Elite Express Holding Successfully Closes $15.2 Million Initial Public Offering

Going public is always a turning point for a growing company. Elite Express Holding has now reached that point with the successful closing of its $15.2 million Initial Public Offering (IPO). This move does more than raise funds; it places the company in front of investors, partners, and markets that value growth and stability. IPOs are often seen as a measure of trust, and in this case, the positive response shows investor confidence in the business model.

We know that raising capital is not just about money. It is about what comes next: expansion, innovation, and long-term growth. Elite Express Holding is now better positioned to strengthen its foundation, scale operations, and explore new opportunities.

This IPO tells a bigger story: how mid-sized companies can build credibility, attract attention, and prepare for a future where competition is tough but potential is wide open.

About Elite Express Holding

Elite Express Holding is a California-based company focused on last-mile delivery. The firm builds local delivery networks to serve retailers and e-commerce platforms. It emphasizes technology for routing and tracking. The company operates through regional teams that handle pickup and final-mile drop-offs. Elite Express grew by adding contract customers and by expanding service zones in recent years.

Its business model blends local delivery crews with software tools meant to cut transit time and lower costs. These features helped the company scale from a startup stage into a business ready for public markets.

Details of the IPO

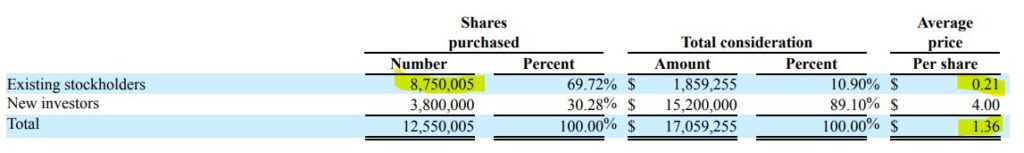

Elite Express completed the offering of 3,800,000 shares of Class A common stock at $4.00 per share. Gross proceeds were about $15.2 million before fees and expenses. The shares began trading on the Nasdaq Capital Market under the ticker symbol “ETS.” The company’s SEC filings and the official press release lay out the firm-commitment nature of the deal and the offering mechanics.

The underwriting group also held a standard option to buy additional shares for a limited time. These facts show a straightforward, modest-sized public debut meant to boost capital and market visibility.

Market Context

IPO activity has been uneven this year. Some small and mid-size listings still reached public windows, while large tech deals faced stronger scrutiny. Investors have shown selective interest in delivery and logistics names. Demand often favors companies with clear paths to profitable unit economics.

For last-mile firms, market watchers now focus on margins, route density, and customer retention. Against that backdrop, Elite Express’s offering size and modest price signal a cautious but realistic entry into public markets. Listing on Nasdaq helps raise visibility in a selective IPO climate.

Use of Proceeds

The company stated that proceeds will be used to grow operations, invest in technology, and support working capital needs. A portion is earmarked for expanding service areas and improving fleet and software. The firm also noted funds may be used for general corporate purposes. These plans match common needs for delivery companies that want to raise capacity while keeping unit costs down. Better routing software and more local hubs typically yield faster deliveries and lower per-package expenses.

Impact on Elite Express Holding

The IPO strengthens the balance sheet. The added capital reduces near-term pressure to fund growth from operating cash alone. Public listing also increases brand recognition. That can help attract higher-profile clients and regional partners.

As a listed company, Elite Express will face new reporting rules. This brings transparency. It also increases the ability to use stock for future acquisitions or employee incentives. For a delivery firm trying to scale, those advantages can accelerate expansion plans.

Investor Perspective

For investors, this IPO offers exposure to local logistics and last-mile services. The modest deal size and $4.00 IPO price may appeal to retail investors hunting growth names at lower entry points. Institutional interest could be limited at first, given the smaller float and market cap.

Key attractions are growth potential, recurring demand from e-commerce, and the chance to benefit if Elite Express expands successfully. Key risks include thin liquidity, tight margins in delivery, and competition from larger national carriers.

Expert Opinions & Analyst Views

Analysts tracking small-cap logistics firms note that unit economics remain the primary yardstick. Experts say companies that show improving per-package margins and denser route networks earn higher market trust. Some market watchers suggested Elite Express’s IPO size is conservative and suitable for a company stepping into public markets for the first time. Others highlight the importance of execution: maintaining service quality while growing will be crucial to justify a higher valuation in future trading. These views reflect common analyst cautions for fresh listings in the sector.

Challenges Ahead

Competition is intense. Large national carriers and well-funded regional players already dominate many routes. Pricing pressure can compress margins quickly. Scaling operations while keeping on-time performance is hard. Compliance and reporting requirements are new burdens now that the company is public.

Cash management remains important. If volume growth lags, the company may face pressure on both revenue and profit metrics. Managing all these factors will test the leadership and operations teams in the months ahead.

Future Outlook

If Elite Express can expand routes efficiently, it can improve per-package revenue and margins. Continued investment in routing software and local depot capacity should boost unit economics. The public listing gives the company a clearer path to raise more capital later, if needed. Strategic partnerships with retailers and same-day service contracts could be key growth levers. Success depends on disciplined expansion, cost control, and strong customer service. If these are achieved, the company could carve out a stronger niche in a crowded market.

Wrap Up

The $15.2 million IPO marks an important step for Elite Express. The company now has extra capital and public-market visibility. The offer size is modest, but it fits a careful market entry strategy. Execution will decide the next phase. For investors and customers alike, the listing creates a clearer track record to watch. Elite Express must turn this funding into measurable gains in coverage, efficiency, and earnings to win long-term confidence.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.