$70B Gain Propels Ellison Toward Richest-Man Status

In the past year, we have seen something unusual in the world of billionaires. Larry Ellison, co-founder of Oracle, added nearly $70 billion to his wealth. This rise was not only fast but also surprising for many market watchers. Ellison now stands close to the title of the world’s richest man, a race usually led by names like Elon Musk and Jeff Bezos.

What caused this jump? The answer lies in Oracle’s strong stock rally. The company has shifted its focus from traditional databases to cloud computing and artificial intelligence. These changes made investors more confident and pushed its value higher. As Oracle grew, Ellison’s fortune grew with it.

This story is not just about money. It shows how new technologies, smart business moves, and bold leadership can reshape a company’s future. It also reminds us how quickly fortunes can change when markets shift.

Who Is Larry Ellison?

Larry Ellison co-founded Oracle in 1977. He led the company for decades and now serves as its executive chairman and CTO. He holds almost 41 percent of Oracle, linking most of his wealth to its performance. Ellison is known for bold business moves and a passion for tech. The height of his fortune is tied to how well Oracle sails through markets.

The $70 Billion Wealth Surge

Oracle’s recent earnings report caused a massive jump in its stock. Shares spiked over 25-27 percent after hours. This surge added about $70 billion to Ellison’s net worth, pushing it to roughly $364 billion. That may become the biggest one-day gain ever in the Bloomberg Billionaires Index.

Oracle’s AI & Cloud Push

Growth in Oracle’s “Remaining Performance Obligations” was key. This figure jumped from $138 billion to $455 billion in one quarter. Four new multibillion-dollar AI cloud contracts helped drive the surge. Clients include OpenAI, xAI, Meta, Nvidia, and AMD. CEO Safra Catz called it an “astonishing quarter” and forecasted cloud revenue to grow from $18 billion this year to $144 billion in five years. Oracle also disclosed a $30 billion cloud contract linked to initiatives like the Stargate project.

Ellison: Wealth and Lifestyle

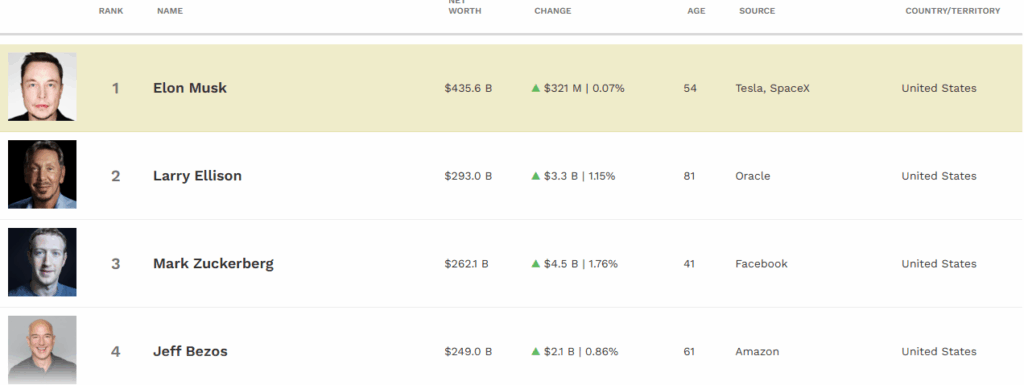

A few months ago, Ellison had already jumped ahead of Mark Zuckerberg and Jeff Bezos, reaching second place on the top-rich lists. As of July 2025, his net worth sat at $251 billion. After the recent bump, he now trails only Elon Musk, who currently holds around $384 billion. Ellison may soon overtake him if Oracle’s rally persists.

Most of Ellison’s holdings remain inside Oracle. He also owns the Hawaiian island of Lānaʻi, as well as other luxury assets. Investments beyond Oracle include previous stakes in Tesla and other tech ventures. His wealth allows him to fund major personal projects and philanthropic efforts.

Oracle’s Future: Growth and Challenges

High stock gains can reverse quickly. Oracle faces intense competition in cloud and AI from AWS, Azure, and Google Cloud. Chip shortages may limit growth. Oracle is investing heavily; its capital spending forecast hit $35 billion in fiscal 2026, up from just $1.6 billion in 2020. That has led to reduced free cash flow. Regulatory scrutiny on big tech looms, too.

Ellison’s new wealth level boosts investor confidence. Oracle’s transformation into a cloud and AI leader got real momentum. The company’s growth targets, large contracts, and rising backlog suggest strong demand ahead. Oracle may soon rival AWS or Azure in scale.

Bottom Line

Larry Ellison’s $70 billion wealth surge is more than a personal milestone. It reflects Oracle’s sharp pivot toward cloud and artificial intelligence. The company’s massive backlog, bold contracts, and high investor trust show how fast the tech landscape is changing. Ellison now stands just behind Elon Musk in the billionaire rankings, with a real chance to take the top spot.

Yet the path ahead will not be simple. Heavy competition, rising costs, and global economic risks remain. Still, Oracle’s momentum proves that a traditional software firm can reinvent itself and lead in a new era. Ellison’s rise is a reminder of how innovation and timing can reshape both fortunes and industries.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.