Broadcom Earnings Face Scrutiny Amid $730 Billion Stock Rally

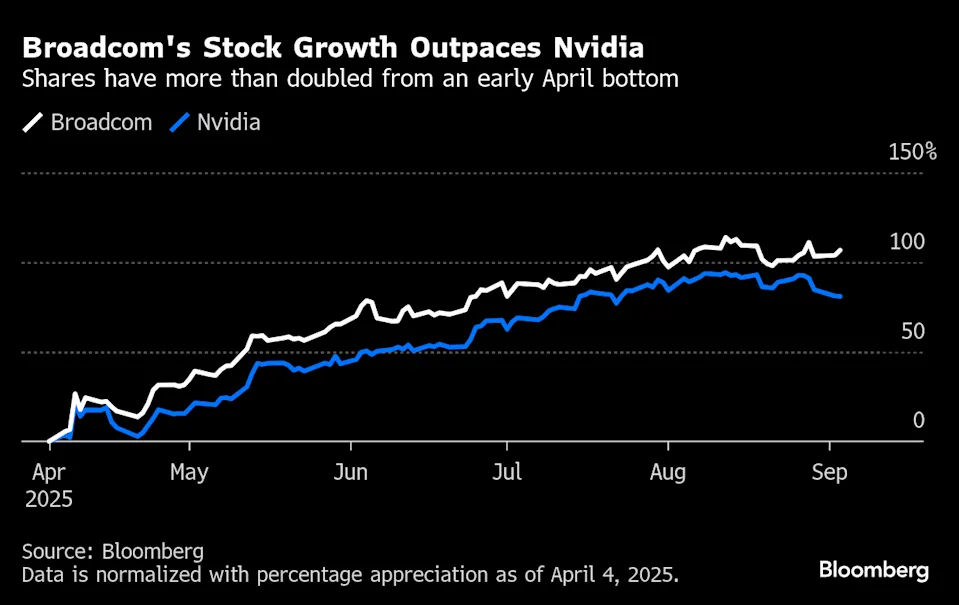

Broadcom stands at a critical juncture as investors prepare for Thursday’s earnings announcement. The semiconductor giant has experienced remarkable growth, with its stock price surging over 100% since April. This exceptional performance has added approximately $730 billion to the company’s market value.

Wall Street expects significant revenue growth of 21% to $15.8 billion for the quarter. Analysts also project a 34% increase in adjusted earnings per share to $1.67. However, concerns mount about potential market reactions following recent volatility in the stock market after other tech earnings releases.

The timing proves particularly sensitive given recent “sell the news” events affecting major chipmakers. Investors remain cautious about whether Broadcom can sustain its momentum or face similar post-earnings declines that have impacted competitors.

Market Performance and Expectations

Stock Rally Analysis

Broadcom extraordinary stock performance has captured significant investor attention throughout 2024. The company’s shares closed at $302.39 on Wednesday, approaching analysts’ average price target of $308. This remarkable surge represents one of the most impressive runs in the semiconductor sector.

The $730 billion market value addition reflects strong investor confidence in the company’s strategic positioning. Broadcom’s focus on artificial intelligence and custom chip solutions has resonated well with market participants. The stock market has rewarded companies demonstrating clear AI revenue streams and growth potential.

Earnings Projections

Wall Street analysts maintain optimistic projections for Broadcom’s upcoming earnings report. The expected 21% revenue increase to $15.8 billion signals robust business momentum. Key factors driving these expectations include:

- Strong demand for AI-related custom chips

- VMware integration progress

- Recovery signals in traditional semiconductor markets

- Continued data center expansion trends

The projected 34% growth in adjusted earnings per share demonstrates operational efficiency improvements. This metric indicates Broadcom’s ability to convert revenue growth into bottom-line results effectively.

Key Business Segments Under Review

AI Custom Chips Performance

Broadcom’s artificial intelligence custom chips represent a crucial growth driver for future performance. These application-specific integrated circuits (ASICs) serve major technology companies requiring specialized processing power. The growth trajectory of this segment will significantly influence investor sentiment and stock market reactions.

Demand for AI infrastructure continues expanding across cloud service providers. Broadcom has positioned itself as a key supplier for companies building large-scale AI systems. The earnings report will provide clarity on order volumes and revenue contributions from this critical segment.

VMware Integration Status

The VMware acquisition remains under intense scrutiny from investors and analysts. Integration progress affects Broadcom’s long-term revenue stability and growth prospects. Successful execution could unlock significant synergies and market opportunities.

VMware’s enterprise software portfolio complements Broadcom’s hardware capabilities effectively. The combination creates comprehensive solutions for data center and cloud infrastructure needs. Progress updates during the earnings call will be closely monitored.

Traditional Semiconductor Recovery

Broadcom’s non-AI semiconductor business has faced challenges, reportedly declining 40% from peak levels. Recovery in this segment remains essential for overall company performance. Traditional markets include networking equipment, industrial applications, and consumer electronics.

Signs of stabilization or improvement would provide positive signals for the stock market. Inventory normalization and demand recovery in key end markets could support revenue growth. The earnings report will address recovery timelines and market conditions.

Risk Factors and Market Concerns

Post-Earnings Volatility Patterns

Recent earnings reactions in the semiconductor sector have created investor caution. Nvidia’s stock declined nearly 6% following its August 27 results despite strong performance. Marvell’s shares plunged 19% after its recent earnings report, demonstrating market sensitivity.

These examples highlight potential “sell the news” scenarios where strong results fail to sustain stock prices. Broadcom faces similar risks despite positive analyst expectations. The stock market has shown limited tolerance for any disappointment in growth projections.

Valuation Concerns

Broadcom’s significant stock rally has raised questions about current valuation levels. The company’s market capitalization reflects high growth expectations and perfect execution assumptions. Any guidance revisions or competitive pressures could impact investor sentiment negatively.

Market participants will scrutinize management commentary regarding future growth sustainability. Realistic projections and achievable targets will be crucial for maintaining investor confidence. Overly optimistic guidance could create future disappointment risks.

Analyst Perspectives and Price Targets

Wall Street Consensus

Analysts maintain generally positive outlooks for Broadcom despite recent market volatility concerns. The average price target of $308 suggests limited upside from current levels. This positioning reflects both optimism about business fundamentals and caution about near-term stock performance.

Key factors supporting analyst confidence include:

- Diversified revenue streams across multiple growth markets

- Strong competitive positioning in AI infrastructure

- Successful track record of strategic acquisitions

- Robust cash flow generation capabilities

Critical Success Factors

Broadcom’s earnings success will depend on several key performance indicators. Revenue growth acceleration in AI-related segments remains paramount. VMware integration progress and traditional semiconductor recovery will also influence analyst recommendations.

The stock market will evaluate management’s ability to balance growth investments with profitability maintenance. Clear strategic communication and realistic forward guidance will be essential for positive reception.

Investor Implications and Market Outlook

Portfolio Considerations

Broadcom represents significant exposure to artificial intelligence infrastructure trends for many portfolios. The earnings report will provide crucial data points for investment decision-making. Investors must weigh growth potential against valuation risks and market volatility.

Diversification remains important given semiconductor sector cyclicality and competitive dynamics. Broadcom’s broad product portfolio offers some protection against specific market downturns. However, overall stock market sentiment toward technology stocks influences performance significantly.

Long-term Growth Prospects

Broadcom’s positioning in key growth markets supports long-term investment appeal. Artificial intelligence infrastructure demand shows no signs of slowing. Cloud service expansion and data center modernization create sustained revenue opportunities.

The company’s acquisition strategy has historically created shareholder value through strategic integrations. VMware represents the latest example of this approach. Successful execution could unlock significant additional growth potential beyond current projections.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.