Berkshire News: Buffett’s Firm Increases Mitsubishi Stake to 10.23%

Berkshire Hathaway has once again made headlines in Japan. Warren Buffett’s Berkshire Hathaway has lifted its stake in Mitsubishi Corporation to 10.23%. This move signals growing confidence in Japan’s largest trading company and the wider Japanese market. Mitsubishi is not just a name in Japan. It is a global player in energy, resources, and consumer goods. By crossing the 10% mark, Berkshire shows it is here for the long term.

We know Buffett’s style. He does not chase hype. Buffett always seeks value, reliable cash flow, and solid business strength. Japanese trading houses, known as “sogo shosha,” fit this model perfectly. They deal in many industries, spread risk across sectors, and offer healthy dividends. That is why Berkshire has been quietly building its position since 2020.

This step also carries weight beyond stocks. It reflects trust in Japan’s economic stability at a time when other global markets remain uncertain. For investors, it raises an important question: should they also be looking at Japan for long-term value? Berkshire’s latest bet suggests the answer may be yes.

Background: Berkshire’s Bet on Japan

Berkshire Hathaway has been building positions in Japan’s five big trading houses since 2019. These are Mitsubishi, Mitsui, Itochu, Marubeni, and Sumitomo. Warren Buffett sees them as value plays. He likes their wide reach, stable cash flow, and dividend yields. Buffett chose Japan’s sogo shosha because they blend old-school trade with modern businesses. He lends in yen at low interest rates and earns high returns. He often calls it a smart use of cheap credit for a big income.

About Mitsubishi Corporation

Mitsubishi Corporation is the biggest of Japan’s five trading houses. It has a century-old history, works in energy, machinery, chemicals, and food. It has offices worldwide. It’s part of the Mitsubishi Group. Berkshire’s stake in Mitsubishi was around 9.6% by early 2025. That figure reflected the holdings of its parent firm.

The Latest Stake Increase

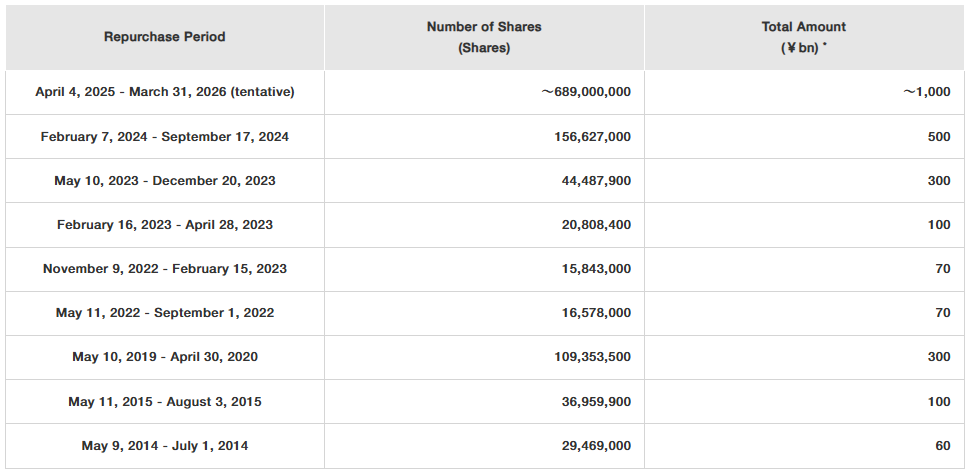

On August 28, 2025, Mitsubishi disclosed that Berkshire, via National Indemnity Company, lifted its stake from 9.74% to 10.23%. That crossed a symbolic 10% barrier. A similar rise happened in Mitsui, though that firm did not share the exact number.

Buffett’s Wider Japan Strategy

Buffett did not stop at Mitsubishi. He holds positions in all five major trading houses. He approved a deal to go above 10% for all. But he promised not to cross 20% or take control.

His investments go beyond just money. He is pushing for better dividends, share buybacks, and fair governance. This reflects his long-held view on shareholder value.

Buffett’s Firm: Market Response

Markets responded quickly. Mitsubishi’s stock rose around 1.8% after the news. Mitsui followed with a 1.2% rise. Other trading firms also gained. The Nikkei index dipped less, showing signs of broader optimism. The news seemed to spark renewed interest in Japanese stocks. It showed that Buffett still sees value here.

Buffett’s Firm and Its Strategic Performance

This move is more than a numbers game. It shows Berkshire’s faith in Japan’s long-term potential. It hints at improved governance in these firms. More transparency and better shareholder returns followed. Mitsubishi even launched a $1 billion buyback plan and pays about 10% in dividends.

Buffett is investing with patience. He and his team plan to hold these shares for decades. Berkshire’s successor, Greg Abel, keeps regular contact with Japanese firms.

Risks and Challenges

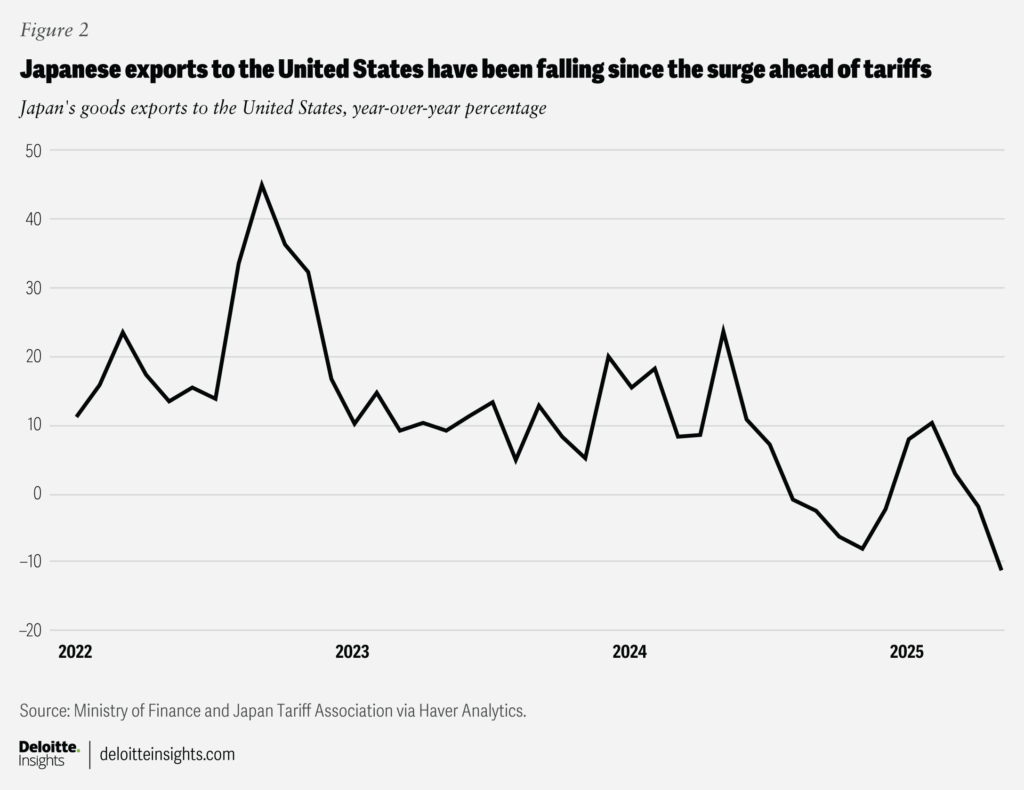

Trading houses face risks, too. Commodity prices can swing. Global tensions may affect supply chains. Currency shifts, especially between the yen and the dollar, can hurt returns. Japan’s politics and regulations around big foreign ownership might add hurdles. These are things to watch.

Buffett’s Firm: Future Outlook

Buffett might raise his holdings further. But he seems content with influence, not control. His bet may inspire other global investors to look at Japan. The broader market stands to benefit if Japan’s economy and governance keep improving. Buffett’s long-term view may shape foreign capital flows and industry standards in Asia.

Bottom Line

Berkshire’s larger stake in Mitsubishi shows a strong belief in Japan’s trading houses. The move signals confidence in stable cash flow, global reach, and reliable dividends. Mitsubishi’s rise above the 10% mark is not just about numbers. It reflects a steady, long-term bet on Japan’s economy. The market reaction proves Buffett’s influence still runs deep.

While risks remain from currency shifts and global supply issues, Berkshire’s patient approach sets the tone. The latest step reminds investors that value investing, when paired with discipline, continues to shape global markets.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.