El Salvador to Transfer Bitcoin Reserves Across Multiple Wallets

El Salvador made a significant move in August 2025 by transferring its entire Bitcoin holdings across multiple wallet addresses. The Central American nation moved 6,274 BTC, valued at approximately $678 million, from a single address into 14 separate wallets. This strategic decision aims to protect the country’s digital assets from potential quantum computing threats.

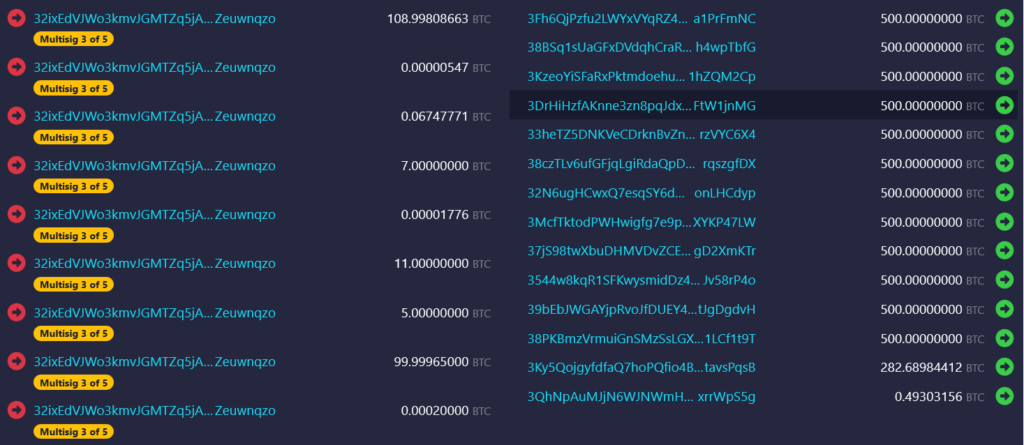

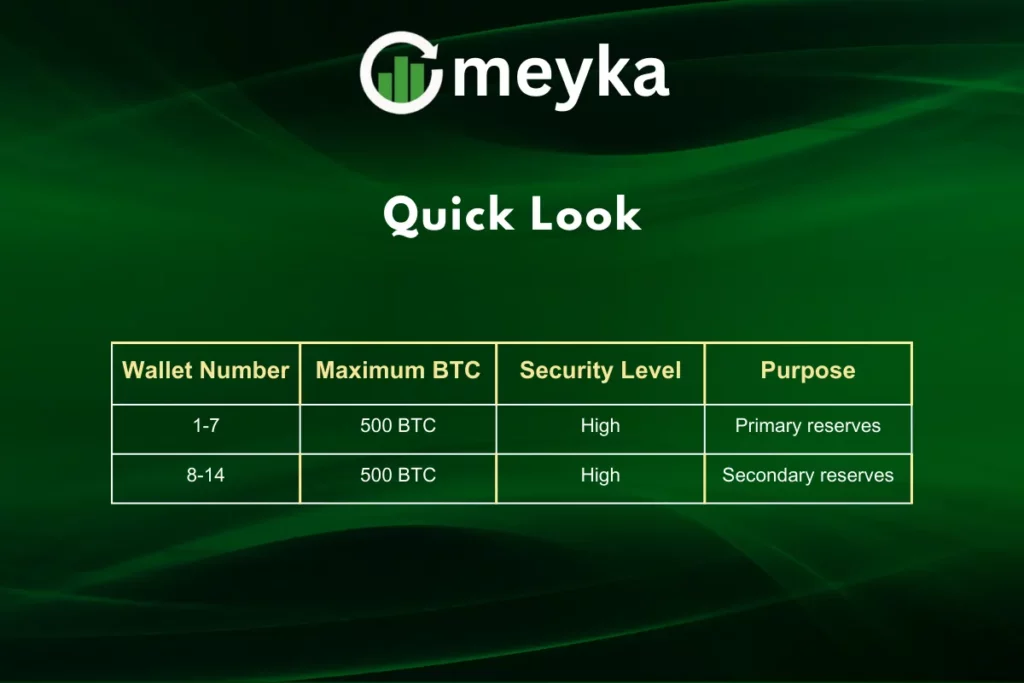

The transfer represents one of the largest institutional Bitcoin movements in recent months. Each new wallet contains a maximum of 500 BTC to distribute risk effectively. This move comes amid growing concerns about quantum computing’s potential impact on cryptocurrency security and its possible effects on the global stock market.

El Salvador’s decision follows similar actions by major institutions worldwide. The country’s proactive approach to Bitcoin security demonstrates its commitment to protecting its digital treasury reserves.

Understanding El Salvador’s Bitcoin Transfer Strategy

The Scale of the Transfer

El Salvador moved a hefty chunk of Bitcoin, worth close to $678 million, to new addresses. The government distributed these holdings across 14 new wallet addresses rather than keeping them in one location. This approach significantly reduces the risk of total loss if one wallet becomes compromised.

The maximum limit of 500 BTC per wallet creates a balanced distribution strategy. This method ensures no single address holds an overwhelming portion of the country’s reserves. The transfer took place efficiently without disrupting Bitcoin prices or affecting broader stock market stability.

Risk Mitigation Through Diversification

The transfer strategy mirrors traditional stock market portfolio diversification principles. By splitting its BTC across different addresses, El Salvador lowers the risk of having too much in one place. This approach protects against potential security breaches or technical failures affecting any single wallet.

Modern cybersecurity best practices recommend distributing large digital asset holdings. El Salvador’s method aligns with institutional standards used by major corporations and investment funds. The strategy also provides operational flexibility for future BTC transactions.

Quantum Computing Threat Assessment

Bitcoin security relies on 256-bit encryption technology that remains robust against current threats. Existing quantum computers have not successfully cracked even 3-bit keys, according to recent research. Most experts believe powerful quantum computers capable of threatening Bitcoin security are still a decade away.

However, the potential threat has prompted preventive action from major institutions. This analysis has influenced both government and corporate security strategies.

Industry Response to Quantum Threats

MicroStrategy, despite CEO Michael Saylor downplaying quantum risks in June 2025, transferred its 252,000 BTC holdings in May 2025. This action demonstrates the gap between public statements and private security measures. The stock market has responded positively to companies taking proactive security steps.

Major technology companies have accelerated quantum-resistant development programs. Google unveiled its Willow quantum chip in 2025, prompting increased security awareness across financial markets. The stock market values companies that demonstrate forward-thinking security strategies.

Global Regulatory and Development Context

Back in late 2022, the U.S. passed the Quantum Computing Cybersecurity Preparedness Act. This legislation requires federal agencies to transition to quantum-resistant cryptography systems. The law’s implementation has influenced private sector security practices and stock market valuations.

The European Union launched a EUR1 billion initiative in July 2025 for post-quantum cryptography development. This massive investment demonstrates the global scale of quantum security concerns. Financial markets, including Bitcoin and traditional stock market instruments, benefit from these security advances.

El Salvador’s Economic Context

In December 2024, El Salvador landed a $1.4 billion funding agreement with the IMF. This agreement came with conditions regarding the country’s Bitcoin adoption strategy. In July 2025, the IMF raised worries about El Salvador leaning too heavily on digital assets.

The international lender claimed no new Bitcoin purchases had occurred since February 2025. However, the recent transfer demonstrates El Salvador’s continued commitment to its digital asset strategy. The stock market has shown mixed reactions to sovereign Bitcoin adoption policies.

Wallet Distribution Strategy

The distribution ensures balanced risk allocation across all addresses. Each wallet employs identical security protocols to maintain consistent protection standards. This approach prevents any single point of failure in El Salvador’s Bitcoin holdings.

Security Protocols

El Salvador implemented multiple security layers for each new wallet address. The protocols include:

- Multi-signature authentication requirements

- Hardware security module integration

- Regular security audits and updates

- Emergency response procedures

- Backup and recovery systems

These measures exceed standard Bitcoin security practices used by most institutions. The comprehensive approach protects against various threat vectors beyond quantum computing risks.

Bitcoin Price Stability

The transfer occurred without significant Bitcoin price volatility or stock market disruption. This stability demonstrates the maturity of cryptocurrency markets and institutional handling procedures. Large-scale transfers no longer create the panic selling seen in earlier years.

Professional execution of the transfer has increased confidence in institutional Bitcoin management. The stock market has responded positively to evidence of sophisticated cryptocurrency handling by government entities.

Bottom Line

El Salvador’s strategic Bitcoin transfer demonstrates sophisticated institutional digital asset management. The country’s proactive approach to quantum security threats sets new standards for sovereign cryptocurrency holdings. This move reinforces Bitcoin‘s role as a legitimate reserve asset while addressing legitimate security concerns.

The successful execution without market disruption proves that large-scale Bitcoin operations can occur smoothly. The stock market and cryptocurrency markets have responded positively to this demonstration of institutional competence. El Salvador continues to lead global Bitcoin adoption through practical, security-focused strategies.

Frequently Asked Questions

El Salvador moved its Bitcoin to safeguard it from quantum computing risks and spread out its exposure. The distribution across 14 wallets ensures better security than a single address.

El Salvador moved 6,274 Bitcoin worth approximately $678 million across 14 new wallet addresses, with each holding a maximum of 500 BTC.

Current quantum computers cannot crack Bitcoin‘s 256-bit encryption. Most experts believe that quantum computers capable of threatening Bitcoin are still a decade away.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.