XRP News Today: Price Stuck Below $3 as Triangle Pattern Tightens

XRP has stayed in the spotlight for years as one of the top digital assets in the market. Today, it is trading below the $3 mark, and the price is tightening inside a triangle pattern. This setup makes many traders watch closely. Patterns like this often signal a strong move ahead. The question is whether XRP will finally break higher or slip lower.

We know XRP has always been different from other cryptocurrencies. It is built for fast and low-cost cross-border payments. Banks and financial firms continue to explore it as a real solution. But price movements do not depend only on technology. Market sentiment, regulations, and global trends also play a big role.

Right now, investors feel stuck. On one side, strong fundamentals push hope for a breakout. On the other side, legal hurdles and weak market mood keep the price capped. We are in a wait-and-see phase. Let’s look at why XRP is locked under $3, what the triangle pattern means, and where the price could go next.

XRP: Current Market Overview

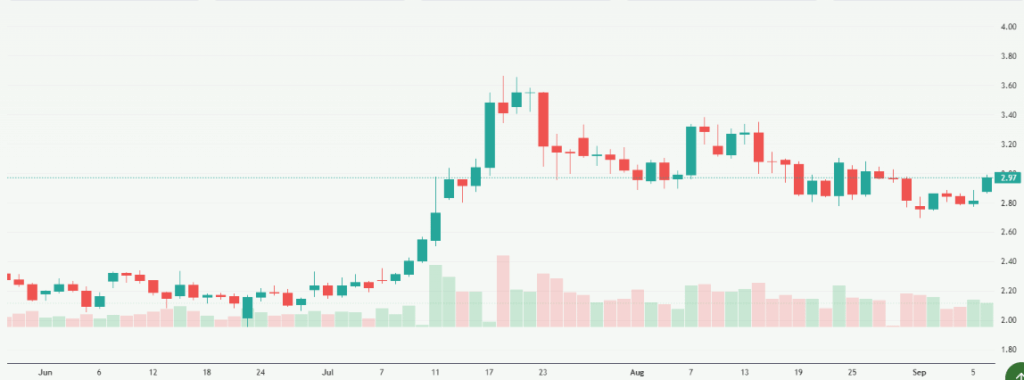

XRP trades just under $3 and has held that zone for days. Volume has narrowed as buyers and sellers wait. Large wallets have been adding coins even as some institutions cut holdings. Price action shows tight ranges between roughly $2.83 and $2.92. These moves point to low short-term volatility but rising pressure for a bigger move, as seen on September 8-9, 2025.

Technical Analysis of XRP

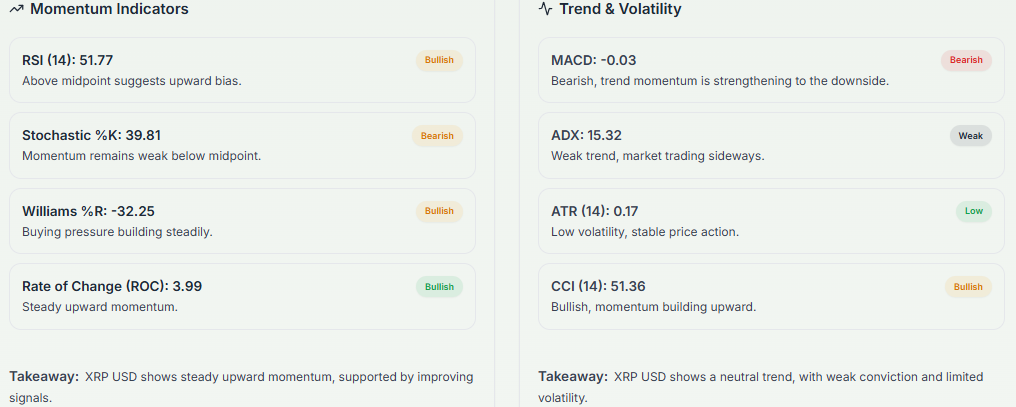

A symmetrical triangle has formed on the chart. The highs keep getting lower. The lows keep getting higher. That creates a narrowing price band. RSI sits near neutral, not overbought or oversold. MACD shows weak momentum with flat histograms. A break above the upper trendline would signal bullish pressure. A break below the lower trendline would open the door to deeper losses. Analysts say the triangle could produce a 20-25% swing when it resolves.

Why XRP is Struggling to Cross $3?

Selling pressure appears at the $3 area. Traders take profit near that round number. Some market participants remain cautious after past false breakouts. Regulatory headlines have also weighed on sentiment. Even with legal wins, the path to full clarity has been bumpy. That keeps some buyers on the sidelines.

External Market Influences

Bitcoin’s mood still shapes altcoin moves. When Bitcoin gains, XRP often follows. When Bitcoin drops, XRP faces steeper declines. Macro trends also matter. Rising interest rates or risk-off markets push many investors away from crypto. Geopolitical news can add sudden swings. These outside forces can either choke or fuel a breakout from the triangle.

Fundamental Developments for XRP

Ripple has kept signing partnerships in 2025. Banks and payment firms have trialed XRP for cross-border payments. Some large financial groups are exploring On-Demand Liquidity and ISO 20022 compatibility. The SEC litigation was officially closed in recent months, which removed a major legal cloud for many traders. That ruling has helped restore institutional interest. Still, direct institutional sales face new compliance steps.

Expert Predictions and Analyst Views

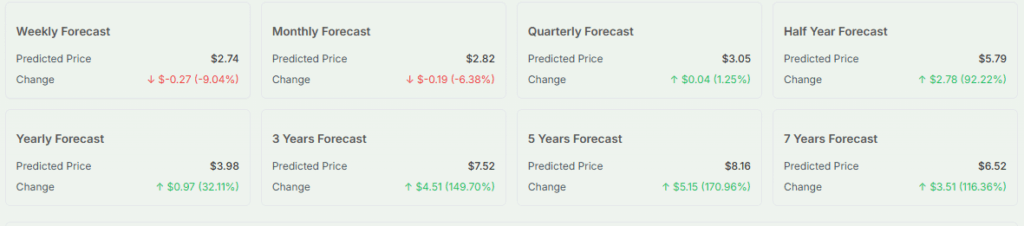

Analysts are split. Some foresee a strong breakout above $3.50 if XRP clears the triangle. Others warn of a drop to near $2.10 if support breaks. A few outlets suggest a medium-term target as high as $5 if adoption grows and market flows turn positive. Forecasts vary with time horizon and risk appetite. Chart-based traders focus more on pattern targets than headlines.

Expert Views and Investor Sentiment

Social media shows a mixed mood. Some long-term holders celebrate legal clarity. Short-term traders voice fatigue after failed breakouts. On-chain data points to steady accumulation by big wallets. The Fear & Greed mood is neither extreme fear nor greed right now. That middle ground often leads to consolidation before a larger move.

Possible Price Scenarios

Bull case: Price breaks above the triangle with volume. The $3.30-$3.60 range becomes the next target. Renewed inflows and positive macro tone could push prices higher. Bear case: Price falls under the triangle support. A quick drop toward $2.10-$2.50 then becomes possible. Neutral case: Price stays inside the triangle for longer. That would extend the squeeze and increase the eventual move size. Traders should watch breakout direction and volume for confirmation.

Final Thoughts

XRP sits below $3 inside a shrinking triangle. The technical setup suggests a powerful move once the pattern ends. Legal clarity and new partnerships have improved the story. Yet short-term resistance and wider market risks keep bulls cautious. Watch trendline breaks and trading volume for real signals. A clear breakout in either direction will decide the next run for XRP.

Frequently Asked Questions (FAQs)

On September 9, 2025, XRP is gaining today. It rose about 4%, climbing from around $2.89 to near $3. It closed near $2.95 with strong trading volume.

No one knows for sure. Some forecasts point to modest gains above $3. But massive jumps are not likely soon. XRP remains stable with mixed signals today. Check out Meyka for the latest updates.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.