Novartis to Buy Tourmaline Bio in $1.4B Acquisition Deal

Novartis has confirmed it will acquire Tourmaline Bio in a deal valued at $1.4 billion. The agreement highlights Novartis’s ambition to expand its oncology pipeline and deepen its commitment to data-driven medicine.

This acquisition also strengthens Novartis’s reputation in the stock market, particularly among those tracking AI stocks that blend biotechnology with digital innovation. It positions the company as a leader not only in pharmaceuticals but also in technology-assisted research.

Tourmaline Bio’s Contributions

Tourmaline Bio (TRML: NASDAQ) is a biotech firm with a strong focus on precision therapies. Its mission has centered on developing treatments for cancer and immune-driven diseases.

The company’s pipeline contains promising candidates designed to target difficult-to-treat tumors. These therapies fit seamlessly with Novartis’s global strategy of advancing personalized medicine.

By acquiring Tourmaline, Novartis secures not only innovative therapies but also a culture of data-driven science. This combination gives the company new tools to speed up development timelines and improve patient outcomes.

Financial Rationale of the $1.4 Billion Price Tag

Some may view the $1.4 billion cost as steep. However, the price reflects the long-term value Tourmaline brings.

Its therapies are already in mid- to late-stage clinical development. This reduces the risks compared to early-stage programs and increases the chance of near-term revenue.

For investors engaged in stock research, the logic is clear. Novartis is securing future cash flows while reinforcing its growth profile in oncology. This makes the acquisition more than a purchase; it is an investment in long-term innovation and resilience.

Investor Sentiment and Stock Market Response

The stock market often reacts strongly to acquisitions of this scale. Analysts are already discussing how the deal could impact Novartis’s valuation.

We anticipate that investor sentiment will be largely positive. This is because the acquisition demonstrates Novartis’s ability to balance risk with strategic foresight.

With global attention on AI stocks and biotech leaders, Novartis is positioned to gain visibility. Its shares may benefit from renewed interest among long-term investors seeking exposure to healthcare innovation.

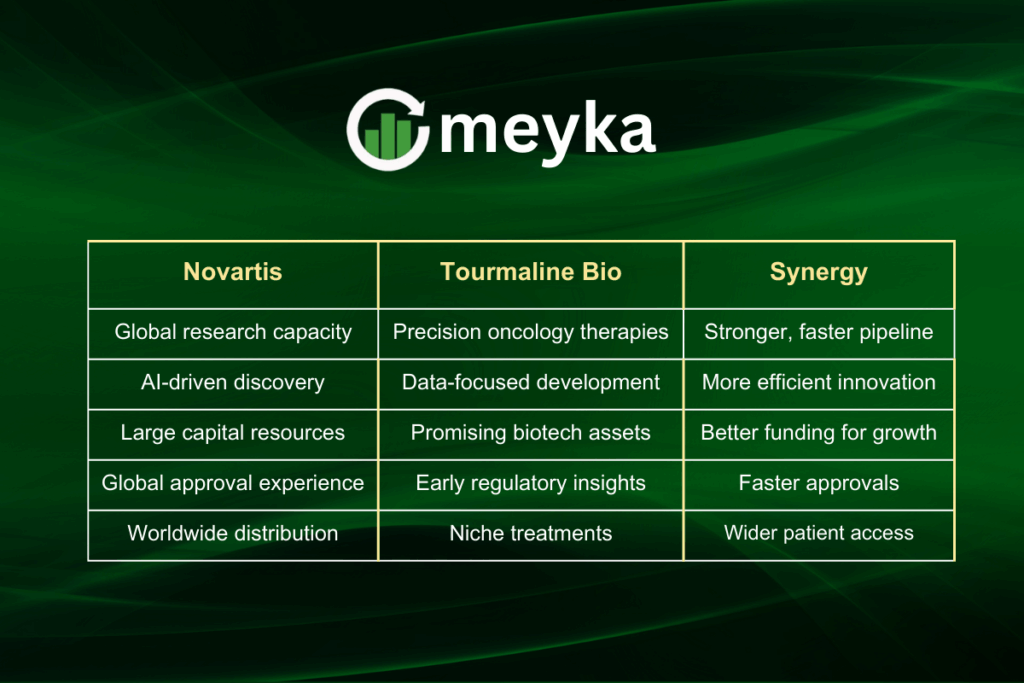

Synergies Between Novartis and Tourmaline Bio

One of the most compelling aspects of this acquisition is synergy. Novartis brings global infrastructure, regulatory knowledge, and financial resources. Tourmaline adds agility, scientific creativity, and novel therapies.

By combining these strengths, the companies can accelerate drug development timelines. AI-driven analytics will allow them to refine trial design, monitor outcomes more efficiently, and move therapies to market faster.

This partnership underscores the increasing convergence between biotechnology and advanced technology. For patients, it means earlier access to potentially life-saving treatments.

Challenges and Potential Risks

As with any major deal, risks remain. Regulatory authorities will carefully examine the acquisition. Delays or additional conditions could affect the timeline. Integration challenges also exist. Blending two different company cultures and operations requires careful management.

Finally, clinical risk must be acknowledged. Not all therapies succeed in late-stage trials, and failure could affect expected returns.

Still, Novartis has a long history of managing such risks. Its global expertise in mergers and acquisitions gives it the tools to handle these challenges effectively.

Novartis’s Competitive Edge

The biotech industry is increasingly competitive. Large pharmaceutical firms are racing to secure the most promising assets.

By acquiring Tourmaline Bio, Novartis strengthens its oncology presence. This gives it an edge over rivals also pursuing advanced cancer therapies.

In addition, Novartis demonstrates leadership in adopting AI-driven research methods. This keeps the company ahead of peers and aligns with broader stock market trends, where AI stocks are gaining traction.

Broader Industry Implications

This deal is not just about one company acquiring another. It reflects a bigger transformation in healthcare.

Pharmaceutical giants are increasingly partnering with or acquiring biotech firms. This strategy helps them accelerate innovation and adapt to the digital era.

Tourmaline’s acquisition by Novartis reinforces the idea that data, AI, and science will define the next phase of drug discovery. For the industry, it is a clear signal that the future belongs to those who can blend technology with biology.

What Patients Stand to Gain

At the center of this acquisition are patients. Tourmaline Bio’s therapies are designed to target conditions with limited treatment options.

By joining Novartis, these treatments will benefit from larger trials, faster approvals, and broader distribution. Patients worldwide may gain quicker access to medicines that could improve survival and quality of life.

This human impact highlights why acquisitions like this matter far beyond financial markets.

Conclusion

The $1.4 billion acquisition of Tourmaline Bio represents a bold step forward for Novartis. It adds valuable assets to its oncology pipeline, embraces AI-powered research, and strengthens its standing in the stock market.

For investors, the deal signals stability and growth. It promises hope in the form of advanced therapies for patients. For the healthcare industry, it sets a new standard for how biotech and big pharma collaborate.

Novartis has not only purchased a company, but it has also invested in the future of medicine.

FAQs

Novartis is acquiring Tourmaline Bio to expand its oncology pipeline with precision therapies and to enhance its research with data-driven, AI-supported approaches.

The acquisition is expected to boost investor confidence, especially among those tracking AI stocks. If clinical programs succeed, Novartis’s stock could see long-term gains.

The primary challenges include obtaining regulatory approvals, integrating cultural and operational aspects, and managing uncertainties in clinical trials. However, Novartis’s experience makes it well prepared to handle these hurdles.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.