Amanta Intraday Stocks to Buy Today: Tata Steel, NALCO, Airtel & More

Intraday trading has grown in popularity over the last few years. Every day, thousands of traders buy and sell stocks to make quick profits. The key to success in intraday trading is picking the right stocks at the right time. Not every stock can give the short-term gains that traders look for. That’s why we focus on stocks that are active, liquid, and show strong price movements.

Today, we take a closer look at some of the most promising intraday stocks. Tata Steel, a leading steel producer, often sees strong price swings during market hours. NALCO, with its steady aluminum business, can provide good opportunities for short-term traders. Airtel, one of India’s top telecom companies, reacts quickly to news and market trends. Besides these, there are a few other stocks worth watching closely for intraday gains.

Let’s guide you through the top picks, explain why they are attractive today, and share practical tips to trade them safely.

Today’s Top Intraday Picks

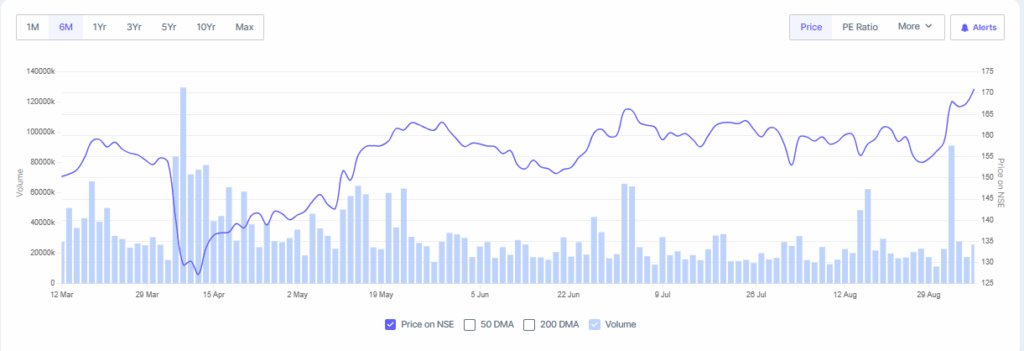

Tata Steel (TATASTEEL)

Tata Steel is showing strong momentum today. The stock has gained 2.21% in early trade, reflecting positive investor sentiment. Recent developments, such as the company’s acquisition of shares worth ₹3,100 crore in its Singapore arm, T Steel Holdings, have contributed to this upward movement.

Key Levels:

- Support: ₹165.25

- Resistance: ₹170.00

- Target: ₹175.00

Strategy: Consider buying near the support level with a target of ₹175.00. Maintain a stop-loss at ₹162.00 to manage risk effectively.

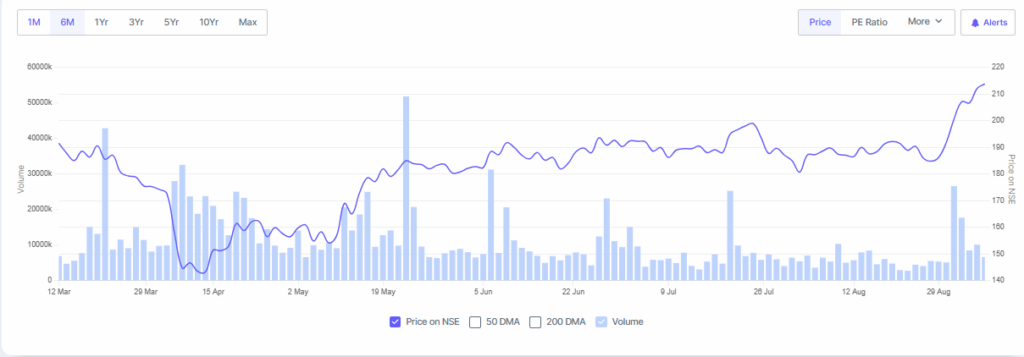

NALCO (NATIONALUM)

NALCO has been witnessing increased trading activity, with a notable 12.11% rise over the past week. The stock’s performance is supported by strong fundamentals and positive market sentiment.

Key Levels:

- Support: ₹200.00

- Resistance: ₹215.00

- Target: ₹225.00

Strategy: Look for buying opportunities near the support level, aiming for a target of ₹225.00. Place a stop-loss at ₹195.00 to safeguard against potential downturns.

Airtel (BHARTIARTL)

Airtel’s stock is exhibiting bullish behavior, trading above key support levels. Technical indicators suggest a potential upward movement, making it an attractive option for intraday traders.

Key Levels:

- Support: ₹1,677.00

- Resistance: ₹1,730.00

- Target: ₹1,780.00

Strategy: Consider entering a long position near the support level, targeting ₹1,780.00. Set a stop-loss at ₹1,650.00 to manage risk.

Other Notable Picks

Reliance Industries (RELIANCE): With strong fundamentals and consistent performance, Reliance is a solid choice for intraday trading.

HDFC Bank (HDFCBANK): Known for its stability and liquidity, HDFC Bank offers favorable conditions for short-term trades.

Intraday Trading Strategies

- Momentum Trading: Focus on stocks showing strong trends. Enter trades in the direction of the trend and exit when momentum wanes.

- Breakout Trading: Identify key resistance levels. Enter trades when the stock price breaks above these levels, signaling potential upward movement.

- Scalping: Make multiple small trades throughout the day, aiming for quick profits. This strategy requires close monitoring and quick decision-making.

Risks in Intraday Trading

Intraday trading involves significant risks due to market volatility. Prices can change rapidly, leading to potential losses. It’s crucial to implement risk management strategies, such as setting stop-loss orders and limiting the amount of capital invested in each trade.

Conclusion & Key Takeaways

The market today offers many opportunities for intraday traders. Stocks such as Tata Steel, NALCO, and Airtel are showing strong potential. Careful technical analysis can help identify the best entry and exit points. Managing risk with stop-loss orders and position sizing is essential to protect capital.

Traders should also monitor market news and sector updates to stay ahead. By combining strategy with discipline, intraday trading can become more consistent and profitable. Always remain alert and adapt quickly to changing trends for maximum gains.

Frequently Asked Questions (FAQs)

Tata Steel shares have reached a 52-week high of ₹172.45 today, driven by strong sector tailwinds and brokerage optimism.

Steel stocks are rising due to China’s plans to reduce steel production capacity, improving the global supply-demand balance.

Stocks like IDBI Bank, Samvardhana Motherson, and Suzlon Energy are popular for intraday trading under ₹100.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.