ITC Shares Outlook: Can FMCG Giant Bounce Back Amid Challenges?

ITC has been one of India’s most talked-about companies in the stock market. Known first for its cigarette business, the company has now built a strong presence in fast-moving consumer goods, hotels, paperboards, and agri-business. The stock often draws attention whenever sector trends shift, with a market cap that keeps ITC among the top firms in the Nifty 50.

In recent months, ITC shares have seen both optimism and doubt. Some investors cheer its steady dividend payouts and growing FMCG portfolio. Others remain cautious due to regulatory risks in tobacco and stiff competition from giants like HUL and Nestlé. This mix of positives and challenges makes ITC’s journey worth watching.

As investors ask: can this FMCG giant bounce back and deliver stronger growth? To answer, we need to explore ITC’s financial performance, its growth drivers, and the hurdles it faces in today’s market.

ITC at a Glance

ITC began as a cigarette maker. Over the decades, it grew into a big Indian firm. Today it runs cigarettes, FMCG, hotels, paperboards, and agri-business. The company sits in the Nifty 50 and is one of the market heavyweights. Its large dividend history keeps many investors interested. ITC’s strategy is to widen FMCG while keeping cash flow from tobacco. This mix makes the stock unique in India’s consumer space.

Recent Performance of ITC Shares

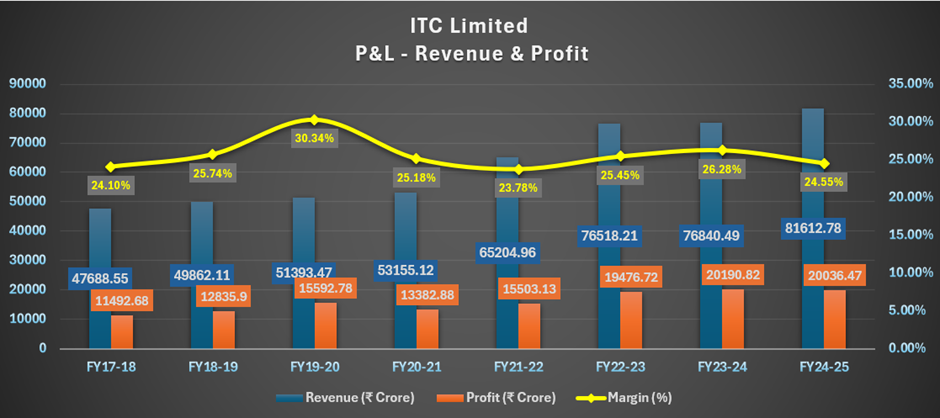

ITC reported strong top-line growth in the latest quarter. Revenue rose about 19-20% year-on-year to roughly ₹23,000 crore. Net profit rose only modestly, by 3-5% year-on-year. The company said margins were under pressure in some businesses, but revenue momentum was broad-based. These figures came as mixed news for the market. Some traders cheered the sales growth. Others focused on the slow rise in profit and near-term risks.

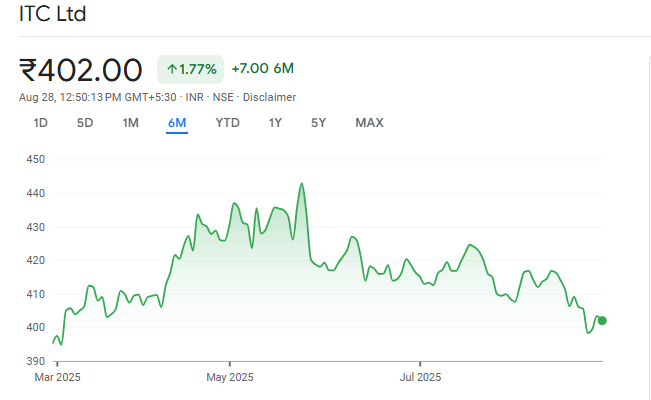

ITC stock has drifted in recent months. The share traded in a wide band between roughly ₹390 and ₹530 in the past year. Volume has been steady, but market sentiment turned cautious in late August 2025 as macro news raised fear across Indian markets. On volatile trading days, ITC has moved with the broader indices.

Growth Drivers Supporting ITC

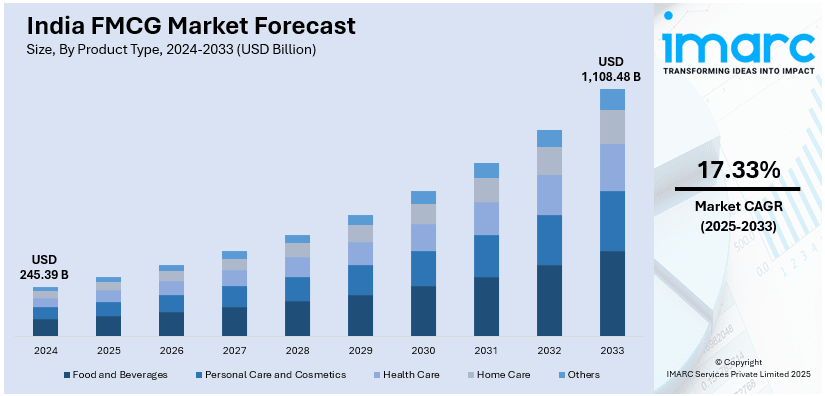

The FMCG push is the clearest growth driver. Packaged foods, snacks, and personal care saw steady demand. ITC has used strong distribution and brand investments to widen its reach in towns and villages. The cigarette business still delivers high cash flows. That helps fund FMCG spending and keeps the balance sheet healthy. Paperboard and packaging can gain from higher demand as FMCG grows.

Recent rural recovery and lower leaf tobacco costs in parts of the year also helped volume recovery in cigarettes. These trends offer a base for steady growth if execution stays on track.

Key Challenges Facing ITC

Tobacco regulation is the biggest structural risk. Higher taxes, graphic health warnings, and stricter rules can hit volumes and margins fast. FMCG competition is intense. HUL, Nestlé, and nimble D2C brands fight for shelf space and consumer mindshare. Paperboards face cyclical swings and weak global demand at times. Rising costs for raw materials can squeeze margins in foods and paper. Finally, macro shocks or trade tensions can dent investor appetite and exports. These factors can limit how fast ITC’s non-tobacco businesses can expand profitably.

Expert & Analyst Opinions

Brokerage views are mixed but lean positive on valuation. Several brokers note that ITC is cheaper than many FMCG peers on price-to-earnings and price-to-sales metrics. Some houses set price targets near ₹500, implying upside from current levels.

Others caution that re-rating will need sustained margin improvement and faster FMCG growth. Analysts also flag the need for steady cigarette volumes to fund the transition. Overall, the consensus sees upside but with clear execution risk.

Long-Term Outlook for ITC Shares

If FMCG gains scale and margin, ITC can earn a higher valuation over time. Strong brands and deep rural reach help. Continued cash flow from cigarettes can fund brand building and distribution. Hotels and agri-business offer optional growth if demand recovers. Sustainability moves and packaging innovations may add long-run value.

Yet, any sustained re-rating depends on visible margin improvement in FMCG and stable cigarettes cash flow. Without both, the stock may remain range-bound despite good revenue growth.

Should Investors Consider ITC Now?

Long-term investors who want income may like ITC for its steady dividend yield. Value investors may see the current price as a chance to buy a diversified business at a discount to peers. Traders should watch quarterly numbers and macro events closely.

Regulatory moves on tobacco or sudden cost inflation can change the story quickly. For a balanced portfolio, ITC can be an allocation to a steady cash-flow business plus a potential growth play in FMCG. Risk tolerance and time horizon matter most before taking a position.

Bottom Line

ITC sits at a crossroads. The firm shows clear revenue growth and has strong cash engines. The shift to FMCG is real, but competition and costs are real too. Short-term market moves may be driven by news and macro shocks.

Long-term re-rating needs consistent margin gains and clear FMCG wins. Investors should weigh steady dividends and diversification benefits against regulatory and execution risks. Watch the next few quarters for signs that FMCG margins are improving and cigarette cash flow stays stable.

Frequently Asked Questions (FAQs)

In 2018, ITC held about 12% market share in India’s FMCG sector, ranking among the top players like HUL and Nestlé.

The share price jumped due to about ₹15,180 crore one-time gain from its hotel business demerger. This boosted investor confidence.

Analysts forecast modest growth. Targets range around ₹494 in 12 months. Long-term may reach ₹700 by 2030, per some forecasts.

Shareholders holding ITC shares by the record date of January 6, 2025, get 1 ITC Hotels share for every 10 ITC shares owned.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.