XRP News Today: XRP Grabs Headlines While Regulators Step Back

XRP is once again in the spotlight, and this time the headlines are brighter. For years, the token has lived under the shadow of tough regulations and legal fights. The most notable one was the U.S. SEC lawsuit that shaped how the world looked at XRP and Ripple. Today, the scene looks different. Regulators seem to be stepping back, and the market is giving XRP a new chance to prove itself.

We see traders talking about XRP on social media. We see banks testing Ripple’s technology for faster cross-border payments. Even large investors are quietly watching its price moves. This sudden shift has brought XRP back into the news cycle.

Why does this matter? Because in the crypto world, perception is as powerful as price. A softer stance from regulators gives the project breathing room. It also builds trust among once hesitant people. As we explore XRP’s current market standing and what’s driving these new headlines, one thing is clear: the story of XRP is far from over.

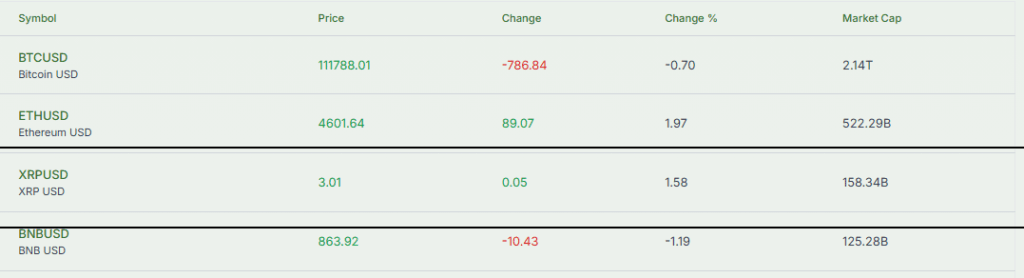

XRP’s Current Market Standing

XRP has climbed back into the top tier of crypto conversations. The coin trades around $2.8-$2.9 in most markets. Volume is high, with billions changing hands each day. Market cap sits in the tens of billions, making XRP one of the larger crypto projects by value. The recent price swings have pushed XRP closer to its 2021 highs than to its low points from earlier years. This renewed interest shows up on major exchanges and price trackers.

Regulatory Landscape: Past vs. Present

XRP’s story was shaped by an extended legal fight with the U.S. SEC. That case once clouded the token’s future in the U.S. The SEC claimed some XRP sales were unregistered securities. That stance changed after appeals and negotiations in 2025. The SEC’s move away from active appeals signaled less legal pressure on XRP in public trading.

Still, parts of the dispute, especially fines tied to institutional sales, have required settlement terms and careful handling. The drop in enforcement focus has given XRP far more regulatory breathing room than it had a year earlier.

XRP News Today Driving Attention

Several big stories have lifted XRP into the headlines. First, the legal de-escalation drew broad media coverage and boosted trader interest. Second, reports of new exchange-traded fund (ETF) filings and institutional interest made investors talk. Third, Ripple announced or publicized more pilot deals and proofs of concept with banks and payment firms. These items combined to make XRP a headline topic across crypto feeds. The press cycle and social media chatter then fed back into price and volume.

Institutional Adoption and Use Cases

Ripple pushes XRP as a tool for fast cross-border transfers. The company highlights lower fees and faster settlement times than older systems. Several banks and money-movement firms have publicly run pilots using Ripple’s tech. Some smaller financial players report time and cost savings in test runs. Large institutions have also added XRP exposure to treasury or liquidity strategies in isolated cases. However, the depth and scale of real-world use differ by region and by partner. Adoption is uneven but gradually expanding.

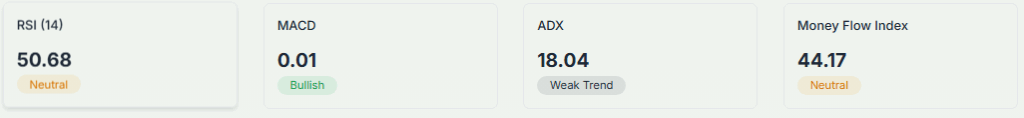

Investor Sentiment & Market Reactions

Retail traders reacted quickly to the positive legal and market news. Social platforms and trading forums showed more bullish talk than in recent years. On-chain metrics also changed: trading volume and wallet activity rose during headline days.

Large holders, often called whales, moved XRP across exchanges, which signaled both profit-taking and repositioning. Analysts published bullish and cautious forecasts. Some argued for long-term upside if real adoption keeps growing. Others warned that hype could fade if fresh catalysts do not arrive. Current market sentiment mixes optimism with healthy skepticism.

Challenges Still Ahead

Not all problems are solved. On-chain activity for payments remains lower than advocates hoped. Critics point out that many Ripple partnerships are pilot projects rather than full production rollouts. Competition from stablecoins, central bank digital currencies (CBDCs), and other fast-payment tokens is fierce. Macro risks such as rate moves and liquidity shifts can also drag crypto prices down. Finally, regulatory clarity in one jurisdiction does not erase rules in others. XRP must show sustained, real-world utility before all doubts evaporate.

The Road Ahead for XRP

If Ripple turns pilots into production, XRP could gain steady volume as a bridge asset. ETF approvals or similar institutional vehicles would likely bring new capital. Continued partnerships with banks and payment firms would help the network prove its use case. Yet long-term success depends on execution. Clear rules and fair access on major exchanges are essential. Markets may reward consistent real-world flows more than headlines. Observers will watch legal follow-up items and settlement terms closely.

Bottom Line

XRP’s recent headlines stem from a mix of legal developments, market moves, and adoption claims. The easing of U.S. regulatory pressure helped restore trader confidence. Price and trading activity reacted fast. Real adoption is growing, but not guaranteed. The next steps will matter more than any single news spike.

Investors and industry watchers should track settlements, exchange listings, and real production rollouts. Those items will decide whether XRP keeps its place in the markets or returns to its old pattern of boom and pause.

Frequently Asked Questions (FAQs)

No one fully controls XRP. Ripple Labs created it, but the network runs on decentralized technology. Ripple holds a large share, yet the blockchain itself works independently.

In July 2023, a U.S. court ruled that XRP is not always a security. This gave partial clarity, but regulations vary worldwide, and some legal questions remain open.

No country controls XRP. Ripple Labs is based in the United States, but XRP runs on a global blockchain. Anyone worldwide can buy, sell, or use it.

The big ruling came in July 2023, ending most disputes. But some parts, like Ripple’s institutional sales, still face ongoing legal and settlement discussions into 2025.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.