Vikran Engineering IPO GMP & Subscription: Day 3 Review for Investors

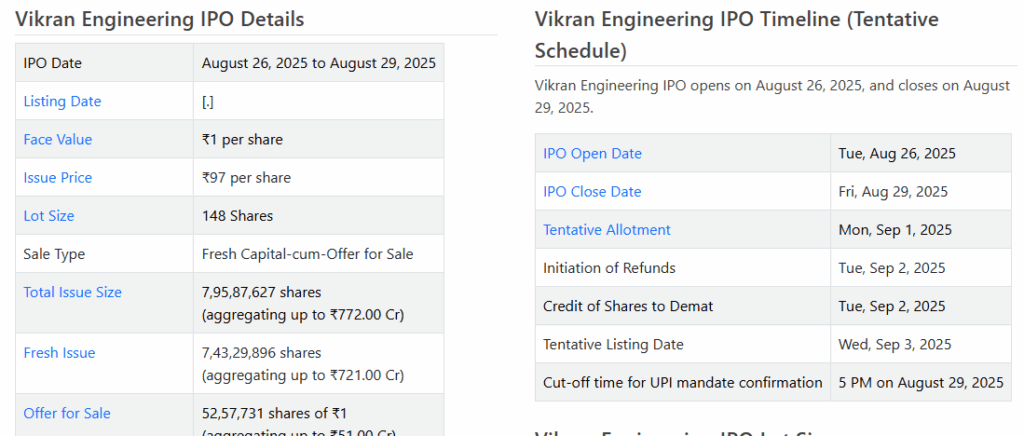

Vikran Engineering has recently launched its much-awaited IPO, and investors across the market are keeping a close watch. The company, known for its strong presence in the engineering and manufacturing sector, aims to raise funds for expansion and future growth.

On Day 3 of the subscription, we see interesting trends that could influence investor decisions. The Grey Market Premium (GMP) and subscription numbers are telling us a lot about market sentiment. As we explore these figures, it becomes clear how retail, institutional, and high-net-worth investors are responding. Understanding the GMP helps us gauge the potential listing price, while subscription trends show how popular the IPO is among different investor categories.

Let’s break down the Day 3 numbers, compare them with the first two days, and provide insights that can help us make insightful decisions.

Grey Market Premium (GMP) Overview

The Grey Market Premium (GMP) serves as an unofficial indicator of an IPO’s potential listing performance. For Vikran Engineering, the GMP has shown a positive trend, reflecting investor optimism. On Day 3, the GMP stood at ₹12, suggesting a potential 12% gain over the issue price upon listing. This uptick indicates strong market sentiment and investor confidence in the company’s prospects. The GMP’s upward movement over the past sessions further bolsters expectations of a favorable listing.

Subscription Status

Investor interest in Vikran Engineering’s IPO has been robust, with the issue witnessing significant demand across various categories. On Day 3, the overall subscription rate reached 5.62 times, driven predominantly by retail and non-institutional investors.

The retail portion was subscribed to 5.23 times, while the non-institutional investor segment saw a subscription of 11.03 times. Qualified Institutional Buyers (QIBs) contributed to 91% of their reserved portion. This strong demand across all investor categories underscores the IPO’s appeal and the market’s positive reception.

Investor Sentiment & Market Response

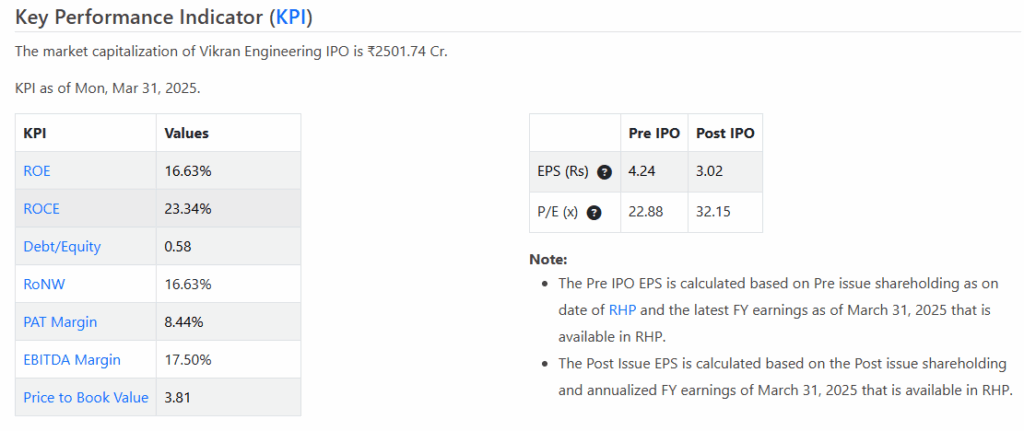

The strong GMP and high subscription rates have positively influenced investor sentiment. Analysts have noted that Vikran Engineering’s IPO is attractively priced compared to its peers, with a TTM EV/EBITDA multiple of 17.3x, lower than the industry average of 32.0x. This valuation, coupled with the company’s consistent financial performance and growth trajectory, has led to favorable recommendations from brokerage firms. While some caution regarding sectoral risks remains, the overall market response has been optimistic, indicating confidence in the company’s future prospects.

Expert Tips for Investors

Prospective investors are advised to consider the following before subscribing to Vikran Engineering’s IPO:

- The IPO is priced attractively, with lower valuation multiples compared to peers, suggesting potential for listing gains.

- Given the company’s consistent financial performance and growth potential, a long-term investment approach may be beneficial.

- While the outlook is positive, investors should be mindful of sector-specific risks and market volatility.

Listing Expectations

Based on the current GMP and subscription trends, Vikran Engineering’s shares are expected to list at a premium. The estimated listing price, considering the ₹12 GMP, could be around ₹109 per share, representing a 12% gain over the upper issue price of ₹97. This anticipated listing gain aligns with the positive market sentiment and investor expectations.

Bottom Line

Vikran Engineering’s IPO has garnered strong investor interest, as reflected in the high subscription rates and positive GMP. The company’s attractive valuation, coupled with its consistent financial performance and growth prospects, makes it a compelling investment opportunity.

While sector-specific risks should be considered, the overall market response indicates confidence in the company’s future trajectory. Investors looking for a blend of short-term gains and long-term growth may find Vikran Engineering’s IPO appealing.

Frequently Asked Questions (FAQs)

As of August 29, 2025, the Grey Market Premium (GMP) for Vikran Engineering’s IPO is ₹12, indicating a potential 12% gain over the issue price upon listing.

No, Vikran Engineering is not listed yet. The IPO closed on August 29, 2025, and the expected listing date is September 3, 2025.

The total size of Vikran Engineering’s IPO is ₹772 crore, comprising ₹721 crore from a fresh issue and ₹51 crore from an offer for sale.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.