Crypto Gears Up: BTC/USD, DOGE/BTC Breakout Potential; XRP MACD Signals Upside

We observe a crypto market entering a phase where technical setups, institutional flows, and social-media momentum are converging.

Bitcoin’s renewed ETF inflows and price strength are creating a risk-on mood. Simultaneously, Dogecoin shows technical signs of a breakout on BTC-paired charts while social chatter lifts retail demand. XRP’s MACD is signaling a potential bullish crossover that, if confirmed, could catalyze further gains.

These are not isolated phenomena; they reflect macro liquidity expectations and concentrated social-media amplification that drive short-term crypto moves.

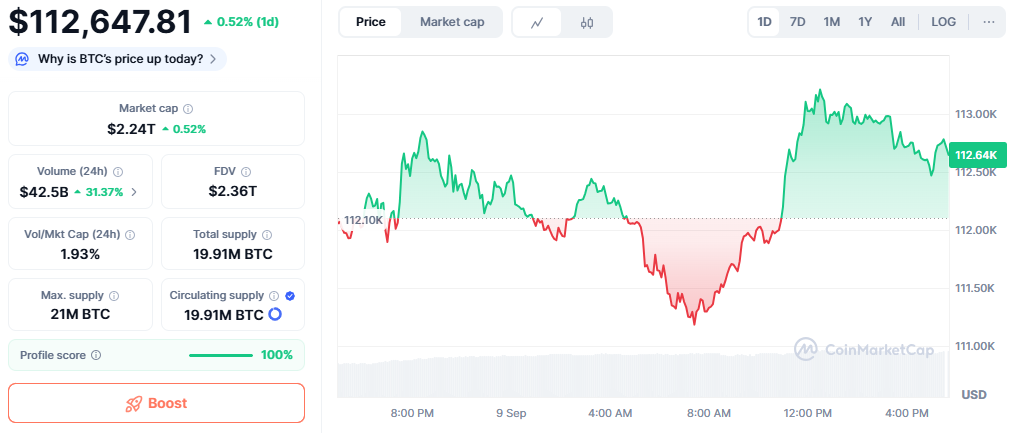

Bitcoin (BTC/USD): institutional flows underpinning price structure

Bitcoin is trading with stronger bid interest after a period of consolidation around five-figure levels. Spot ETF flows have shown consistent net inflows recently, and that institutional demand is materially reducing sell-side liquidity on exchanges while providing a structural bid under price.

The combination of ETF inflows and macro expectations for easier policy has supported price momentum. If BTC clears the immediate resistance band that market makers are watching, upside continuation toward the next major supply zone becomes plausible.

ETF-driven accumulation tends to compress float on exchanges and amplify volatility on breakouts. For traders, this means breakouts accompanied by widening volume and reduced orderbook depth can be sharp and fast. We therefore monitor not just price but fund flows and exchange reserves for confirmation.

DOGE/BTC: technical breakout possible

Chart setup and on-chain context

Dogecoin’s price action against Bitcoin has formed a consolidation base on multi-day charts with rising volume spikes on intraday break attempts. Analysts and on-chain trackers report increased whale accumulation and reduced exchange liquidity for DOGE, classic conditions for a momentum breakout if retail volume returns. An 8-hour breakout trigger noted by active traders has already drawn fresh entries from momentum desks.

Social media as a force multiplier

Dogecoin remains unusually sensitive to social signals. Posts on X (formerly Twitter), high-engagement TikToks, and coordinated Telegram/Discord activity produce rapid retail inflows. High-profile mentions can materially change order flow in short windows; recent spikes in social mentions have correlated with intraday pumps. We therefore treat social-volume metrics (mentions, engagement rate, viral posts) as a real-time risk filter for DOGE trades.

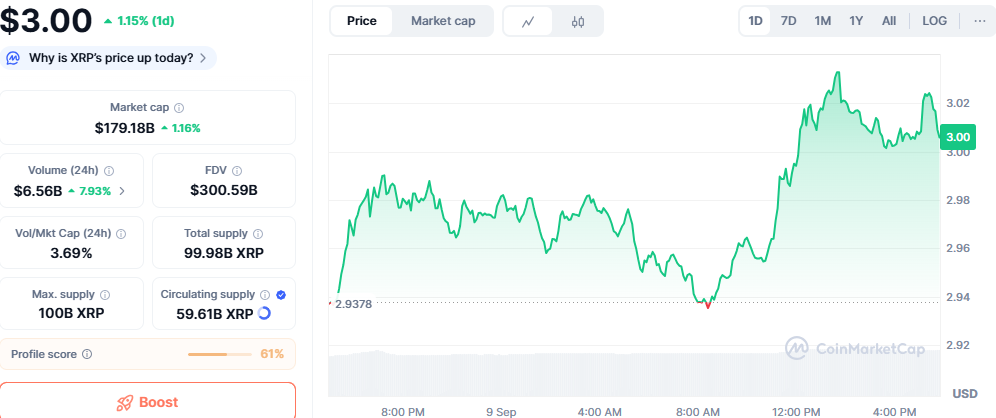

XRP: MACD crossover and institutional catalysts

Technical signal and fundamentals

XRP’s MACD indicator has been moving toward a bullish crossover, a classical momentum signal that often precedes a multi-session advance when supported by volume and on-chain accumulation.

Recent whale buying reports and custody/partnership announcements have provided a fundamental backdrop that increases the probability of a sustained move should the MACD confirm. We watch for MACD histogram expansion together with rising weekly volumes as the confirmation set.

Regulatory clarity and partnerships

XRP’s price action this year has been sensitive to legal and institutional developments. Positive custody arrangements and bank partnerships increase trust and open avenues for real-world utility, which can shift market allocation from pure speculation to strategic accumulation. These developments are the fundamental fuel behind a technically valid MACD signal.

How social media, on-chain, and macro interact — practical checks

- Volume confirmation: Breakouts on BTC and DOGE require above-average exchange and derivative volume to be reliable. If price moves occur on weak volume but massive social buzz, expect short-lived fakeouts.

- Flow confirmation: ETF inflows and custody announcements create persistent demand. For BTC and XRP, these institutional signals materially raise breakout odds.

- Sentiment monitoring: Track spikes in X/TikTok/Reddit mentions and Discord/TG coordination. For DOGE, a single viral post can produce outsized short-term moves, treat social momentum as a volatility amplifier, not a primary trend signal.

Risk management and trade framework

We recommend combining technical thresholds with flow and social checks: enter on confirmed close above the breakout zone with volume and lower exchange reserves; use tight stops below the breakout candle for short-duration trades; scale exposure down if social sentiment outpaces on-chain or flow confirmation. Always size positions to the volatility regime and avoid leverage spikes during social-media-driven frenzies.

Conclusion

The confluence of ETF/flow-driven demand for BTC, on-chain accumulation and social amplification for DOGE, and technical MACD momentum with institutional partnerships for XRP forms a credible multi-asset setup.

Breakouts are probable but will be subject to rapid reversals if not backed by volume and flow. We encourage disciplined entries tied to specific confirmations: ETF and custody flows for BTC/XRP, and combined volume + social-confirmation for DOGE/BTC moves.

FAQs

Social-media posts can prompt measurable price moves within minutes; viral posts and influencer mentions historically produce intraday volume surges that turn small breakpoints into full rallies. Monitor mention velocity, not just sentiment.

A MACD crossover is a useful momentum signal, but should be paired with volume confirmation, on-chain accumulation, and any relevant institutional or regulatory news for higher-probability setups.

ETF inflows are a meaningful structural demand indicator; sustained inflows reduce circulating float and support higher prices. However, macro policy shifts and liquidity events can still trigger corrections, so use flows as a strong but not infallible input.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.