Ashmore Profit Drops 15% as Fees Weaken, AuM Slips to $47.6 Billion

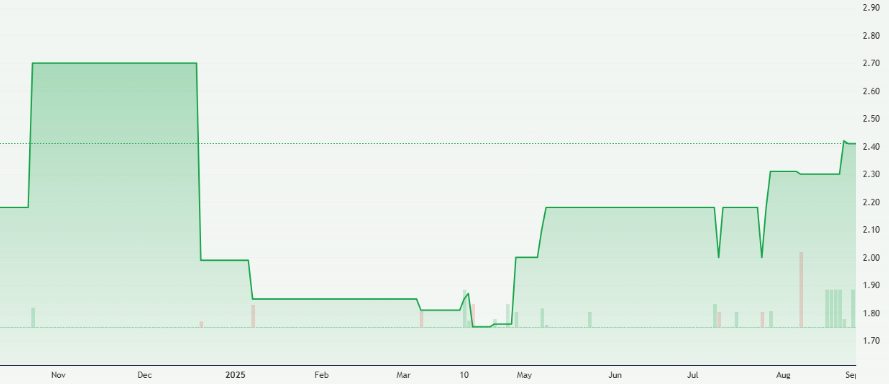

Ashmore, a leading emerging markets investment manager, has reported a 15% decline in profits as its fee revenues weakened and assets under management (AuM) slipped to $47.6 billion. This financial setback has raised concerns among investors who closely follow the global stock market and rely on stock research to gauge performance in volatile sectors.

The latest results highlight the ongoing pressure on asset managers who are facing shrinking margins, changing investor preferences, and growing competition from passive investment products.

Ashmore’s Financial Performance in Focus

The reported 15% fall in profit reflects both reduced fee income and declining investor flows. According to Ashmore’s latest update, management fees, the backbone of its revenue stream, were weaker due to lower average AuM levels.

The firm’s AuM fell to $47.6 billion, compared with higher levels in previous reporting periods. This decline was mainly attributed to market volatility, investor redemptions, and muted inflows. As one of the largest dedicated emerging markets fund managers, Ashmore is particularly sensitive to shifts in global investor sentiment toward developing economies.

Despite these headwinds, Ashmore remains confident in its long-term growth strategy. Its diversified portfolio, which spans equities, fixed income, and alternative assets, continues to position it well to capture future opportunities when investor confidence returns.

Why Fees Are Weakening

One of the biggest challenges for asset managers like Ashmore lies in the fee compression trend. Investors today demand lower costs, while passive investment vehicles such as ETFs continue to gain market share.

In Ashmore’s case, fees have come under pressure due to:

- Lower AuM averages across key asset classes.

- Increased competition from passive products offering cheaper exposure to emerging markets.

- Shifts in investor appetite, where more funds are directed toward AI stocks, technology-focused ETFs, and diversified global funds.

This environment makes it harder for active managers to justify higher fees unless they consistently deliver strong returns above benchmarks.

Assets Under Management: Slipping Confidence

The drop in assets under management to $47.6 billion illustrates the cautious mood of investors. Outflows were recorded across several strategies, particularly in fixed income, where emerging market debt faced pressure from rising interest rates and a stronger U.S. dollar.

Investors tend to retreat from riskier markets during uncertain times, and this behavior directly impacts Ashmore’s bottom line. Still, the company emphasizes its long-term commitment to emerging markets, highlighting that these regions historically offer higher growth potential compared to developed markets.

For investors conducting stock research, Ashmore’s results serve as a reminder that AuM fluctuations are natural in cyclical markets but can significantly affect earnings in the short term.

Ashmore in the Global Stock Market Context

Ashmore’s struggles mirror broader trends within the global stock market. Asset managers worldwide face challenges due to:

- Geopolitical uncertainty, particularly in emerging markets.

- Monetary tightening has reduced liquidity and capital flows into riskier asset classes.

- Increased investor focus on technology and AI stocks, drawing capital away from traditional active funds.

At the same time, regulatory scrutiny and environmental, social, and governance (ESG) pressures are shaping how funds are structured and managed. Ashmore has been working to align with these trends, but must also balance short-term profitability with long-term sustainability goals.

Stock Research: Should Investors Be Concerned?

From a stock research perspective, Ashmore’s performance offers both caution and opportunity. The decline in profits and AuM signals short-term challenges, but for investors who believe in the resilience of emerging markets, the current weakness may represent a chance to buy into a firm with deep expertise.

Historically, emerging markets have gone through cycles of volatility followed by strong rebounds. Ashmore’s global footprint and disciplined investment approach could allow it to benefit significantly when capital flows return.

Still, investors must remain aware of the risks. Currency fluctuations, political instability, and global interest rate shifts all play a role in shaping the performance of Ashmore and similar asset managers.

Future Outlook for Ashmore

Looking ahead, Ashmore’s recovery depends on:

- Restoring investor confidence in emerging markets.

- Stabilizing fee income by retaining existing clients and attracting new mandates.

- Diversifying strategies to compete effectively with ETFs and AI-driven investment platforms.

If global conditions improve and investors regain their appetite for higher-yielding opportunities, Ashmore could see a rebound in AuM and profitability. In the meantime, the firm will likely focus on cost discipline and selective expansion into attractive growth areas.

Conclusion

Ashmore’s recent report shows a company navigating turbulent waters. With profits down 15% and AuM slipping to $47.6 billion, the asset manager faces significant short-term hurdles. Yet, its long-term positioning in emerging markets, combined with disciplined investment strategies, gives it the potential to recover when global conditions stabilize.

For investors interested in the broader stock market and emerging markets, Ashmore remains a company to watch. While near-term risks are clear, the long-term case for growth in developing economies continues to be strong.

FAQs

Ashmore’s profits declined due to weaker fee revenues, which were impacted by lower average AuM and continued investor outflows.

It indicates reduced investor confidence in emerging markets, leading to outflows and reflecting broader global stock market caution.

Ashmore faces short-term challenges, but for long-term investors who believe in emerging markets, it may still hold potential once capital flows return.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.