Supply Concerns Push Oil Rises Amid Russia-Ukraine Conflict

Oil prices are often the first thing we notice when global tensions rise. Today, the Russia-Ukraine conflict is one of the strongest forces shaping those prices. Russia is the world’s third-largest oil producer, and Ukraine’s position as a key transit route makes the crisis even more complex. When a major supplier faces disruption, the balance of global supply and demand quickly shifts, and we feel it at the pump, in our energy bills, and even in the cost of goods.

We cannot ignore how connected we all are to oil markets. Every economy, whether advanced or developing, depends on steady energy flows. But the war has shaken this balance. Sanctions on Russian exports, shifting trade routes, and rising insurance costs have created new uncertainties. At the same time, nations are scrambling for alternatives, while OPEC and other players try to keep stability.

Let’s explore how supply concerns have pushed oil prices higher, what this means for economies around the world, and what possible paths lie ahead for the global energy market.

Background of the Russia-Ukraine Conflict and Energy Ties

The war between Russia and Ukraine has reshaped global energy flows. Russia is a top crude oil exporter. Ukraine sits on key pipelines and shipping lanes. Attacks on ports and refineries have hit tanker routes and storage. These moves raise the risk of sudden supply gaps. Markets watch every new strike or sanction. Markets also track how buyers shift their orders. The pattern of trade has changed since 2022 and remains unstable in 2025.

Oil Market Dynamics: Why Supply Matters?

Oil price hinges on the balance of supply and demand. Small drops in supply can push prices much higher. Big producers OPEC+ and Russia shape that balance. When they cut output or face export limits, global stocks tighten. Traders price in the chance of more disruption. That makes futures and physical markets more volatile. Analysts also look at inventories and refinery runs to judge real tightness.

Immediate Impact on Oil Prices

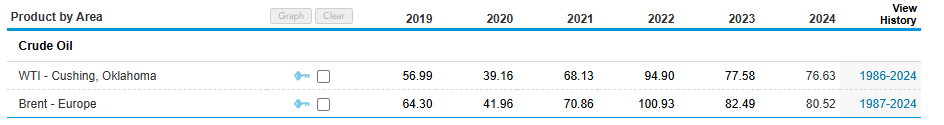

Recent clashes and targeted strikes have lifted oil prices. Brent and WTI both rose after reports of damaged Russian refineries and pipeline risks. Traders reacted fast. Insurance and shipping costs went up. Some buyers delayed shipments or paid premiums to secure cargo. Even when OPEC+ increased output, the fear of interruptions kept prices elevated. Markets are now sensitive to headlines from the front lines.

Global Supply Chain Challenges

Logistics are under strain. Longer routes add time and cost. Insurers charge more for vessels near conflict zones. Refineries that take specific crude grades face trouble if supplies shift. That forces reruns or slower processing. Ports can become bottlenecks. These chain frictions raise the final cost of fuel and feed through into other goods. The system has little spare capacity for big shocks.

Role of Sanctions and Political Decisions

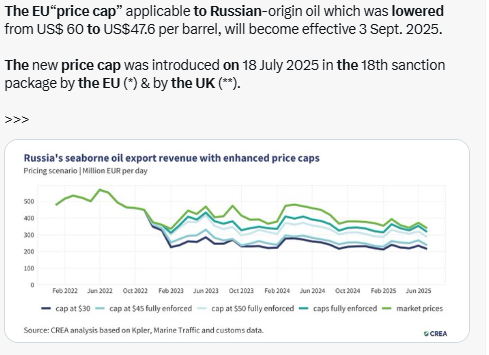

Sanctions on Russian oil remain a major driver. The EU and UK tightened rules and lowered the price cap on Russian crude to limit Moscow’s revenue. At the same time, some countries kept buying discounted Russian barrels. This split in global policy made trade routes more complex. Russia adapted by using a “shadow fleet” and redirecting flows to new buyers. Political moves have thus created both pressure and workarounds. Markets respond to both the rules and how well those rules are enforced.

Impact on Major Economies

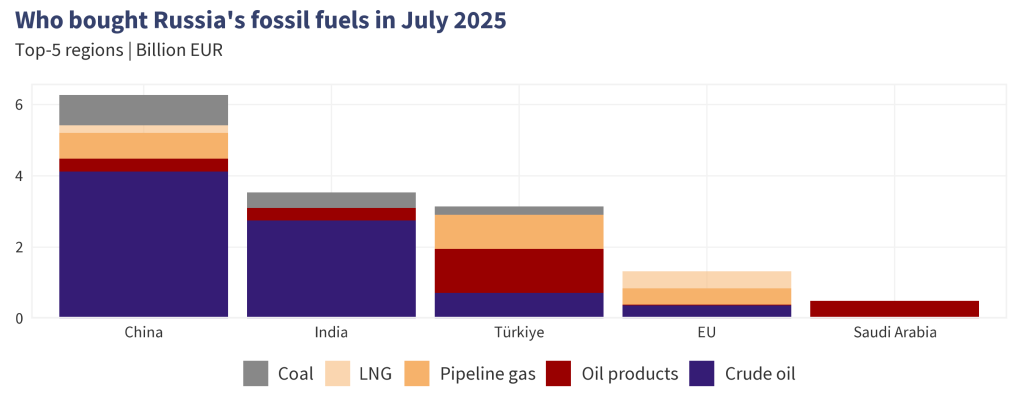

Europe feels the strain most. High dependence on Russian hydrocarbons created an urgent need for alternatives. Consumers face higher bills, and governments face tough choices on aid and industrial competitiveness. Asia, led by India and China, has stepped up purchases of discounted Russian oil. This helped Moscow keep export volumes but shifted the profit picture.

The United States saw mixed effects: domestic supplies are robust, yet consumers still face higher pump prices tied to global benchmarks. Developing nations face sharp import bills and rising inflation.

Alternatives and Mitigation Efforts

Policymakers and firms moved on several fronts. OPEC+ adjusted production plans to manage market balance. Some consuming nations tapped strategic reserves to calm prices. Oil traders sought new suppliers in the Middle East, Africa, and Latin America to replace risky flows. At the same time, investment in renewables and gas infrastructure accelerated as a longer-term hedge. These steps help, but they rarely fix immediate shortages.

Strategic Petroleum Reserves and Their Limits

Strategic reserves can ease sudden shocks. Governments release stockpiles to add supply and cool price spikes. However, releases are finite and often slow to reach markets. Restocking reserves can also push demand later. Experts warn that SPR action is not a full substitute for stable production. The U.S. SPR levels and refill plans are closely watched. Large-scale use of reserves can help in a pinch, but it is not a long-term answer to persistent supply risk.

Future Outlook for Oil Markets

If the conflict drags on, market stress could deepen. Prices may swing between $60 and $80 per barrel depending on attacks, sanctions, and OPEC+ moves. If peace talks advance, some normalcy could return, and prices might ease. A key factor will be how buyers and major producers act next. Investment choices also matter: faster renewable buildout would lower long-term crude reliance. For now, the path ahead is shaped by short-term events and slow structural shifts.

Bottom Line

Supply concerns from the Russia-Ukraine conflict feed directly into the oil market. The mix of strikes, sanctions, and shifting trade routes makes pricing uncertain. Short fixes such as reserve releases or extra OPEC+ output provide temporary relief. Lasting stability will require reduced reliance on volatile suppliers and steady investment in alternatives. Close monitoring of the situation remains essential for traders, policymakers, and consumers alike.

Frequently Asked Questions (FAQs)

The Ukraine war disrupts supply routes and limits Russian exports. Less supply makes oil scarce. Traders fear shortages, so prices rise. This impact is clear since 2022.

As of September 2025, countries like China and India buy discounted Russian oil. Turkey and some African nations also purchase it. Western nations reduced imports due to sanctions.

True. The Russia-Ukraine war has pushed oil prices up since early 2022. Sanctions, damaged refineries, and shipping risks made the market volatile and increased global fuel costs.

Yes, but limited. Some Russian oil and gas pipelines pass through Ukraine. However, after 2022, flows reduced due to conflict, sanctions, and Europe seeking other suppliers.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.