Moschip Technologies shares rally 19% on India’s semiconductor boom

India’s semiconductor industry is growing fast, and Moschip Technologies is leading the way. Recently, the company’s shares jumped 19%, attracting investors’ attention. Semiconductors are vital for modern devices. They power smartphones, laptops, electric cars, and AI systems. India once depended heavily on imports. Now, it is pushing to become a key player in chip manufacturing. Government programs like “Make in India” and production-linked incentives are helping local companies grow.

Moschip Technologies is in a strong position to grow. The company works on chip design, connectivity solutions, and embedded systems. Global demand for semiconductors is rising, which is increasing investor confidence. Both domestic and international investors are showing interest. The 19% rise in Moschip’s stock is not only short-term. It reflects belief in the company’s long-term potential.

Let’s explore what is driving this surge, how Moschip stands out in the market, and what it means for investors.

Overview of Moschip Technologies

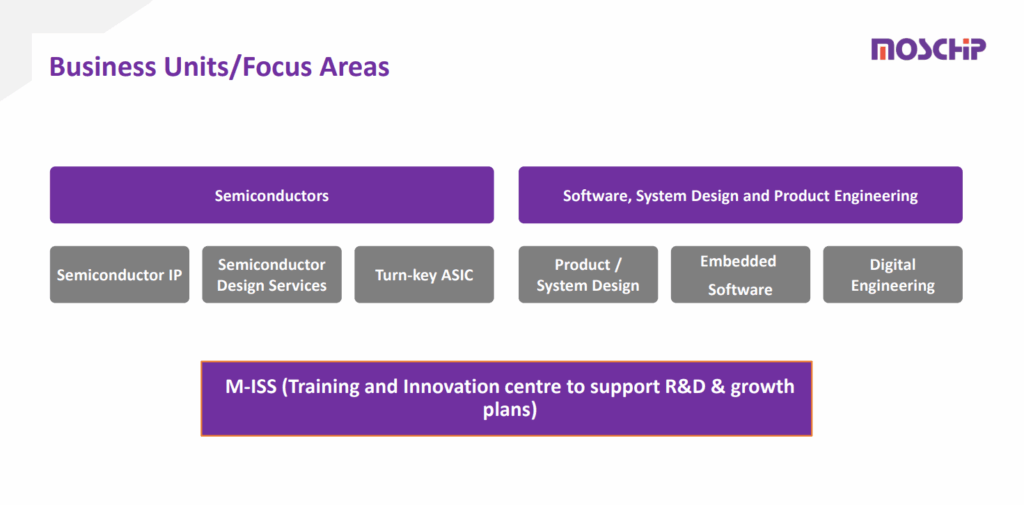

Moschip Technologies Ltd., headquartered in Hyderabad, is one of India’s top semiconductor companies. Founded in 1999, it provides semiconductor and system design services. The company works on System on Chips (SoCs), connectivity solutions, and embedded systems. Over the years, Moschip has earned a reputation for delivering reliable and cost-effective solutions. Its products serve industries like networking, storage, and consumer electronics.

Recently, Moschip has been expanding into advanced technologies. It focuses on edge AI, RISC-V-based processors, and high-speed SerDes interfaces. These moves aim to make the company a key player in India’s growing semiconductor market. Moschip has also joined TSMC’s Design Center Alliance. In addition, it appointed DVR Murthy as Vice President of Strategic Initiatives. These steps show Moschip’s commitment to innovation and leadership in chip design.

The Semiconductor Boom in India

India is working hard to become a global hub for semiconductors. The government launched the India Semiconductor Mission (ISM) to build a strong manufacturing and design ecosystem. This program provides funding, policy support, and incentives for companies. The second phase of ISM focuses on improving infrastructure, training skilled workers, and promoting innovation.

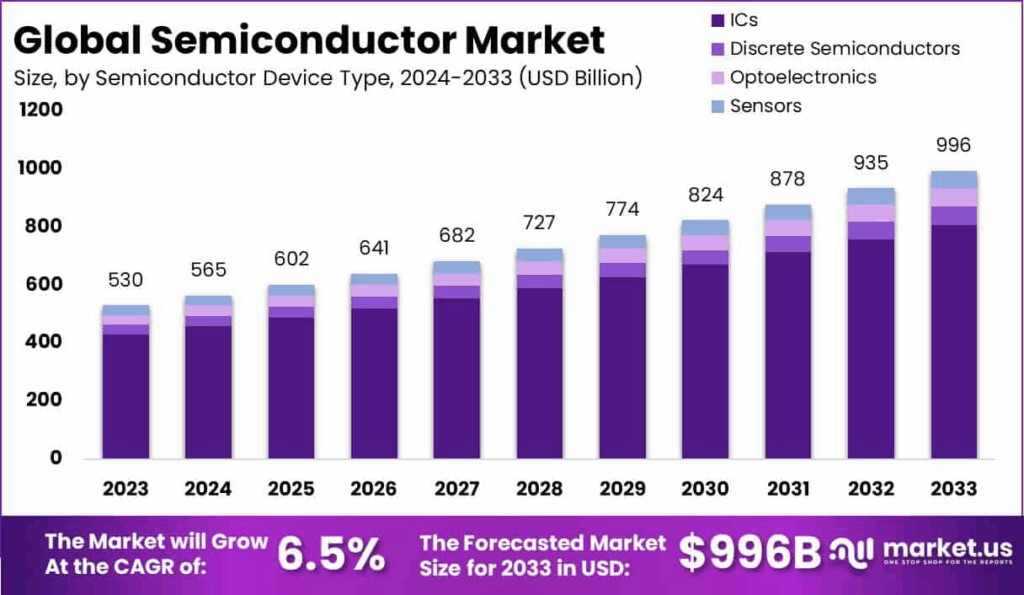

The global semiconductor market is growing rapidly. It is expected to reach around $697 billion in 2025, an 11% increase from last year. Demand is rising for chips used in data centers, servers, and storage devices. India’s push to enter this market creates big opportunities for local companies. Firms like Moschip can expand operations and play a key role in the country’s technology growth.

Factors Behind Moschip’s Stock Surge

Moschip’s stock has risen sharply due to several key reasons.

First, government support has boosted investor confidence. Prime Minister Narendra Modi highlighted India’s plan to become a full-stack semiconductor nation at the Semicon India 2025 Summit. This showed the country’s strong potential in the global market.

Second, strategic appointments have strengthened the company. DVR Murthy joined as Vice President of Strategic Initiatives. His experience in semiconductor design and development will guide Moschip’s programs in areas like RISC-V and edge AI.

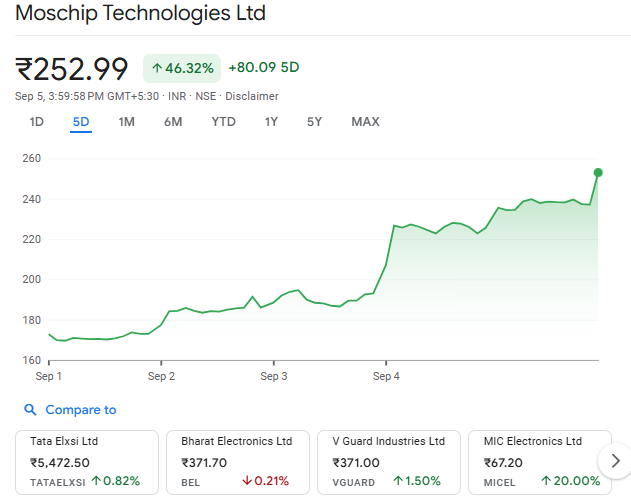

Third, market trends have played a role. Positive sentiment toward semiconductor stocks, driven by government policies and global demand, has helped Moschip. The company’s shares rose 42% in a week, showing strong investor interest.

These factors together explain why Moschip’s stock is performing so well and why investors are optimistic about its future growth.

Industry Impact and Competitor Comparison

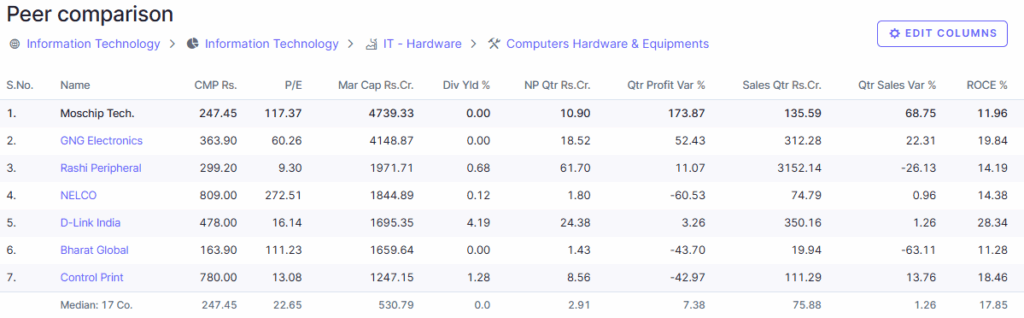

Moschip’s growth matches the trends in India’s semiconductor industry. The company focuses on fabless semiconductor design, which gives it an edge over some peers. Companies like CG Power and Bharat Electronics are moving into packaging and testing. CG Power plans to open India’s first OSAT facility by 2026. Moschip, however, excels in design and strong strategic partnerships.

India is also developing its own technologies. Examples include the Vikram 32-bit processor and the APEEC1 analog memristor emulator. Moschip contributes to these advancements through its design expertise and collaborations. This highlights the company’s role in helping India become more self-reliant in semiconductor technology.

Investor Perspective

Moschip offers an interesting opportunity for investors in India’s growing semiconductor sector. The company’s strategic plans, along with government support, give it strong growth potential.

However, investors should be careful. The company’s P/E ratio is 217.60, which shows it is highly valued. Semiconductor stocks are also known for their volatility.

Analysts say Moschip’s recent surge may be short-term. Still, its long-term prospects look promising. Success depends on executing strategic programs and staying aligned with India’s semiconductor development goals.

Future Outlook

Looking ahead, Moschip plans to take advantage of the growing semiconductor market. The company focuses on edge AI, RISC-V processors, and high-speed connectivity solutions. Its work with the India Semiconductor Mission and other partnerships will help it benefit from India’s push for self-reliance in chip manufacturing.

The global semiconductor market is projected to grow rapidly in the coming years. This gives Moschip a chance to expand operations and support India’s technology growth. Continued investment in research and development and strong partnerships will be key. These steps will help Moschip stay competitive and achieve steady, long-term growth.

Final Words

Moschip Technologies’ recent stock rise shows growing confidence in India’s semiconductor sector. The company’s strategies, government support, and alignment with industry trends make it a key player in India’s push for self-reliance in chip manufacturing.

For investors, Moschip offers a unique chance to take part in India’s technology growth. However, it is important to consider market trends and the company’s financial fundamentals before investing.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.