Nvidia Reveals Two Mystery Clients Made Up 39% of Q2 Revenue

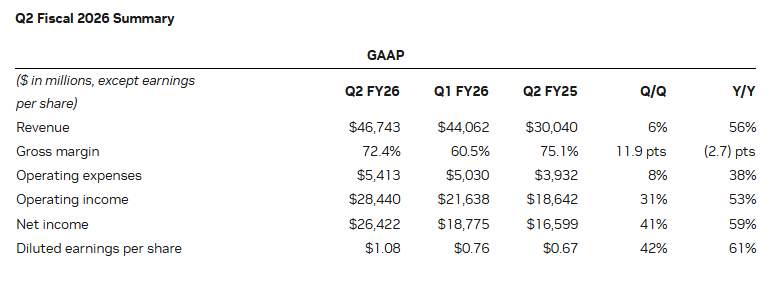

In the second quarter of 2025, Nvidia reported a record-breaking revenue of $46.7 billion, marking a 56% increase from the previous year. However, a surprising detail emerged from the company’s financial filings: two unnamed clients, referred to as “Customer A” and “Customer B,” accounted for nearly 39% of this revenue. Specifically, Customer A contributed 23%, while Customer B added 16%. This concentration is a significant rise from the same quarter in the previous year, when the top two customers represented 14% and 11% of sales, respectively.

This revelation has sparked discussions about the implications of such client concentration. Nvidia’s data center segment drives most of its growth. It includes AI infrastructure. But the company relies heavily on a few clients. This raises concerns about revenue stability. Losing one of these major customers could be risky.

Let’s find out the details of Nvidia’s Q2 performance, explore the identities and significance of these mystery clients, and analyze the potential impact on Nvidia’s prospects.

Nvidia’s Q2 Financial Performance

In the second quarter of fiscal year 2026, Nvidia reported a record revenue of $46.7 billion, marking a 56% increase year-over-year. This growth was primarily driven by the company’s data center segment, which generated $41.1 billion, accounting for 88% of total revenue. The introduction of the Blackwell architecture contributed significantly to this surge, with Blackwell Data Center revenue growing 17% sequentially.

Despite the impressive top-line growth, Nvidia’s gross margin declined from 75.1% to 72.4% year-over-year. This dip was attributed to increased competition in the AI hardware space, leading to pricing pressures. Additionally, the company’s operating income and earnings per share showed strong growth, with operating income rising and earnings per share increasing from $0.67 to $1.08.

The Mystery Clients

A notable aspect of Nvidia’s Q2 performance was the significant contribution from two unnamed customers. According to a filing with the U.S. Securities and Exchange Commission, “Customer A” accounted for 23% of total revenue, while “Customer B” contributed 16%. Together, these two customers represented nearly 39% of Nvidia’s Q2 revenue, a sharp increase from the 25% combined share in the same period the previous year.

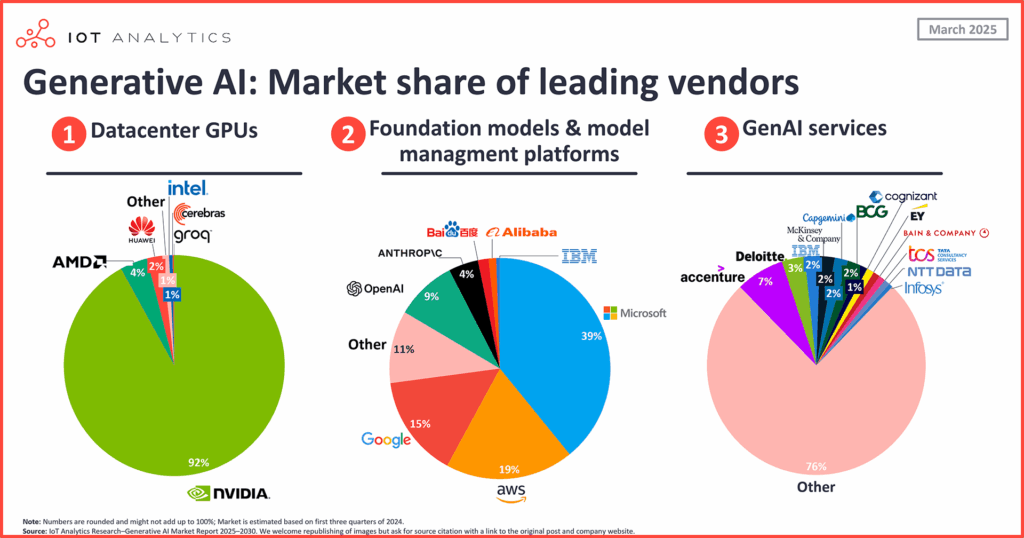

These customers are classified as “direct customers,” which typically include original equipment manufacturers (OEMs), system integrators, or distributors who purchase Nvidia’s chips to assemble complete systems or boards. The identities of these customers are not disclosed. Some speculate they are big cloud service providers. Others think they could be major tech firms. These companies likely work in AI infrastructure. Their spending drives Nvidia’s growth.

Impact on the AI and Tech Market

Nvidia’s dominance in the AI hardware market is evident, with the company leading in the development and supply of GPUs essential for AI and data center operations. The significant revenue concentration among a few clients raises questions about the long-term stability of Nvidia’s revenue streams. If any of these major customers reduce their spending or switch suppliers, it could impact Nvidia’s financial performance.

The increasing reliance on a limited number of clients also highlights the growing importance of AI infrastructure investments. As more companies and governments invest in AI technologies, the demand for high-performance computing solutions is expected to rise, potentially benefiting Nvidia and its competitors.

Investor Perspective and Market Reaction

Despite surpassing Wall Street expectations with its Q2 results, Nvidia’s stock experienced a slight decline in after-hours trading. This downturn was attributed to concerns over the company’s heavy reliance on a few large customers and the potential risks associated with such concentration. Analysts have expressed caution, noting that while Nvidia’s market position remains strong, diversification of its customer base could mitigate potential revenue volatility.

Speculation on Client Identities

The identities of Nvidia’s top two customers have been the subject of much speculation. While Nvidia has not disclosed its name, industry experts have pointed to major cloud service providers as potential candidates. These companies are significant consumers of AI hardware and could be purchasing Nvidia’s chips through direct customers like OEMs or system integrators.

However, without official confirmation from Nvidia, the true identities of these customers remain unknown. The company’s refusal to disclose this information has fueled further speculation and intrigue within the tech community.

Nvidia’s Future Outlook

Looking ahead, Nvidia projects continued growth in its AI and data center segments. The company anticipates that investments in AI infrastructure will drive demand for its products, contributing to revenue growth. However, Nvidia also faces challenges, including increased competition in the AI hardware market and regulatory uncertainties in key markets like China.

To sustain its growth, Nvidia may need to diversify its customer base and reduce its dependence on a few large clients. Expanding its reach into new markets and strengthening relationships with a broader range of customers could help mitigate risks associated with customer concentration.

Final Words

Nvidia’s Q2 results show it is a leader in AI hardware. Yet, a large portion of revenue comes from just a few clients. This concentration could pose risks to the company’s financial stability. As the tech industry changes, Nvidia must focus on both growth and spreading its customer base. Doing so will help the company stay strong and secure long-term success.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.