Ulta Beauty Taps Into K-Beauty and Margin Mastery for Sustainable Growth

The beauty industry in the U.S. is massive, valued at over $100 billion and still growing. Within this space, Ulta Beauty has built its name as a one-stop destination for makeup, skincare, hair, and wellness. But the real story today is how Ulta is tapping into two powerful forces: the rise of K-Beauty and the art of mastering profit margins.

We all know how quickly beauty trends spread online. Korean skincare routines, glass-skin hacks, and viral products dominate TikTok and Instagram. Consumers, especially Gen Z and Millennials, are curious to try affordable yet effective formulas. Ulta has seen this shift and is moving fast to bring K-Beauty to more shelves, both in stores and online.

At the same time, Ulta is focused on something less flashy but equally critical: margin discipline.

By improving private labels, optimizing supply chains, and investing in loyalty programs, Ulta is making sure growth is not just about sales but also about long-term sustainability.

This balance of trend-driven innovation with financial control is shaping Ulta’s path. And it gives us insight into how a retailer can stay relevant while protecting its future.

Ulta Beauty’s Market Position

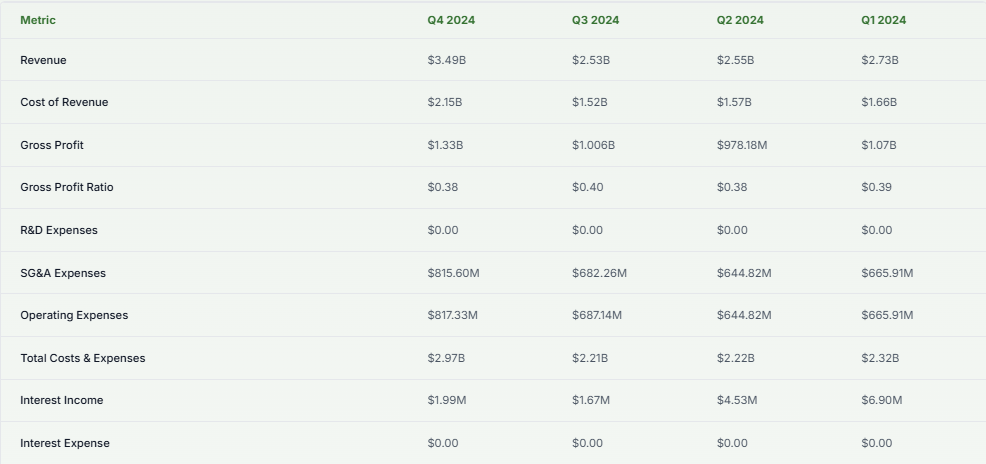

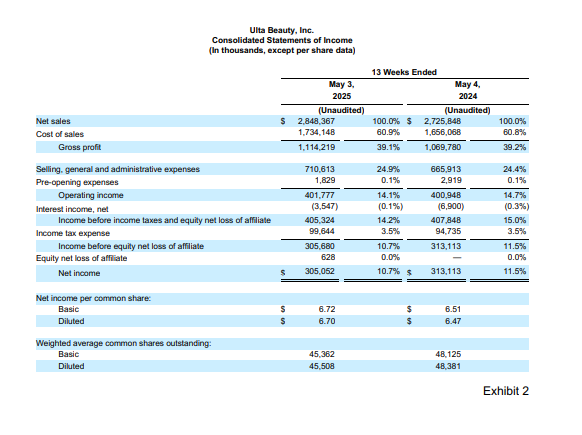

Ulta Beauty sits in a sweet spot. It blends mass and prestige under one roof and reaches shoppers online and in 1,451 U.S. stores. That reach matters when trends move fast. The brand closed fiscal 2024 with $8.63 billion in net sales and $986 million in net income, signaling strong scale and cash power. Recent updates show momentum returning in 2025.

First-quarter net sales rose 4.5% to $2.8 billion, with comps up 2.9% and EPS at $6.70. Ulta also opened new stores, taking the fleet past 1,450 locations. This size and spread give it an edge over single-channel rivals and smaller specialty players.

Why K-Beauty Is a Strategic Bet?

K-Beauty is no fad. It is a pipeline of skin-first formulas, smart textures, and playful packaging that keeps social feeds buzzing. In 2025, the U.S. demand curve still tilts up, even with tariff talk in the background. Korean brands are expanding assortments and pushing into major U.S. retailers to lock in shelf space. Viral products fuel trial, while accessible prices support repeat buys.

For a retailer that trades on “newness,” K-Beauty delivers frequent drops and high engagement. That mix draws younger shoppers without alienating value seekers. Ulta’s timing lines up with a wave of new brands entering U.S. stores this summer.

Ulta’s Approach to K-Beauty Integration

Ulta is turning the dial from “carry some” to “curate many.” In July 2025, the company added a large cohort of K-Beauty labels online, with stores to follow through the summer. The retailer is also partnering to bring in eight more brands across makeup and skincare.

The K-Beauty hub on Ulta’s site now showcases hundreds of items, making discovery simple for first-time shoppers and loyal fans. This is not just about shelf space. It is a steady drumbeat of drops, exclusives, and education that turns trends into traffic. The result is a broader basket and a reason to visit more often.

Margin Mastery: Behind the Numbers

Growth only works if profits keep pace. Ulta’s 2025 first-quarter print showed that discipline. Operating profit ran a healthy share of sales, and management lifted the full-year outlook after a strong start. Mix helps. Private-label and exclusive products offer better margin control, while vendor terms and supply chain execution limit leakage.

The 10-K notes that Ulta Beauty Collection plus permanent exclusives made up a mid-single-digit slice of sales in 2024, with total exclusives at about 9%. Those pieces support gross margin while giving shoppers reasons to choose Ulta over rivals.

Omnichannel & Digital Innovations

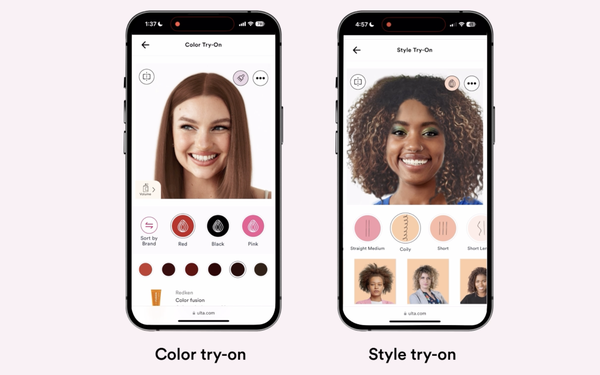

Ulta has turned tech into a service, not a gimmick. Its GlamLab 2.0 upgrades brought sharper virtual try-ons and AI skin and hair analysis. A new generative-AI hair try-on, built with Nvidia, lets shoppers test styles from a selfie. The site and app also feature tools like shade finders and guided routines that lower returns and boost confidence. These features tie to the store trip, where associates close the loop with samples, services, and advice. The result is a smoother path from scroll to sale.

Competition and Industry Challenges

Competition is fierce. Sephora pushes prestige and has grown fast inside Kohl’s. Amazon and mass merchants chase price and convenience. Beauty also cycles through hot and cold categories, which can swing traffic. Ulta faced softer trends late in 2024 but stabilized into 2025 with better-than-expected results and higher guidance. Analysts pointed to share gains and improved execution, even as the macro backdrop stays choppy. The task now is to keep “newness” flowing while holding the line on margins.

Sustainability and Ethical Practices

Shoppers care about what is in the bottle and what happens to the bottle after. Ulta’s Conscious Beauty and ESG work aim to meet that bar. The company targets packaging progress by 2025, pushing for recyclable, refillable, or recycled materials across half of the assortment by weight.

Its 2024 ESG report outlines broader goals on product, environment, and community, including Scope 3 emissions reduction and supplier science-based targets. Clean and cruelty-free filters help customers shop values without guesswork. This clarity builds trust and supports long-term brand health.

The Road Ahead: Growth Outlook

Ulta’s playbook blends reach, relevance, and return. The store base now spans all 50 states, and management continues to invest in locations, remodels, and services that drive traffic. Loyalty remains the backbone. Recent reporting and industry coverage place active members in the mid-40-million range, with the program responsible for the vast majority of sales. The company plans feature upgrades and deeper personalization to keep members engaged.

If K-Beauty flow stays hot and digital tools keep conversion high, Ulta can defend, share, and expand where shoppers live on phones and in neighborhoods. Guidance lifts and positive market reactions in May back that case, while leaving room for caution if the consumer slows.

Final Thoughts

Ulta is leaning into what moves the needle now: K-Beauty, discovery, and digital help while guarding the P&L through mix and scale. The model works when freshness meets focus. The near-term script depends on steady traffic, strong loyalty economics, and continued drops that catch the eye on TikTok and in the aisle. If those pieces hold, sustainable growth looks achievable without trading away margin.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.