CRM Stock Outlook: Salesforce Gives Weak Revenue Guidance Despite Earnings Beat

Salesforce, known by its ticker CRM, is one of the biggest names in cloud software and customer relationship management. Recently, the company surprised Wall Street with stronger-than-expected earnings. Yet, instead of celebrating, the market reacted with caution. Why? Salesforce gave weaker revenue guidance for the coming months.

This mix of good and bad news has left many investors wondering what comes next. On one hand, Salesforce continues to grow its earnings and expand margins. On the other hand, slower revenue forecasts raise doubts about future demand. We see this tension clearly in the stock’s movement right after the announcement.

In today’s tech world, even strong players face challenges. Rising competition, economic slowdowns, and cautious spending by businesses all play a role. At the same time, Salesforce is betting big on artificial intelligence and customer-focused innovation.

So, what does this mean for CRM stock? Should we treat the weak guidance as a warning or see it as a temporary bump in a long growth journey? Let’s break it down.

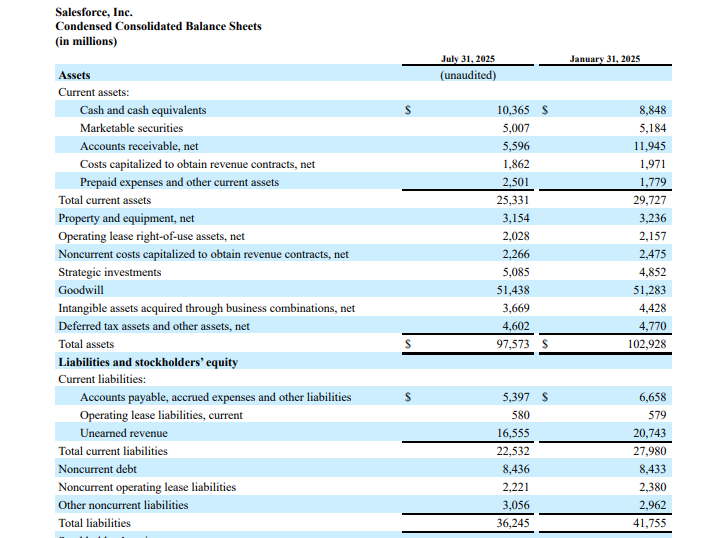

Salesforce Earnings Report Highlights

Salesforce reported fiscal second-quarter revenue of about $10.24 billion. That was roughly a 9-10% rise year over year. Adjusted earnings per share came in near $2.91, beating Wall Street estimates. The company also raised the low end of its full-year revenue outlook and expanded its stock buyback program. These results show the core business still sells well, especially subscription and support services.

Why Does the Revenue Guidance Feel Weak?

Salesforce guided the next quarter to about $10.24 billion to $10.29 billion in revenue. The midpoint sat just under some analyst forecasts. That small miss, plus cautious wording about demand, is what made investors nervous. Management pointed to a cautious buyer mood in some sectors and the slower-than-expected ramp of high-value AI features as reasons for the careful tone. The guidance looked conservative compared with the upbeat earnings numbers.

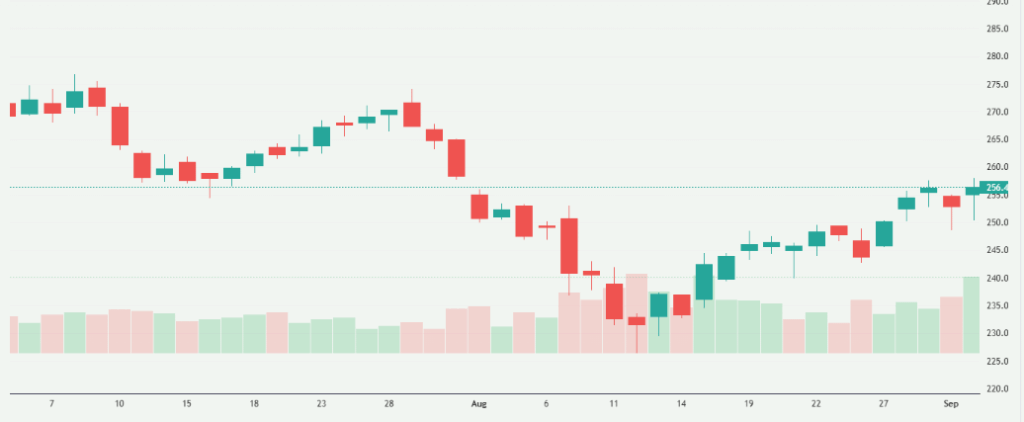

Market Reaction and Analyst Moves

After the report, CRM shares slipped several percent in after-hours trade. Traders reacted to the guidance more than to the actual beat. A number of analysts reviewed price targets and outlooks. Some kept buy ratings, noting long-term strength. Others trimmed near-term growth forecasts. The stock had already fallen significantly earlier in the year, so even a small surprise can spark larger swings.

What to Watch in Salesforce’s Business Drivers?

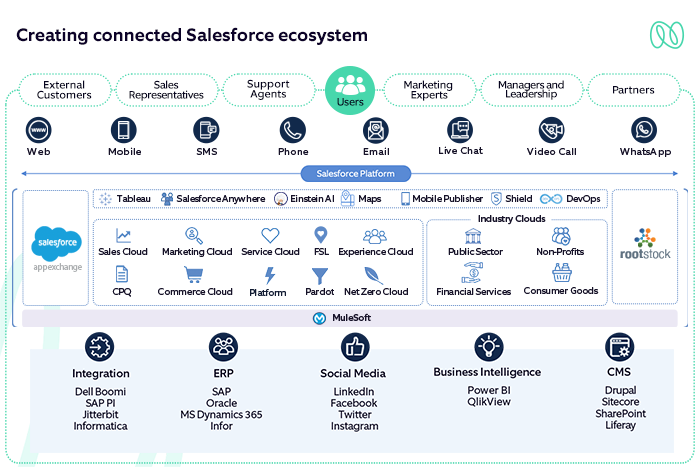

Salesforce is pushing hard into AI. The company is building agent products that automate tasks and boost productivity. Data Cloud and the new Agentforce offerings got special mention. These AI tools grow fast in ARR but still make up a small slice of total revenue today. The pace of monetizing AI will shape future growth. Also watch the move toward consumption-based pricing. That model can lift long-term sales but can slow reported revenue early on.

Competition and Market Position

Salesforce faces strong rivals. Microsoft, Oracle, Adobe, and HubSpot all push into customer data and automation. Microsoft’s deep enterprise reach is a constant threat. Oracle and Adobe compete on data platforms and marketing clouds. HubSpot fights for mid-market customers. Salesforce’s scale, broad product suite, and brand still give it an edge. But rivals are closing gaps in features and price. Execution on AI features will be a big differentiator.

Risks and Challenges

Economic uncertainty remains a clear risk. Companies can freeze software spending during tight budgets. The shift to new pricing models adds short-term revenue risk. Integrating big acquisitions or new AI tools has execution risk. Regulators and data-privacy rules add complexity to selling AI and cloud services. Finally, fast investor expectations for immediate AI profits may be unrealistic and could keep pressure on the stock.

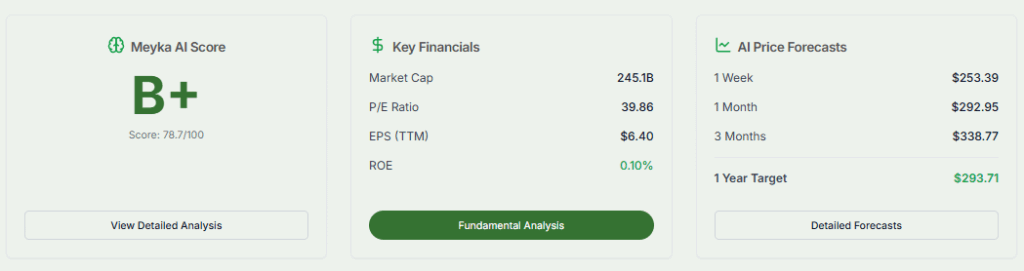

Long-term Outlook for CRM Stock

Salesforce still has durable strengths. The customer base is large and contracts often recur. The company generates strong cash flow and has room to buy back shares. AI and data services provide a real runway if monetization works. Short-term growth may wobble while the company pivots products and pricing. Over several years, successful AI capture and steady enterprise demand could restore stronger top-line growth. Analysts remain mixed, but many keep above-average price targets, signaling faith in the long-term story.

Investment Considerations

Long-term investors should focus on the execution of the AI roadmap and progress in growing high-margin cloud offerings. Short-term traders must watch quarterly guidance and product monetization updates, especially at Dreamforce and upcoming earnings calls. Check valuation versus peers. The stock’s recent fall makes it cheaper on some multiples, but the timing of recovery depends on whether AI sales accelerate and enterprise IT budgets loosen.

Bottom Line

The quarter shows a mixed picture. Core sales are solid, and earnings beat estimates. Guidance pulled attention away from the beat. The AI push brings promise but also uncertainty. Watch next quarter for signs that Agentforce and Data Cloud turn into large, recurring revenue streams. Until then, the stock may stay sensitive to guidance and tech-sector sentiment.

Frequently Asked Questions (FAQs)

CRM stock shows strong AI growth but faces cautious demand. Many analysts rate it a “buy” but with mixed confidence. It may suit long-term investors more than short-term traders.

The company leads in CRM and pushes AI platforms. If AI tools gain traction, the stock could pay off over the years. But short-term risks still exist.

Analysts forecast a 2025 price between $302 and $342, with averages near $340. Some see upside above current levels if growth picks up.

Salesforce leads CRM and grows with AI. Success depends on AI adoption, cost control, and customer demand. If executed well, the long-term outlook remains solid.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.