Figma Forecasts Annual Revenue Beat on Strong Software Demand

Figma continues to demonstrate robust growth momentum in the competitive design software market. The company recently announced revenue projections that exceed analyst expectations, driven by strong demand for collaborative design solutions. Following its public market debut in July, Figma has positioned itself as a key player in the evolving stock market landscape for software companies.

The design platform’s financial performance reflects broader trends in digital transformation and remote collaboration tools. Despite recent stock market volatility affecting tech shares, Figma maintains optimistic revenue forecasts for fiscal 2025.

Market analysts view these projections as indicative of sustained growth potential in the software sector.

Strong Revenue Growth Drives Market Confidence

Figma projects fiscal 2025 revenue between $1.02 billion and $1.03 billion, surpassing analyst estimates of $1.01 billion. This forecast represents continued expansion in the company’s core design collaboration market. The revenue guidance signals management’s confidence in sustained customer demand and product adoption rates.

Second quarter results demonstrated impressive momentum with revenue jumping 41% to $249.6 million. This growth rate positions Figma favorably among software companies in the current stock market environment. The company’s ability to maintain double digit growth reflects strong market positioning and effective execution strategies.

Third Quarter Revenue Projections

Management forecasts third quarter revenue between $263 million and $265 million. These projections indicate consistent quarter over quarter growth trajectories. The revenue range suggests Figma maintains visibility into customer spending patterns and subscription renewals.

Key revenue drivers include:

- Enterprise customer acquisition

- Platform expansion initiatives

- Product innovation rollouts

- International market penetration

Product Innovation Fuels Market Position

Figma launched four new products this year, including the AI powered “Figma Make” feature. These product releases demonstrate the company’s commitment to innovation and market leadership. The integration of artificial intelligence capabilities positions Figma to capture emerging market opportunities in design automation.

The product expansion strategy addresses evolving customer needs in collaborative design workflows. New feature releases support Figma’s goal of becoming the comprehensive design platform for enterprise customers. These innovations contribute to customer retention and average contract value growth.

AI Integration Strategy

The “Figma Make” AI tool represents a significant technological advancement for the platform. This feature automates routine design tasks and enhances user productivity. AI integration aligns with broader stock market trends favoring companies with artificial intelligence capabilities.

Product development priorities include:

- Enhanced collaboration features

- Advanced automation tools

- Improved performance optimization

- Extended integration capabilities

Stock Market Performance Analysis

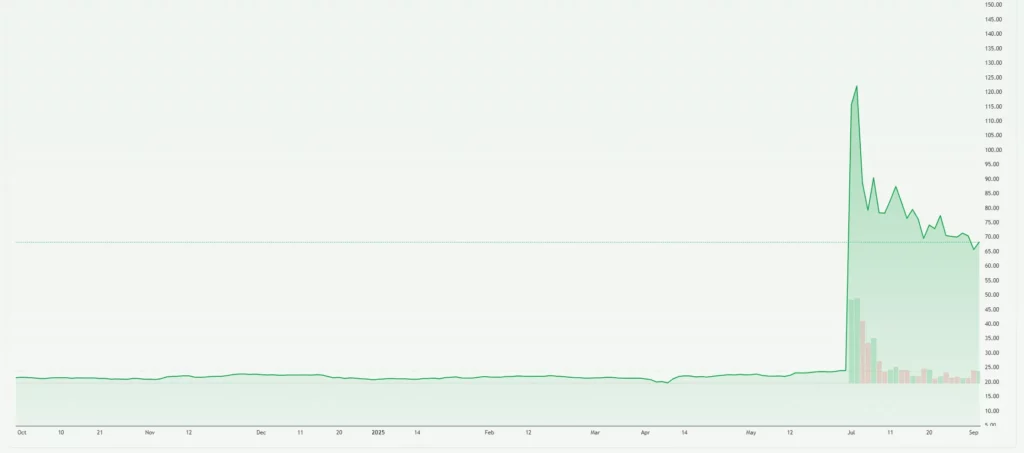

Figma stock (FIG) experienced significant volatility following its July public debut. The shares gained 250% on the first trading day, reflecting strong investor enthusiasm. However, subsequent market corrections have impacted the stock price performance.

Recent trading shows the stock closed at $68.13 before declining 10.13% to $61.23 in after hours trading. The price movement reflects broader stock market sentiment toward growth oriented technology companies. Despite short term volatility, Figma’s fundamental business metrics remain strong.

Market Valuation Considerations

The current stock decline of more than 40% from peak levels presents potential opportunities for investors. Market analysts continue evaluating Figma’s valuation relative to revenue growth rates and market position. The company’s subscription based model provides predictable revenue streams that support long term valuation assessments.

Valuation factors include:

- Revenue growth sustainability

- Market expansion opportunities

- Competitive positioning strength

- Customer retention metrics

Industry Outlook and Growth Prospects

The design software market continues expanding as companies prioritize digital transformation initiatives. Figma’s collaborative approach addresses key market needs in remote work environments. Industry trends support continued growth in cloud based design platforms and collaboration tools.

Market research indicates sustained demand for integrated design workflows and cross functional collaboration features. Figma’s platform architecture positions the company to capture these market opportunities. The stock market increasingly values software companies with strong recurring revenue models and customer expansion potential.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.