Powell’s Dovish Surprise Helps US Dollar Recover After Recent Slump

The US Dollar has faced a rough patch in recent weeks. Against many major currencies, it has weakened, leaving investors concerned. Global markets watched closely as the greenback lost ground, affecting trade, investments, and even commodity prices. Suddenly, expectations changed.

Federal Reserve Chair Jerome Powell gave a speech that surprised many. His tone was more cautious than markets had expected. We saw hints that the Fed might slow down interest rate hikes and focus more on supporting economic growth. This “dovish” approach was a shift from the previous strict stance. As soon as Powell spoke, the US Dollar started to recover. Traders reacted quickly, and market sentiment improved.

Let’s analyze why Powell’s comments mattered, how the US Dollar responded, and what it means for investors and global markets.

Background: The US Dollar’s Recent Weakness

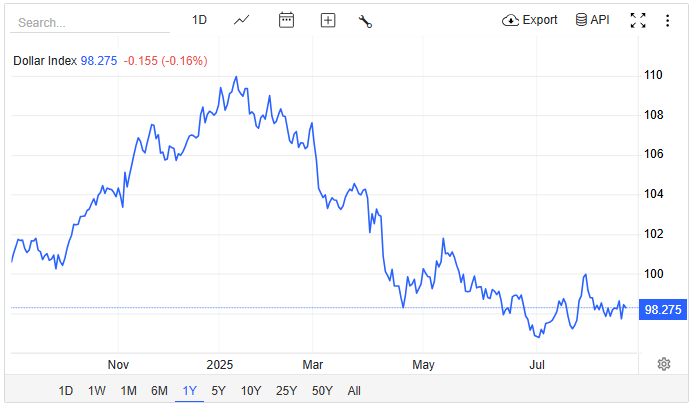

The US Dollar had been on a downward trajectory for several months leading up to August 2025. The Dollar Index (DXY), which measures the greenback against a basket of major currencies, had fallen over 9% year-to-date, marking one of its steepest annual declines in recent history. This decline was attributed to a combination of factors, including expectations of prolonged low interest rates, concerns over the US economic slowdown, and geopolitical tensions.

Against the euro, the dollar had weakened by more than 12% during the year, with the euro reaching a four-week high of $1.1742 on August 22. Similarly, other major currencies like the British pound and Swiss franc had gained strength against the dollar. This depreciation of the dollar had implications for global trade, as it made US exports more competitive but increased the cost of imports, contributing to inflationary pressures.

Powell’s Dovish Surprise

On August 22, 2025, Federal Reserve Chair Jerome Powell gave a speech at the Jackson Hole Economic Symposium that surprised markets. He acknowledged ongoing inflation but warned about rising risks to the US labor market. He suggested the Federal Reserve might slow the pace of interest rate hikes. This shift in tone showed a “dovish pivot” and a more cautious approach to monetary tightening.

Markets reacted quickly. Traders updated their expectations. The probability of a 25-basis-point rate cut in the September FOMC meeting rose to about 84%, up from 61% a month earlier. Powell’s dovish comments temporarily weakened the US dollar as traders priced in the possibility of lower interest rates.

Immediate Impact on the US Dollar

Following Powell’s remarks, the US dollar experienced a brief rebound. On August 25, the Dollar Index rose 0.49% to 98.32, marking its largest daily percentage gain since July 30. The euro fell 0.69% to $1.1634, retreating from its four-week high. Other major currencies like the British pound and Swiss franc also saw slight declines against the dollar.

Despite the short-term rebound, the dollar stayed down more than 9.5% year-to-date. Investors worried about the US economic outlook and the Fed’s policy direction. Analysts warned that, even though the market reacted positively at first, ongoing challenges like inflation and a slowing economy could keep pressure on the dollar.

Broader Market Implications

The Federal Reserve’s shift towards a more dovish policy stance had ripple effects across global markets. Bond markets reacted to the potential for lower interest rates, with US Treasury yields edging higher after initially declining following Powell’s speech. In Europe, German 10-year bond yields also ticked up, signaling that the eurozone bond market was adjusting to the Fed’s dovish tilt.

Equity markets experienced increased volatility as investors reassessed the implications of a potential rate cut. Lower interest rates could boost stock values. However, concerns about a slowing economy and persistent inflation remained strong. Commodities like gold and oil saw price fluctuations as investors sought safe-haven assets amid the uncertainty.

Expert Opinions

Economists and market analysts offered varied perspectives on the Federal Reserve’s dovish surprise. Some saw the shift as a wise response to weak labor market data. They suggested that a cautious approach to monetary policy could support steady economic growth.

Others expressed concern that political pressures, particularly from President Donald Trump’s criticism of Fed officials, might be influencing the central bank’s decisions. Analysts warned that undermining the Fed’s independence could have long-term negative effects on investor confidence and economic stability.

Final Thoughts

Jerome Powell’s dovish surprise marked a significant shift in the Federal Reserve’s approach to monetary policy, leading to a temporary rebound in the US dollar. However, the underlying economic challenges and political pressures suggest that the dollar’s recovery may be short-lived.

Investors and policymakers will need to closely monitor upcoming economic data, including inflation and labor market indicators, to assess the sustainability of the dollar’s performance and the Federal Reserve’s policy trajectory.

Frequently Asked Questions (FAQs)

A dovish Federal Reserve stance suggests lower interest rates to stimulate the economy. This can decrease the US Dollar’s value as investors seek higher returns elsewhere.

Jerome Powell’s recent comments led to expectations of a potential rate cut. This caused the US Dollar to weaken, influencing global markets and currency valuations.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.