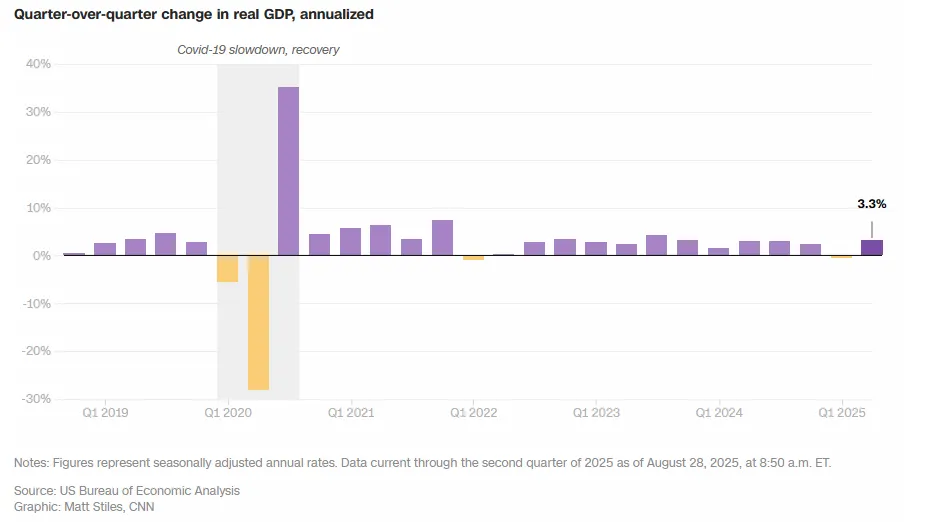

US Economy Grew 3.3% in Q2, Stronger Than Initial Forecasts

The US economy expanded at a faster pace than expected in the second quarter of the year. Growth reached 3.3%, well above the initial 3.0% forecast. This upward revision highlights stronger consumer activity, improved business investment, and a significant boost from trade.

Consumer spending rose by 1.6%, driven by steady demand for goods and services. Meanwhile, business investment posted a sharp increase of 5.7%, a sign of resilience in the corporate sector. At the same time, trade shifts played a major role as imports fell nearly 30%, helping lift the overall GDP figure despite weaker exports.

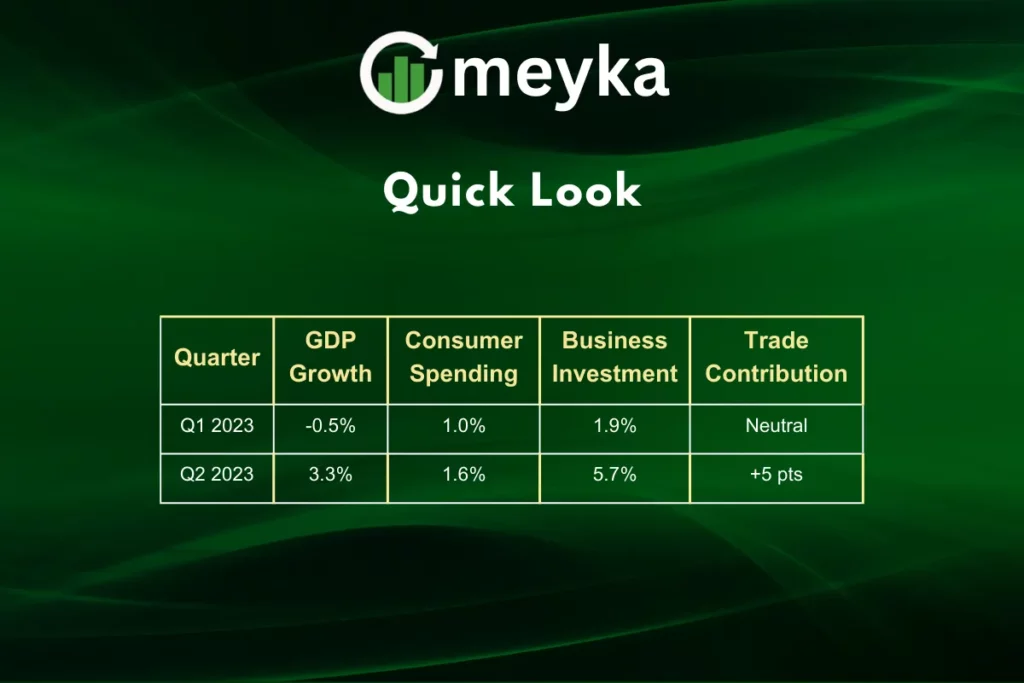

After a rough first quarter where the economy shrank by 0.5%, it bounced back nicely. For the first half of the year, growth averaged 2.1%, keeping things on a steady footing.

Key Drivers of the US Economy Growth

Stronger Consumer Spending

In Q2, household spending climbed to 1.6%, up from the earlier 1.4% estimate. Key areas included:

- Increased demand for services such as travel and leisure.

- Steady purchases of everyday essentials.

- A modest rise in durable goods, though at a slower pace.

Consumer spending remains the backbone of the US economy, accounting for nearly two-thirds of activity.

Business Investment Surges

Business investment jumped to 5.7%, way up from the initial 1.9% estimate. Stronger corporate spending included:

- Technology and equipment upgrades.

- Real estate and infrastructure projects.

- Inventory adjustments to meet demand.

This rebound signals business confidence, despite concerns about trade policy and tariffs.

Trade Contribution

Trade played a surprising role in Q2 performance.

- Imports dropped 29.8%, easing pressure on domestic producers.

- Exports slipped 1.3%, reflecting weaker demand abroad.

- Net exports added almost 5 percentage points to the overall GDP growth.

This shift boosted short-term growth but raised questions about sustainability.

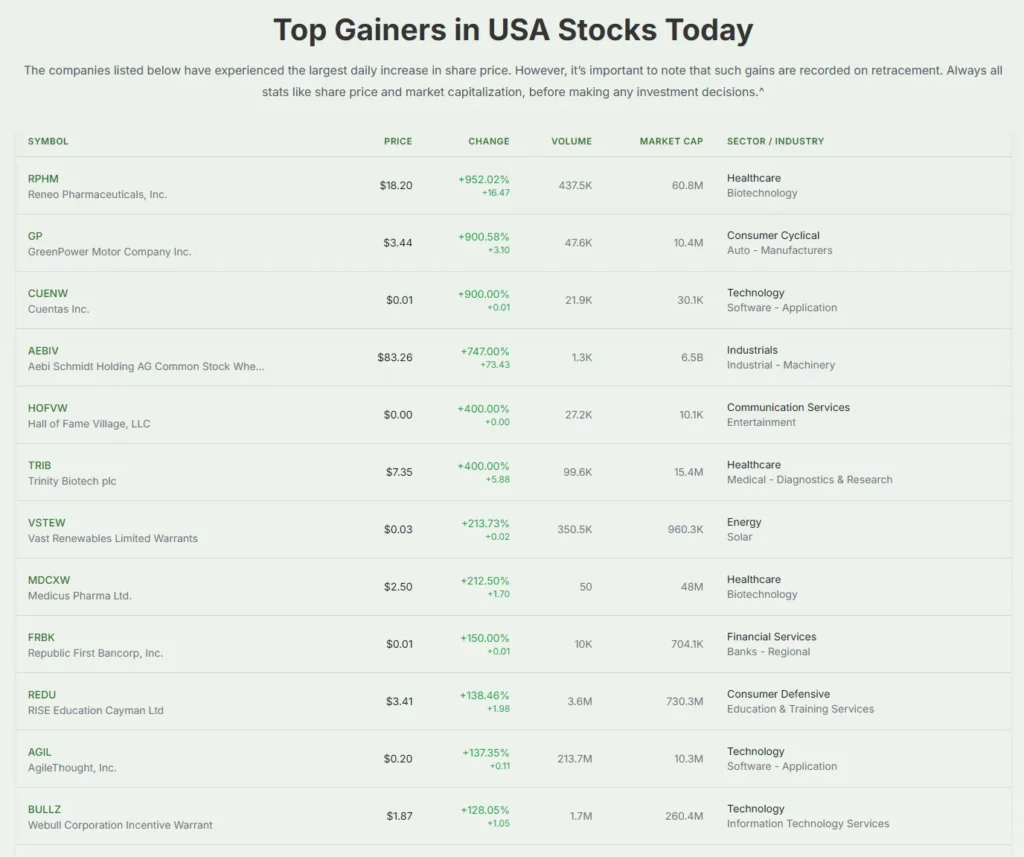

Impact on the Stock Market

The stock market closely tracks GDP performance. A stronger economy often supports higher earnings and investor optimism.

- Positive GDP news in Q2 fueled gains in major indexes.

- Consumer-driven sectors like retail and travel benefited from increased spending.

- Business investment growth supported industrial and technology shares.

- Trade-related companies faced mixed results due to falling exports.

While investors welcomed the stronger-than-expected growth, concerns remain about slower activity in the months ahead.

Inflation and Prices

Inflation stayed moderate in Q2.

- Core PCE prices rose 2.5%, signaling steady underlying price growth.

- The headline PCE index increased 2%, consistent with the Federal Reserve’s target.

Stable inflation allows policymakers more flexibility, though risks remain if tariffs drive prices higher later in the year.

Tom Williams/CQ-Roll Call, Inc/Getty Images

Outlook for the Second Half

Economists caution that momentum may cool. Several forecasts suggest growth could slip to 1.5%, or even below 1%, by year-end. Factors to watch include:

- Slower consumer demand as savings shrink.

- The impact of tariffs on both imports and exports.

- Rising borrowing costs that may limit business spending.

The Atlanta Fed’s GDPNow model projects 2.2% growth for Q3, still solid but weaker than Q2.

Comparison of Q1 and Q2 Performance

What It Means for Investors

For investors, the results suggest a mixed picture:

- Opportunities exist in consumer-driven and business-focused sectors.

- Risks include trade disruptions and slower growth in coming quarters.

- Diversification remains key as different sectors respond differently to changing conditions.

The stock market may continue to reflect this push-and-pull between strong current data and weaker future expectations.

Bottom Line

The US economy posted a strong 3.3% growth rate in Q2, surpassing early forecasts. Consumers, businesses, and trade shifts combined to deliver this rebound. While the stock market welcomed the news, the path ahead looks less certain. Slower spending, trade risks, and higher costs may limit momentum in the coming months.

Frequently Asked Questions

The growth came from stronger consumer spending, higher business investment, and reduced imports, which lifted net exports.

Spending rose 1.6%, supporting growth in travel, leisure, and essential goods.

Imports fell by nearly 30%, which gave a big lift to net exports and added close to five points to GDP.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.