

- Tariffs increase product costs.

- Competition from new brands grows.

- New store openings boost sales.

- UK and Europe provide stability.

These points help investors gauge risks.

Profit Outlook and Investor Expectations

JD Sports predicts £890 million in profits this year. This marks a small drop from last year. US drags pull it down.

Stock market shareholders seek growth paths. Half-year update on August 27 matters. It will detail US and profit views.

We see ongoing Nike worries. Increased rivalry weighs on JD Sports. Investors want clear growth plans.

Strategies for JD Sports Growth Amid Challenges

JD Sports plans more store openings. This drives organic sales up. It counters US weakness well.

In the stock market, growth focus calms nerves. UK and Europe strength helps balance. Tariffs need smart handling.

We note competition from On and Hoka. JD Sports must stock hot brands. This keeps shoppers coming back.

JD Sports Growth Initiatives

JD Sports uses several tactics for growth.

- Expand store network in key areas.

- Strengthen online sales channels.

- Partner with top sports brands.

- Adjust prices to beat tariffs.

- Focus on UK and Europe markets.

These steps aim for steady gains.

Comparing JD Sports Regional Performance

Future Prospects

JD Sports eyes recovery in the stock market. August 27 update could lift shares. Strong UK helps offset US.

Profits at £890 million show resilience. Organic growth at 3.1% is a plus. Investors seek more US fixes.

We expect focus on tariffs and sentiment. Growth in Europe aids outlook. Stock market may respond well.

Final Thoughts

JD Sports navigates US consumer weakness. Shareholders push for growth in the stock market. August update will clarify paths.

We see potential in new stores and regions. Profits hold steady despite dips. JD Sports remains a key player.

Focus stays on US turnaround. Stock market trends depend on it. Growth seeks balance across areas.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.