DRDO Partnership Sends Apollo Micro Systems Share Price Up 14% in 2 Days

Apollo Micro Systems has been making headlines after its stock jumped nearly 14% in just two trading days. The sudden rise came soon after the company announced a partnership with the Defence Research and Development Organisation (DRDO). This collaboration has created a wave of excitement among investors and industry watchers.

We know that defense is one of the most promising sectors in India right now. With the government pushing for “Make in India” and greater self-reliance, companies that work with DRDO are seen as strong players for the future. Apollo Micro Systems, with its focus on defense and aerospace technology, is now at the center of attention.

The market reaction shows how much trust investors have in the long-term potential of this tie-up. A partnership with DRDO is not just about contracts. It is about credibility, innovation, and opportunities that can shape the future of India’s defense industry. Let’s explore why this move has boosted investor confidence, what it means for the company, and where the stock could be heading.

Company Background: Apollo Micro Systems

Apollo Micro Systems (AMSL) develops and produces electronic and electromechanical systems. Its main focus is on defense and aerospace applications. It works across missiles, naval systems, avionics, and ground platforms. The firm has long partnered with public sector majors and DRDO on critical subsystems. Its July 2025 investor deck lists work that spans mines, rockets, torpedoes, UAV systems, and artillery support gear. The presentation also highlights growing export ambitions and margin expansion over the FY20-FY25 period.

DRDO Partnership Announcement

The stock moved after DRDO cleared AMSL as a production agency for the Multi-Influence Ground Mine (MIGM-Vighana) under the Development-cum-Production Partner route. DRDO also signed a technology transfer pact for an omnidirectional multi-EFP warhead for the NASM-SR anti-ship missile. These are formal approvals under DRDO’s industry programs. The DRDO DcPP framework brings industry into projects early to speed development and induction.

Market Reaction and Share Price Surge

Shares jumped almost 14% in two sessions and hit a fresh 52-week high on September 1, 2025. Media attributed the move to the DRDO clearance and the warhead ToT deal. The rally came right after a separate spike the week before on news of ₹25.12 crore orders, where AMSL was L1. Trading volumes and price action showed strong momentum into new highs for 2025. Business Standard also noted the scrip at record levels on contract wins.

Why Investors are Excited?

Defense has become a major focus in India. The 2025-26 Union Budget raised overall defense spending and lifted DRDO’s allocation by more than 12%. Policies now encourage local procurement and quicker technology sharing. DRDO’s new transfer policy waives fees for key projects under DcPP and allied partners. This move reduces entry barriers for private firms and strengthens revenue visibility for trusted suppliers such as Apollo Micro Systems.

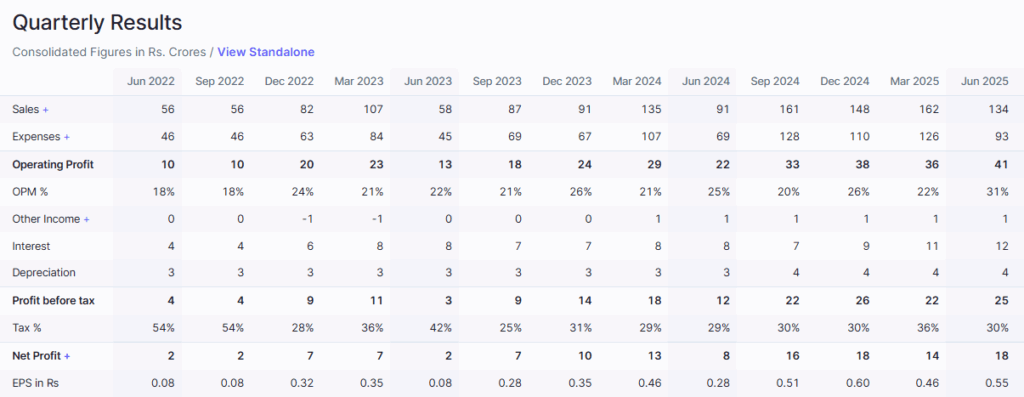

Financial Performance of Apollo Micro Systems

Recent numbers back the story. In Q1 FY26, revenue rose ~46% year on year to about ₹133-134 crore. EBITDA grew faster, and PAT more than doubled, lifting margins. Independent trackers quoted similar growth ranges for revenue and profit. FY25 also saw stronger profitability versus FY24, according to research summaries. The company’s deck shows margin expansion over multiple years and a shorter working-capital cycle.

Broader Industry & Policy Tailwinds

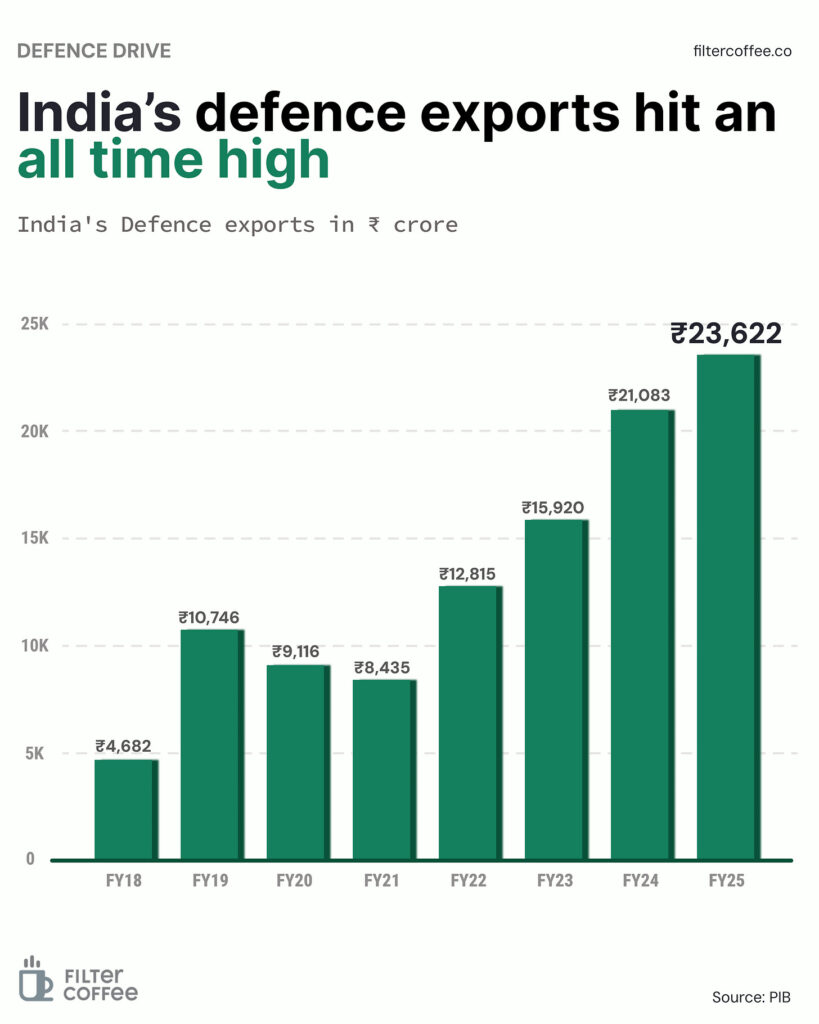

India’s defense exports hit a record ₹23,622 crore in FY25. The Ministry of Defence signed a record number and value of contracts in 2024-25, with the bulk awarded to domestic firms. Capital outlay for modernization has been raised, even as analysts push for more. DRDO has widened industry access to labs and cut ToT fees, which can speed productization. All of this creates a supportive setting for suppliers positioned on missiles, mines, and naval systems.

Analyst Views and Expert Commentary

Market desks described the move as momentum backed by real orders and formal approvals. ETMarkets, Moneycontrol, and LiveMint linked the stock rally to DRDO’s production approval and the technology transfer deal for the NASM-SR warhead. Some reports also flagged an “overheated” zone after a sharp multi-week run, which calls for caution near highs. Business Today noted the stock under short-term ASM surveillance, a routine exchange risk-control flag during fast rallies.

Risks & Challenges

Revenue is still closely linked to government programs and approval timelines. Project execution can face testing and certification delays. Exchanges placed the stock under additional surveillance during the spike, which can cool speculative activity. Sector budgets are rising, but a large share still goes to salaries and pensions, not capex, which can slow orders if priorities shift. Competitive intensity is also rising among private defense tech firms.

Future Outlook

The DRDO approvals open two clear lanes: serial production of the MIGM mine and possible scale-up of NASM-SR warhead hardware. That can lift the order book and improve the mix. Recent quarterly results show operating leverage and higher margins. Policy is aligned with local sourcing and exports, which support longer pipelines in missiles and naval warfare systems. Sustained execution, on-time qualification, and disciplined working capital will be key to converting headlines into cash flow.

Bottom Line

The stock’s two-day, ~14% jump followed concrete DRDO actions, not rumor. The company sits in a growing niche with formal approvals, ToT access, and a supportive policy wave. Numbers are improving, but the tape is hot, and risks remain around timelines and surveillance rules. For now, the partnership news strengthens the long-term narrative while the price sets new marks for 2025.

Frequently Asked Questions (FAQs)

Apollo Micro Systems shares rose about 14% by September 1, 2025, after DRDO approved it for defense projects and signed a warhead technology transfer deal.

Apollo Micro Systems may benefit from defense growth and DRDO support, but investors should stay cautious because project delays, competition, and market swings can affect future performance.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.