Tata Motors: What Analysts Advise If You Bought at Peak Levels

Tata Motors has fallen sharply from its highs, driven by profit hits at home and margin pressure at JLR, and analysts say patience, caution, and a plan matter more than panic. If you bought at peak levels, do not react only to the headline price drop; consider the fundamentals, the technical triggers, and your own time horizon before acting.

Tata Motors Stock Performance in Recent Months

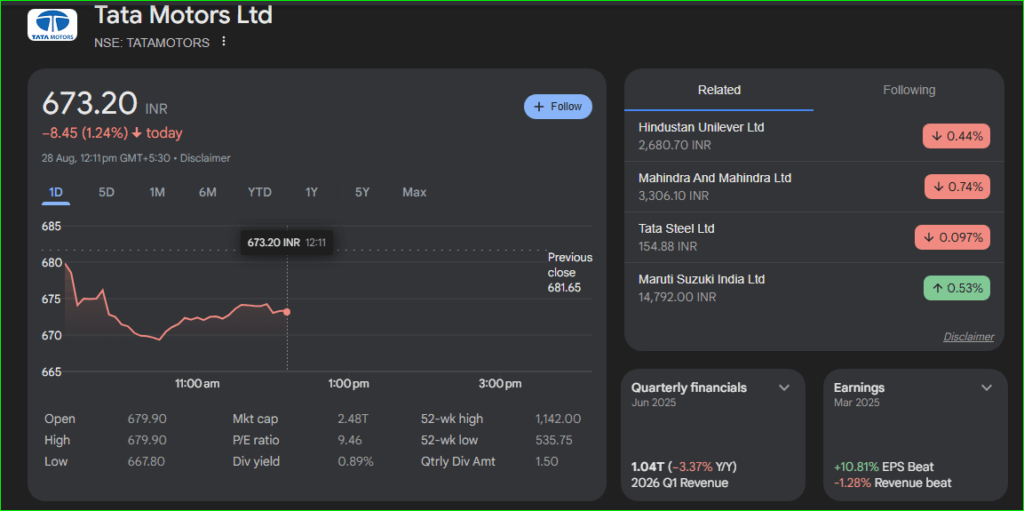

Tata Motors’ share price has shown strong momentum over the past few months, driven by consistent growth in domestic sales and improving global demand. The stock has traded in a steady upward trend, supported by record quarterly deliveries and a rebound in Jaguar Land Rover’s (JLR) performance.

Compared to other auto players such as Maruti Suzuki and Mahindra & Mahindra, Tata Motors has seen faster traction in the EV and SUV segments, which has given it an edge. Despite some volatility due to global economic concerns. Investors remain optimistic about Tata Motors’ ability to sustain its momentum in the near term.

Tata Motors: why analysts are cautious now

Why did the stock tumble from peak?

Shares are down roughly forty two percent from their record highs, after a string of weak quarterly numbers, slowing volumes, and fresh margin cuts at Jaguar Land Rover. Traders point to tariff shocks, slower passenger vehicle demand in India, and rising costs at JLR as the main drivers. Those are not easy problems to fix overnight.

What does that mean for you, if you are sitting on a peak buy?

Analysts are split, but most offer a similar framework. Decide whether you are a long-term investor or a short-term trader, size your exposure, set clear stop-loss limits, and watch specific business catalysts before adding more. The technical zone and the firm’s guidance matter a lot right now.

Key facts to keep in mind

Here are the load bearing facts you should know before deciding:

- Earnings pressure: Tata Motors reported large profit declines recently, showing real pressure on earnings and margins across the group. Consolidated quarterly profits and EBITDA have weakened, which is why analysts trimmed targets and raised caution.

- JLR margin cut: Jaguar Land Rover trimmed its FY26 EBIT margin guidance to five to seven percent from around ten percent earlier. A major change that lowers group profitability expectations. This margin reset is a big reason for the share weakness.

- Tariffs and trade: Global tariff developments influence JLR volumes and profits. A recent US European trade deal that capped car tariffs at around fifteen percent eases one overhang. But the full effect will be gradual and conditional. Watch trade headlines closely as they act as a key catalyst for JLR.

- Analyst targets: Some brokerage houses, including Jefferies, have issued cautionary notes and lowered price targets, suggesting further downside is possible in a stressed scenario. Jefferies has flagged a downside towards the five hundred fifty rupee region in its cautious scenario, which reflects near term risks.

Market analysts have a mixed but mostly positive outlook on Tata Motors. Several brokerages, including Motilal Oswal and ICICI Securities, have given a “Buy” rating, citing the company’s leadership in EVs, solid JLR recovery, and strong SUV portfolio in India. Price targets range from ₹1,000 to ₹1,200 per share, depending on global economic conditions and demand sustainability.

However, some analysts remain cautious, pointing to rising input costs, potential global slowdowns, and stiff competition in the EV segment. Overall, the stock is seen as a good long-term bet for investors, especially those seeking exposure to India’s growing auto and EV market.

Impact of EV Push on Tata Motors Growth

One of the biggest factors fueling Tata Motors’ growth story is its aggressive push into the electric vehicle (EV) segment. Models like the Nexon EV, Tigor EV, and Tiago EV have already made Tata the market leader in India’s fast-growing EV space. Government incentives under the FAME II scheme and state-level subsidies have also boosted demand.

Analysts believe Tata Motors is well-positioned to benefit as more consumers shift toward affordable EVs. Additionally, the company’s future lineup, including advanced EV platforms and upcoming SUVs, indicates that its EV journey is only at the beginning. This strong EV foundation is expected to contribute significantly to Tata Motors’ long-term revenue growth and strengthen its global competitiveness.

What analysts advise if you bought at the peak

Should you sell, hold, or buy more? Below are the 6 clear, practical points that many analysts and strategists are recommending now:

- Check your time horizon, then decide.

If you are a long-term investor with a multi-year view on electric vehicles, commercial vehicles, and JLR’s turnaround, consider holding and give the company time to execute on product cycles and margin recovery. If you are a short-termgiving trader, tighten risk controls and use stop losses. - Trim size, do not panic sell

Many advisors say avoid emotional selling at a plunge. Trimming a portion to rebalance, while keeping a base position, is often smarter than an all out exit. Use the proceeds to rebalance into less volatile parts of your portfolio. - Average down selectively, in tranches

If you are convinced of Tata’s long term story, average down in limited tranches, not all at once. Set price bands and buy only if key fundamentals show improvement, like stable India PV volumes, better CV recovery, or clear JLR margin stabilization. - Watch the technical buy triggers

Technical analysts point to a range bound pattern between roughly six sixty five and seven forty five rupees. A confirmed breakout above seven thirty five to seven forty five on good volume would be a positive sign for traders. While a break below six sixty five increases downside risk to prior swing lows. Use those levels as objective triggers, not guesses. - Look for specific catalysts before increasing exposure

Add only after one or more of the following appear. JLR margin guidance shows signs of recovery, trade tariffs stabilize in favour of exports. India passenger vehicle volumes stop sliding, or management provides credible evidence that cost saves and new models will restore margins. News on the rumored Iveco asset buyout and its financing could also shift sentiment, so track it closely. - Consider tax loss harvesting if appropriate

If you have realized losses on paper and tax rules allow, offset gains elsewhere by selling a portion to crystallize losses, then reenter later with a disciplined plan. Check local tax rules and holding period rules before doing this.

Valuation: Overvalued or Attractive Buy?

When it comes to valuation, Tata Motors trades at a premium compared to some of its peers. However, this premium is often justified by its leadership in the EV market and the turnaround of JLR. Investors should note that the stock’s Price-to-Earnings (P/E) ratio is higher than the industry average. Then it raises the question of whether it is overvalued.

On the other hand, analysts argue that considering the company’s future growth potential, especially in EVs and luxury cars, Tata Motors may still be fairly priced for long-term investors. For those with a medium to long-term horizon current levels are seen as attractive entry points, provided they can withstand near-term volatility.

Risks Investors Should Watch

- Rising raw material and input costs may reduce profit margins, especially with high EV battery prices.

- Global operations expose Tata Motors to currency fluctuations and geopolitical uncertainties in key markets like Europe and China.

- Competition in domestic and international EV markets is intensifying, with strong players such as BYD, Hyundai, and Ola Electric.

- Regulatory changes in emission norms and government policies could affect business operations.

- Investors should remain cautious yet optimistic while evaluating Tata Motors’ growth potential.

Quick checklist for action

Ask yourself three simple questions: do I need the money short term, do I trust Tata’s multi year plan, and do I have a clear add or exit price? If the answers favour a patient approach, hold with stops and a plan to average in if catalysts appear. If not, reduce exposure and redeploy capital into less cyclical names.

Future Outlook for Tata Motors Shareholders

Looking ahead, Tata Motors appears well-positioned to capture growth opportunities in both domestic and international markets. The company’s EV leadership in India, combined with JLR’s improving profitability, sets a strong foundation for sustained earnings. With increasing consumer demand for SUVs, EVs, and premium vehicles, Tata Motors is expected to maintain its growth momentum.

Analysts believe that the company can deliver long-term value to shareholders if it continues to innovate and strengthen its market share. For investors, Tata Motors offers an exciting growth story, though it comes with risks that must be carefully managed.

Conclusion: plan first, react second

In short, Tata Motors is no longer a one way bet from the peak. The path back will be driven by JLR margin recovery, tariff clarity, volume stabilization, and execution on product cycles.

Analysts suggest measured responses not panic, with clear technical levels and business catalysts used as trading rules. If you bought at the peak, make a written plan now, size your bets to comfort, and let facts, not fear, guide your next trade.

FAQ’S

Analysts suggest Tata Motors has long term growth potential due to strong EV plans and JLR recovery. But entry at current levels should be with caution, depending on personal risk appetite.

Brokerages see a target range between ₹1,000 to ₹1,200 in the coming year, driven by EV growth, JLR margins, and domestic demand. Targets vary based on global conditions.

Short term movements depend on market trends, crude prices, and global news. No one can predict with certainty, but positive global cues may support an uptick.

The future looks strong with expansion in electric vehicles, solid demand in commercial and passenger segments, and JLR turnaround. It is seen as a long term compounder.

After the recent correction, many analysts believe Tata Motors is fairly valued. Its valuation depends on execution of EV growth and global economic trends.

Market experts highlight quality blue chip stocks like Tata Motors, TCS, and HDFC Bank for stable growth. Sectoral leaders are usually the safest bets.

Yes, Tata Motors has strong fundamentals and is expected to recover with JLR debt reduction, EV launches, and higher domestic demand.

Disclaimer

This is for informational purposes only and does not constitute financial advice. Always do your research.