NVDA News Today: Nvidia Stock Falls 2.9% Pre-Market After Earnings Report

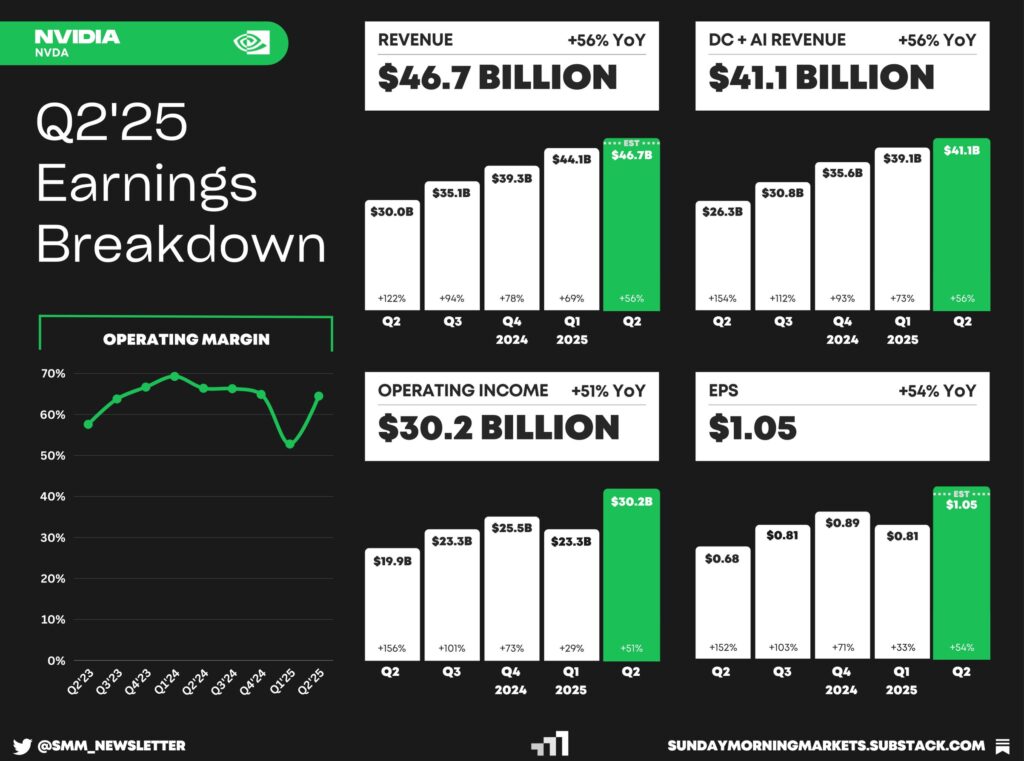

Nvidia Stock slid approximately 2 .9 percent in pre-market trading after its Q2 earnings report. While overall revenue of $46.74 billion and earnings per share of $1.04 topped expectations, a shortfall in data center revenue and a muted outlook for China weighed heavily on investor confidence. Early reactions suggest that even minor misses in key segments can trigger significant shifts in sentiment for high-growth tech stocks.

Nvidia Stock: What Drove the Early Sale-Off?

So why did Nvidia Stock fall despite strong earnings? The answer lies in the data center segment, which generated $41.1 billion, missing analysts’ $41.34 billion forecast. Adding to concern, Nvidia’s Q3 revenue guidance of $54 billion assumed no H20 GPU sales to China, deepening uncertainty around near-term growth.

Even with impressive financial figures, the lack of visibility into China and data center performance proved enough to dampen bullish expectations.

How Did Global Markets React to Nvidia’s Earnings?

In Europe, Nvidia shares fell 2 .9 percent in Frankfurt following the results, reflecting a nearly identical reaction to U.S. pre-market movement. The drop signals global investor caution, especially when high-growth names fall short in key segments.

“Nvidia shares fall 2 .9 percent in Frankfurt, day after results” — via PiQSuite on X

That tweet captures investor mood: even stellar headline numbers can falter if expectations in mission-critical areas like AI and data centers are unmet.

Breaking Down the Earnings Report

- Revenue and EPS: Nvidia reported top-line growth of 56 percent year-over-year and a $25.8 billion net income, both comfortably beating forecasts.

- Data Center Miss: The dominant revenue driver disappointed with $41.1 billion, undercutting profitability sentiment.

- China Uncertainty: No H20 GPU sales forecast for China raised geopolitical and supply-side concerns.

- AI Whisperers: Analysts still view Nvidia as a leader in AI infrastructure, but near-term pressure demands close tracking.

Will Nvidia Stock Bounce Back or Stay Soft?

What could fuel a rebound in Nvidia Stock?

- Better-than-forecast data center results next quarter.

- Clarity on H20 chip agreements with China.

- Improved macro momentum in enterprise IT spending.

- Continued excitement around AI infrastructure, especially Blackwell GPUs.

If those drivers align, the stock could stage a comeback. But for now, investors are likely to stay cautious.

Nvidia Stock: What Should Investors Do Now?

Here’s a calm, human approach to the drop:

- Hold Long-Term: For investors focused on AI, data centers, and Nvidia’s leadership in chips, this dip may be a chance to reset levels or hold steady.

- Wait for Confirmation: Traders may prefer to see strength above key technical points or improved segment performance before adding more.

- Trim Some Exposure: If your position is large relative to your comfort zone, trimming on the earnings news can rebalance risk.

How Does This Affect Broader Equity Markets?

Nvidia’s early decline nudged tech and AI-related ETFs lower. The S&P 500 and Nasdaq futures softened, showing how Nvidia still anchors sentiment in the semiconductor and AI sectors.

Analysts warn this episode reflects the delicate balance between growth story and expectations: Nvidia must consistently meet high bars to maintain market confidence.

Conclusion: Nvidia Stock Faces Short-Term Pressure, Long-Term Promise

In summary, Nvidia Stock dropped around 2 .9 percent pre-market despite strong overall growth, highlighting how the market values precision in performance and outlook, especially for critical drivers like data centers and China exposure. The stock’s long-term potential in AI, metaverse infrastructure, and GPU innovation remains strong, but short-term sentiment reflects high expectations.

As always, reacting to earnings should combine facts with strategy: consider your time horizon, track Nvidia’s next moves closely, and let clarity, not panic, dictate your next trade.

FAQ’S

Nvidia stock fell after earnings because its forward guidance disappointed investors, despite strong revenue. Concerns about slowing demand in data centers and AI chip growth added to the decline.

Nvidia typically reports earnings after market close. This allows analysts and investors to digest results before the next trading session.

If Nvidia shows stronger AI chip demand and improved guidance, its stock could rebound. However, volatility is common around earnings announcements.

A $1000 investment in Nvidia 20 years ago would now be worth several hundred thousand dollars, thanks to stock splits and massive growth in AI and GPUs.

Yes, Nvidia reported strong earnings driven by AI and data center sales, but weaker guidance created concerns. Investors reacted negatively to the outlook.

Nvidia usually reports earnings after U.S. market hours, around 4:20–4:30 PM EST. The company also holds a conference call shortly after.

Experts remain bullish long-term due to Nvidia’s AI dominance but warn that valuation is stretched. Short-term fluctuations are likely as investors digest results.

Google (Alphabet) generally reports earnings after the market close, similar to Nvidia. This is a common practice for tech giants.

Yes, Nvidia is part of the S&P 500 index. It is also among the most valuable companies by market capitalization.

Disclaimer

This is for information only, not financial advice. Always do your research.