Morgan Stanley Analyzes Whether Nio Stock Rally Shifts the Outlook

Nio just surged, and many traders ask what changed in the outlook. The stock market reacted to new model news and to fresh analyst notes. We explain what this move could mean for Nio.

Nio’s stock skyrocketed over 90% in just two months, before hitting Morgan Stanley’s price target of $6.50. That quick run lit up screens across the stock market. We review the rally, the research, and the road ahead.

Stock market information for NIO Inc (NIO)

- NIO Inc is a equity in the USA market.

- The price is 6.09 USD currently with a change of -0.25 USD (-0.04%) from the previous close.

- The latest open price was 6.68 USD and the intraday volume is 155580719.

- The intraday high is 6.81 USD and the intraday low is 6.07 USD.

- The latest trade time is Tuesday, August 26, 02:12:37 +0500.

Nio Rally, The Core Facts

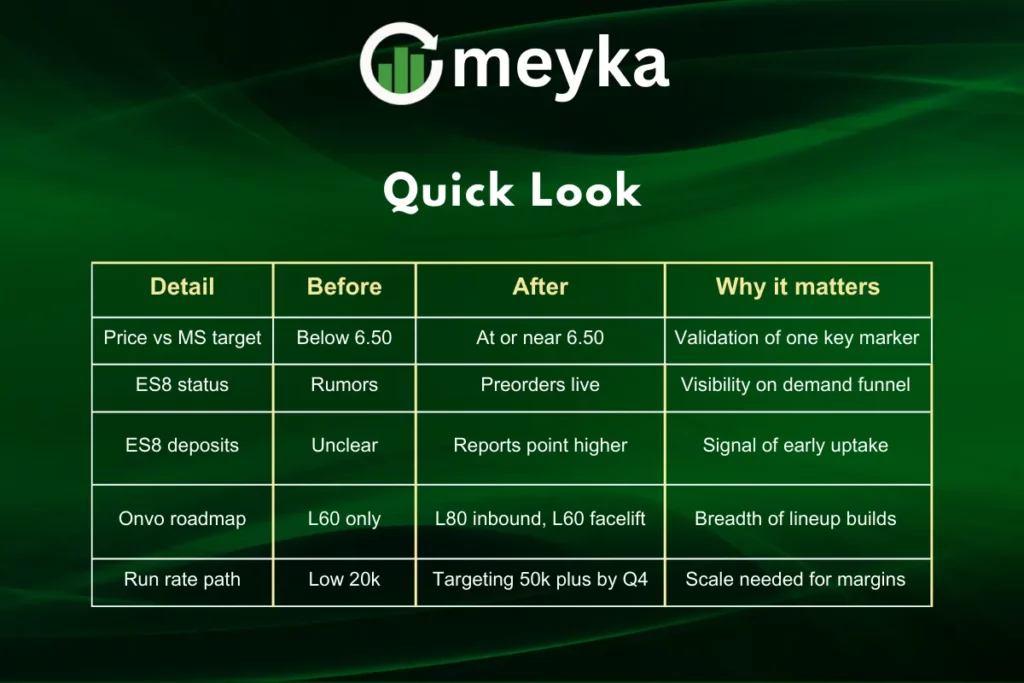

Nio reached Morgan Stanley’s stated target of 6.50 dollars after a sharp climb. The firm recently marked its base case near that level. Context helps when a price tag meets a target.

People got excited again after preorders kicked off for the third-gen ES8 and shipments started hitting the showrooms. The preorders began with a small deposit that boosts early demand signals. Momentum often starts with simple steps like these.

What Morgan Stanley Is Watching

Morgan Stanley flagged that sentiment could shift if strength holds. The call linked the rally to demand and product timing. Tone matters when a large bank highlights a change.

In separate notes this year, the bank discussed Onvo model updates. It also pointed to a possible L60 facelift early next year. Timing on facelifts can keep showroom traffic steady.

Onvo L60 and L80, The Next Triggers

Onvo L60 is in market and due a facelift next year. Onvo L80 is lined up for release later this year. Pipeline depth gives Nio more ways to reach buyers.

Analysts expect the L80 to expand mix and average selling price. Family buyers and larger fleets may take notice. Mix shifts can support margins after launch.

Run Rate, What Must Happen Next

Management has spoken about getting to more than fifty thousand units a month by the fourth quarter. That would mark a clear step up from recent levels. Execution is the bridge from talk to results.

Some analyst math says a second half run rate near fifty five thousand would be needed to hit bold full year goals. The gap looks narrow only if weekly orders stay firm. Pressure rises as the calendar turns.

Why The Stock Market Cares Now

Big moves draw volume, and volume draws attention. Liquidity improves price discovery in both New York and Hong Kong. Flow like this can speed sentiment shifts.

Preorders and showroom traffic create near term news. Short feedback loops keep the stock market engaged. Feedback keeps traders watching the tape.

Quick Table, What Changed After The Rally

Key Drivers To Watch

- Orders and deliveries: weekly orders, conversion, and delivery mix.

- Margins: parts cost, battery rental mix, and pricing.

- Funding: balance sheet moves and any raise talk.

- Competition: local rivals, new trims, and policy shifts.

- Global rollout: dealer partners outside China and service reach.

Data Points, A Short Scorecard

- ES8 preorders opened with deposit perks; launch in late September. Calendar matters for quarter end prints.

- L80 expected this year, with L60 refresh next year. Cadence helps maintain showroom energy.

- Management speaks to fifty thousand monthly by year end; analysts cite fifty five thousand needed for stretch goals. Alignment between plans and math will be key.

Catalysts Over The Next Two Quarters

- Official ES8 launch and first deliveries

- Onvo L80 reveal, pricing, and first orders

- Monthly delivery prints and margin trend

- Any cash flow update or guidance

- Brokerage model changes and price target moves

Bottom Line, Does The Rally Shift The Outlook

We see a credible case for a sentiment shift if orders keep flowing and deliveries scale. Nio still needs a clean launch cycle and better margins. The stock market will reward steady progress more than headlines.

We think Nio now has a clearer path to prove its plan. New models, a larger pipeline, and focused costs can support the next leg. Follow through will decide if the move holds.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.