US Stock Market Today: Dow, S&P 500, Nasdaq Futures Rise as Nvidia Takes Spotlight

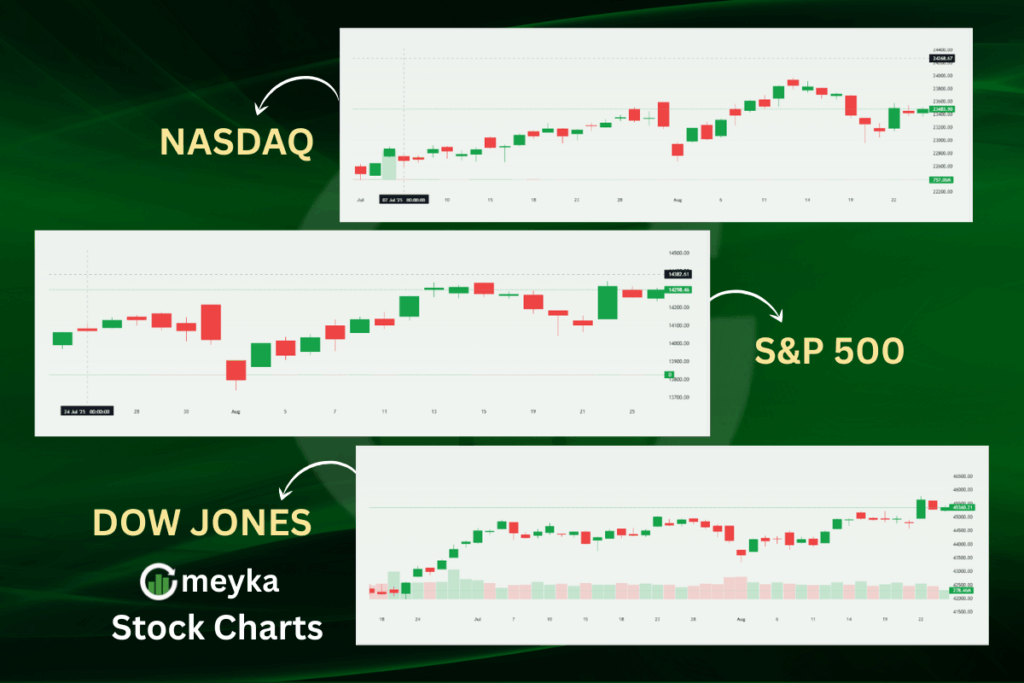

The U.S. stock market is waking up with energy today. Futures for the Dow Jones, S&P 500, and Nasdaq are all pointing higher. The big story? Nvidia. Once again, the chipmaker is in the spotlight, and investors are watching closely.

We know that technology stocks often set the tone for Wall Street. Nvidia’s role in artificial intelligence and high-performance chips makes it a leader in this space. When its stock moves, the ripple is felt across the entire market. This is exactly what we are seeing now. The excitement around AI is pushing futures higher, giving traders more confidence at the start of the day.

At the same time, global market cues and U.S. economic signals are also shaping the mood. Investors want clarity on the Federal Reserve’s next steps on interest rates. Others are tracking jobs, inflation, and corporate earnings.

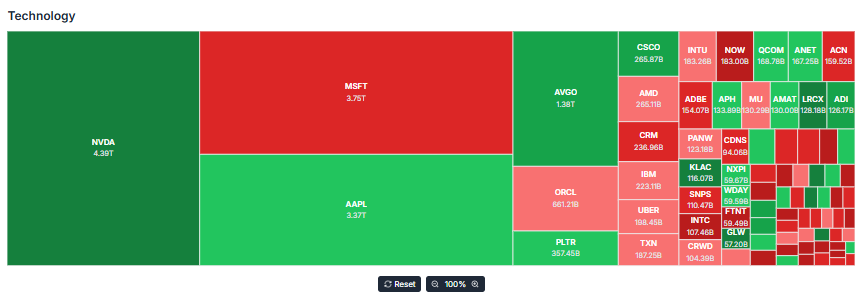

Stock Market Overview

U.S. stock futures opened higher as investors digested fresh tech news and awaited major corporate reports. Dow, S&P 500, and Nasdaq futures showed modest gains in early trading. The moves were cautious. Traders are watching for any sign that recent tech strength can spread to the broader market. Several sources flagged a quiet but optimistic start to the day.

Nvidia Takes Center Stage

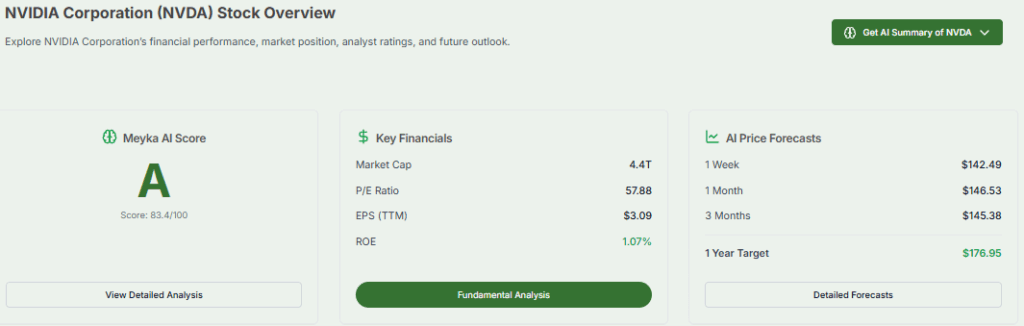

Nvidia again became the main focus. The company recently topped a roughly $4 trillion market value. That size makes its results a big market event. Analysts expect strong revenue and growth tied to AI data-center demand. Still, forecasts show slower double-digit growth versus the blistering pace of prior years. Investors will listen for guidance on China sales and chip demand. Nvidia’s report could either lift the whole tech trade or expose limits to the AI boom.

How Nvidia’s Results Affect the Market?

Nvidia is huge in the indexes. A big beat could push the Nasdaq and S&P higher. A miss could trigger a broad tech selloff. Options markets even imply a large possible swing in Nvidia’s market value around earnings. Traders are pricing in a wide range of outcomes. That leaves sentiment fragile. Smaller chip and cloud names often follow Nvidia’s lead.

Tech Sector Momentum

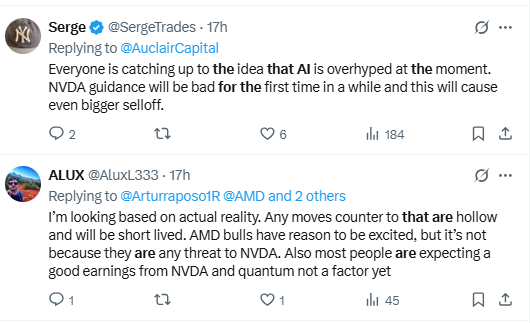

Tech stocks carried the gains into premarket trading. Nvidia’s rally has boosted demand for semiconductors and AI infrastructure names. Some big-cap techs showed modest gains alongside Nvidia. Still, some analysts warned that the AI trade may be crowded. Reports of AI project failures and debate over real economic benefits have raised caution. That creates mixed signals for investors chasing growth.

Economic Data and the Federal Reserve Watch

Economic signals remain central to market direction. Recent Fed commentary suggested caution and emphasized careful policy moves. Federal Reserve Chair comments note that labor-market shifts could change the rate outlook. Traders are watching jobs and inflation data due in the coming weeks. Any surprise here could alter expectations for rate cuts or hikes. That would affect equities and bond yields alike.

Global Market Influence

Overnight action in Asia and Europe also shaped sentiment. Asian markets have been sensitive to China’s demand, especially for chips. Europe showed mixed moves tied to economic reports and energy prices. Currency swings and commodity moves added another layer. Global demand for AI and data-center capacity is a common thread. Any sign of a slowdown in China could weigh on chip names listed in the U.S.

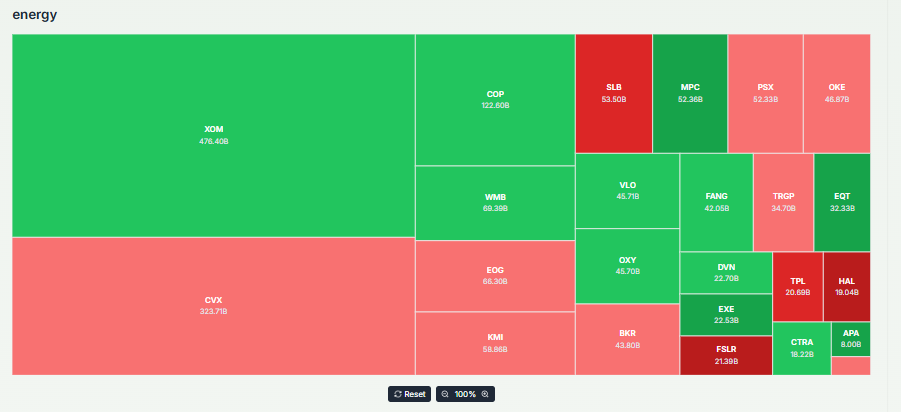

Sector Performance Beyond Tech

Not all sectors moved the same way. Financials lagged as yields and policy uncertainty muddied the outlook. Energy swung with oil prices and global supply news. Consumer names reacted to retailer earnings and spending trends. Some industrial and cyclical names saw small gains on hopes of a broader economic recovery. Market breadth stayed narrow, with tech and a few growth leaders doing most of the heavy lifting.

Market Risks and Short-Term Outlook

Several risks could reverse the early gains. First, if Nvidia reports weaker-than-expected revenue, tech could pull back sharply. Second, sticky inflation or weaker jobs data could force the Fed to delay cuts. Third, geopolitical or trade tensions with China remain a tail risk for global tech supply chains. Traders should expect higher volatility around earnings and major data releases. Short-term moves may be sharp. Investors should watch guidance and macro cues closely.

Investor Sentiment and Analyst Views

Analysts remain split. Some call Nvidia the bellwether for the AI cycle. Others caution that valuations are stretched. Market commentaries show a mix of bullish forecasts and warnings about concentration risk. Sentiment indicators point to optimism in tech, but caution elsewhere. That split explains why futures can rise even as some parts of the market look fragile.

Bottom Line

U.S. stock futures are moving higher as Nvidia drives attention. The company’s role in AI makes it a key force in the market. Still, risks remain from economic data, Fed policy, and global demand. Investors are hopeful, but the real test is Nvidia’s earnings and outlook. That will show if the rally can last or if volatility will return.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.