Hewlett Packard Beats Revenue Estimates on Strong Server Demand

Hewlett Packard Enterprise delivered impressive financial results that exceeded market expectations. The company reported record revenue of $9.1 billion for its fiscal third quarter. This strong performance highlights the growing demand for artificial intelligence infrastructure in today’s stock market.

The technology giant’s success stems from robust server sales and strategic acquisitions. Wall Street analysts had projected revenue of $8.53 billion for the quarter. Hewlett Packard’s actual results surpassed these estimates by a significant margin, demonstrating the company’s strong market position.

The stock market responded positively to these results, reflecting investor confidence in the company’s direction. Strong demand for AI servers continues to drive growth across the technology sector.

Record Financial Performance Drives Market Confidence

Hewlett Packard achieved remarkable growth with revenue increasing 19% compared to the previous year. The company’s fiscal third quarter ended July 31, 2025, marking a period of exceptional performance. This growth trajectory positions the company favorably within the competitive technology landscape.

The earnings report showed non-GAAP diluted earnings per share of $0.44. Management declared a quarterly cash dividend of $0.13 per share. These financial metrics demonstrate the company’s commitment to returning value to shareholders while maintaining growth investments.

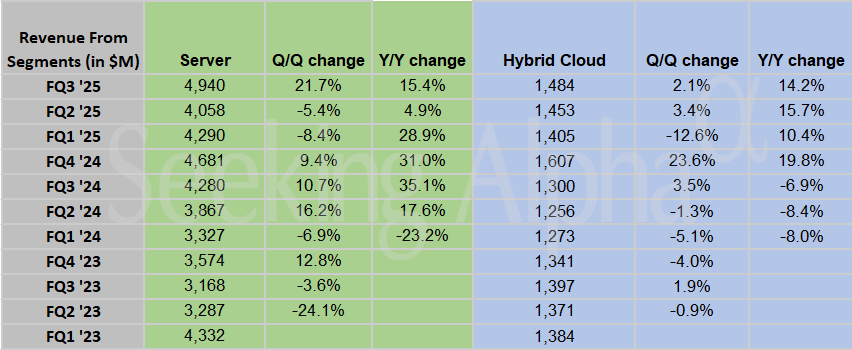

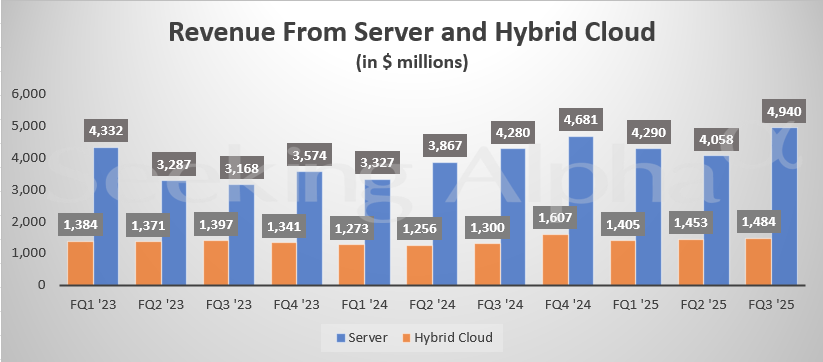

Server Segment Powers Revenue Growth

The Server segment generated $4.9 billion in revenue, representing 16% growth year-over-year. Artificial intelligence workloads continue driving unprecedented demand for high-performance computing infrastructure. Enterprise customers are investing heavily in AI capabilities, benefiting Hewlett Packard’s server business.

Data centers worldwide require advanced server technology to support growing computational needs. The company’s server portfolio addresses these requirements effectively. Market demand for AI infrastructure shows no signs of slowing down.

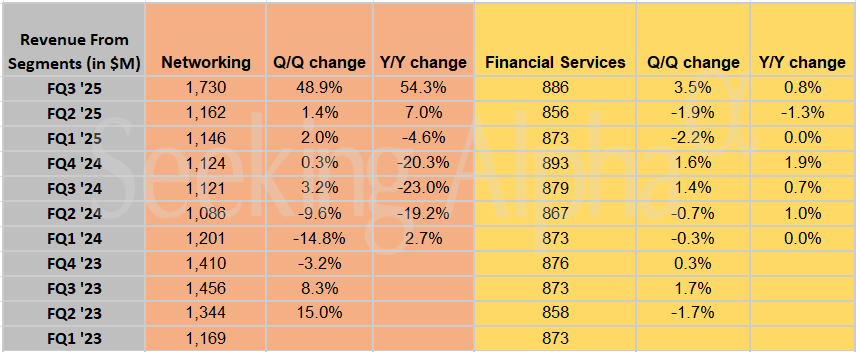

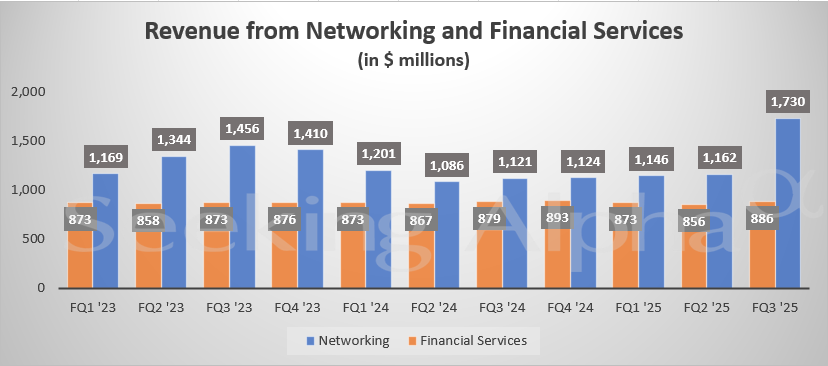

Networking Division Experiences Exceptional Growth

The Networking segment achieved outstanding results with 54% revenue growth reaching $1.7 billion. This performance reflects the increasing importance of network infrastructure in modern business operations. Companies need robust networking solutions to support digital transformation initiatives.

The segment’s growth demonstrates Hewlett Packard’s successful expansion beyond traditional server markets. Network infrastructure investments are essential for supporting AI and cloud computing workloads. The stock market recognizes this strategic positioning as a competitive advantage.

Strategic Acquisition Enhances Market Position

Juniper Networks Integration Completed

Hewlett Packard successfully closed its $14 billion acquisition of Juniper Networks on July 2, 2025. This major transaction significantly expands the company’s networking capabilities and market reach. Juniper’s financial contributions are included in the quarterly results from the acquisition date forward.

The acquisition strengthens Hewlett Packard’s position in the networking equipment market. Combined operations create synergies that benefit both customer service and operational efficiency. This strategic move positions the company for continued growth in networking solutions.

Market Impact and Integration Benefits

The Juniper acquisition enhances Hewlett Packard’s ability to serve enterprise customers comprehensively. Integrated networking and server solutions provide customers with streamlined procurement and support. The stock market views this vertical integration strategy positively.

Revenue diversification through the acquisition reduces dependence on any single product category. This strategic approach provides stability during market fluctuations. The combined entity offers enhanced value propositions to enterprise customers.

Forward-Looking Financial Projections

Raised Revenue Guidance Reflects Confidence

Management increased fiscal 2025 revenue growth projections to 14% to 16%. This upward revision demonstrates confidence in market demand and execution capabilities. The stock market typically responds favorably to raised guidance from technology companies.

Fourth-quarter revenue projections range between $9.7 billion and $10.1 billion. These estimates suggest continued momentum through the fiscal year end. Strong pipeline visibility supports these optimistic projections.

Market Outlook and Growth Drivers

The artificial intelligence revolution continues driving demand for advanced computing infrastructure. Enterprise digital transformation initiatives require significant technology investments. These trends create sustained growth opportunities for Hewlett Packard.

Investment Implications and Market Context

Competitive Positioning Strengthens

Hewlett Packard’s strong financial performance reinforces its competitive position in enterprise technology markets. The company effectively capitalizes on growing demand for AI infrastructure. Stock market investors recognize the value of this strategic positioning.

Revenue growth across multiple segments demonstrates balanced business execution. The networking and server segments complement each other effectively. This diversification provides stability and growth potential.

Shareholder Value Creation

The company’s dividend payment reflects commitment to shareholder returns. Consistent dividend payments attract income-focused investors to the stock. Management balances growth investments with shareholder distributions effectively.

Strong cash flow generation supports both dividend payments and strategic investments. This financial flexibility enables opportunistic acquisitions and research development spending. The stock market values companies that demonstrate disciplined capital allocation.

Conclusion

Hewlett Packard Enterprise’s exceptional quarterly performance demonstrates the company’s ability to capitalize on growing technology trends. Strong server demand and successful strategic acquisitions position the company for continued success. The stock market recognizes these achievements through positive investor sentiment and confidence in future performance.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.