Quantum Computing Risk Mitigation: Safeguarding Institutional Bitcoin Holdings

Quantum computing breakthroughs have sparked real concern about Bitcoin’s future. Quantum computers, far more powerful than today’s machines, could break Bitcoin’s current security. The focus keyword for this discussion is quantum computing, shaping the core of the topic.

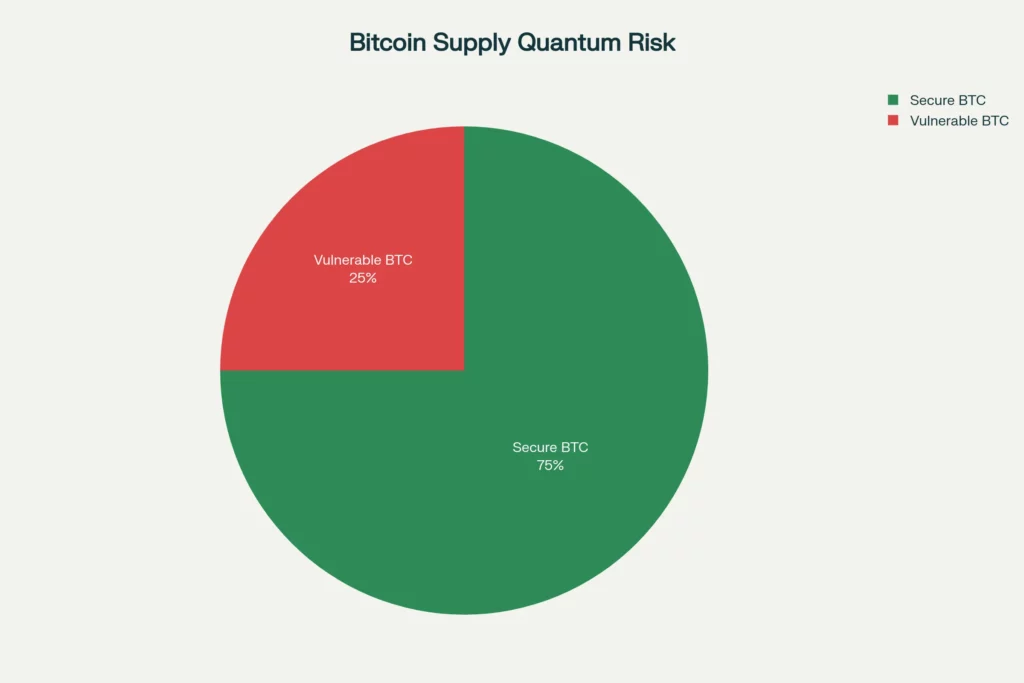

An estimated 6-7 million BTC, up to a quarter of the total Bitcoin supply, sit especially vulnerable in legacy addresses. Institutions, banks, and even countries now hold large Bitcoin reserves. Keeping these holdings secure from quantum risks is a major challenge. These threats are not far off; experts warn that 1,500 to 2,600 qubits could bypass Bitcoin’s encryption within ten years.

What Makes Quantum Computing Dangerous for Bitcoin?

Quantum computing can solve math problems much faster than traditional computers. Bitcoin wallets use a certain type of math-based lock, called ECDSA, to keep coins safe. Quantum computers might crack this lock in minutes using special methods, making current Bitcoin defenses weak.

How Many Bitcoins Are At Risk?

- Around 6 to 7 million BTC are at risk from weak legacy wallets.

- This is about 25% of all Bitcoin.

- The rest of the Bitcoin supply uses somewhat stronger measures, but still needs upgrades.

The Timeline for Risk

Researchers believe fault-tolerant quantum computers with 1,500 to 2,600 qubits could break current Bitcoin protections.

- This may happen within the next decade.

- Preparations are underway to move before this risk becomes a reality.

Real-World Responses to Quantum Threats

El Salvador’s Stance

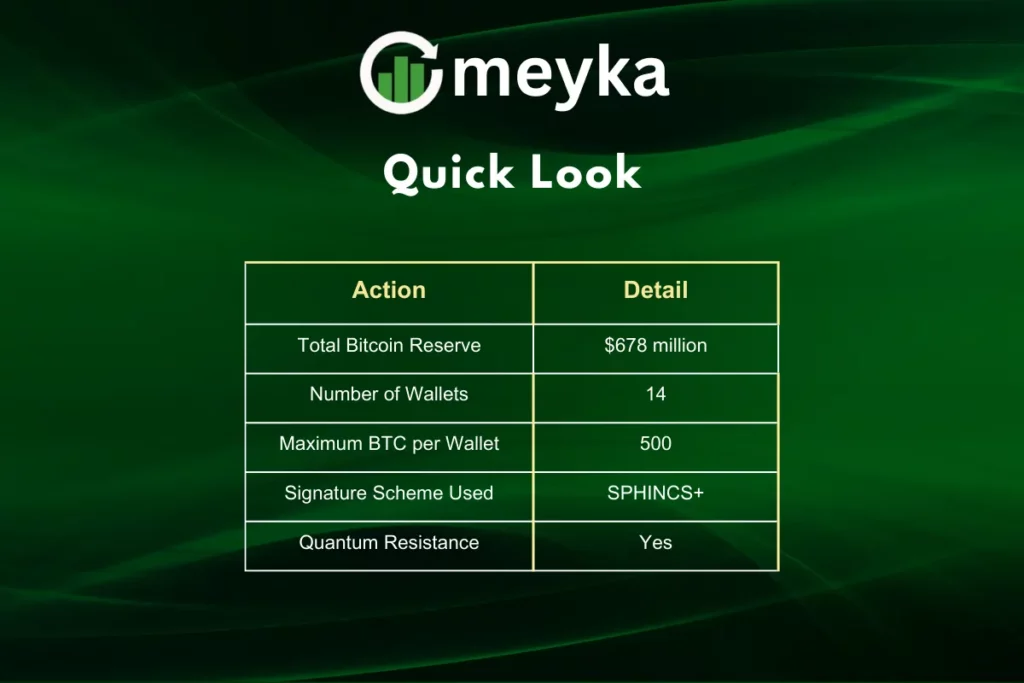

El Salvador, a country with a major Bitcoin reserve, split its $678 million in Bitcoin into 14 wallets.

- Each wallet holds no more than 500 BTC.

- These wallets utilize SPHINCS+ signatures, a quantum-resistant system.

Table: El Salvador’s Bitcoin Protection

HSBC and Banking Innovation

HSBC piloted a quantum-secure solution for a €30 million FX trade in 2023. This shows banks take quantum computing seriously. Other banks watch these projects to learn how to protect client assets.

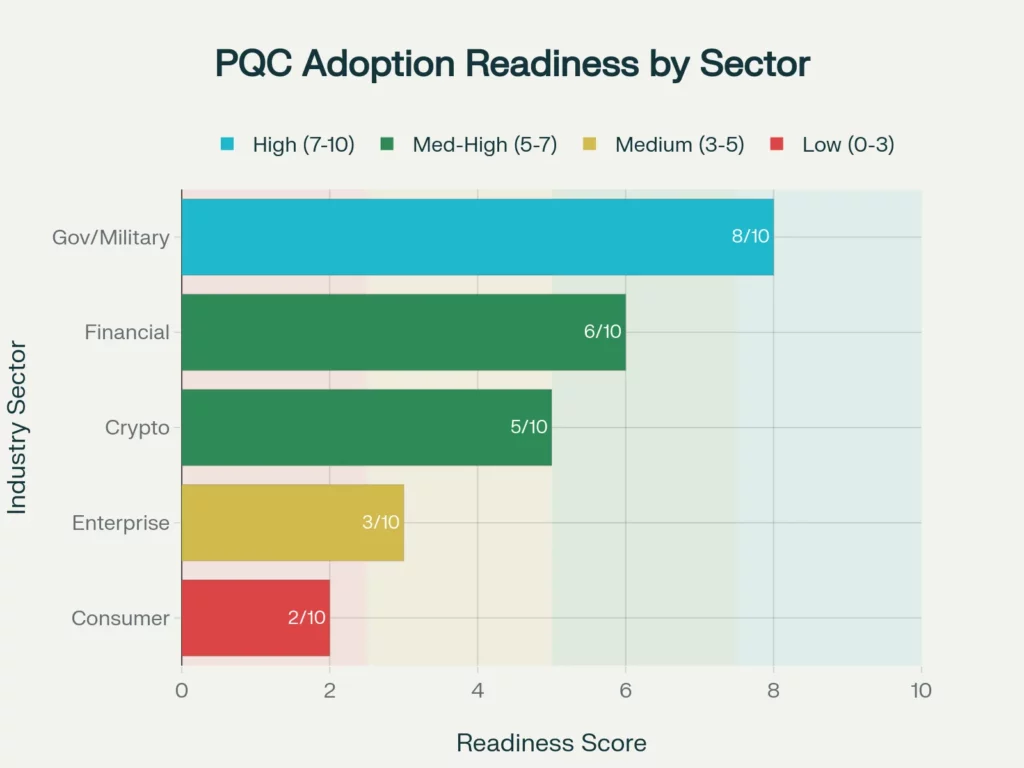

U.S. Government Mandates

The U.S. government requires all agencies to shift to post-quantum cryptography by 2035. Large financial firms tied to government contracts will make this change, too. The shift pushes everyone in finance, even those on the stock market, to rethink security now.

Institutional Mitigation Strategies

Wallet Fragmentation

Dividing large Bitcoin holdings across more wallets lowers the amount at risk from an attack. El Salvador’s strategy is an industry example.

Quantum-Resistant Signatures

SPHINCS+ and similar cryptographic methods defy quantum cracking. Financial giants can use these options now:

- Switch to quantum-resistant wallets.

- Adopt new digital signature standards.

Regular Wallet Rotation

Moving Bitcoin to fresh addresses using strong new cryptography protects old coins. This process removes exposure from addresses visible on the Bitcoin blockchain.

Cold Storage and Custody Upgrades

Storing large Bitcoin holdings offline, with quantum-safe protections, reduces exposure. Trusted custody solutions invest in this level of security.

How Quantum Computing Threats Could Impact the Stock Market

Quantum risk is not only a crypto problem. Widespread loss of trust in digital assets could affect the stock market through:

- Broader financial instability

- Reduced investor confidence

- Fast asset reallocation

For example, if a major institution loses Bitcoin due to quantum hacking, panic could drive quick stock sales or halt critical services.

Final Thoughts

Quantum computing poses a large challenge to Bitcoin’s long-term safety. Large holders, including countries and major banks, are moving fast. Using quantum-resistant protection and adopting wallet rotation keep Bitcoin safer. This urgent shift impacts not just crypto but also the world’s wider financial system, including the stock market.

We must adapt now to keep institutional Bitcoin assets secure as quantum computing advances. By using strategies described above, institutions lead the way in shielding digital wealth from new risks.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.