Oracle Earnings: Strong Quarter Propels Oracle Into Top Tier of AI Players

Oracle recent quarter stunned markets, as a surge in AI-driven demand sent the company’s cloud metrics and backlog to levels few expected. Investors, customers, and enterprise architects are now asking:

Why is Oracle suddenly standing out in the AI race? The results show how Oracle is turning database strength and infrastructure investment into a credible play for AI workloads. This quarter underlines Oracle AI demand, Oracle cloud growth, Oracle quarterly results, enterprise AI adoption, and Oracle AI investments.

Oracle’s record quarter explained

Oracle (ORCL) reported adjusted earnings per share of $1.47, with revenue of $14.9 billion for the fiscal quarter. Management said multibillion-dollar customer wins and rising consumption helped push a more optimistic outlook.

Crucially, the company now expects cloud infrastructure sales to grow 77% to $18 billion this fiscal year, a revision it directly attributes to accelerating AI demand. These moves underlie why analysts are calling the results historic for the company.

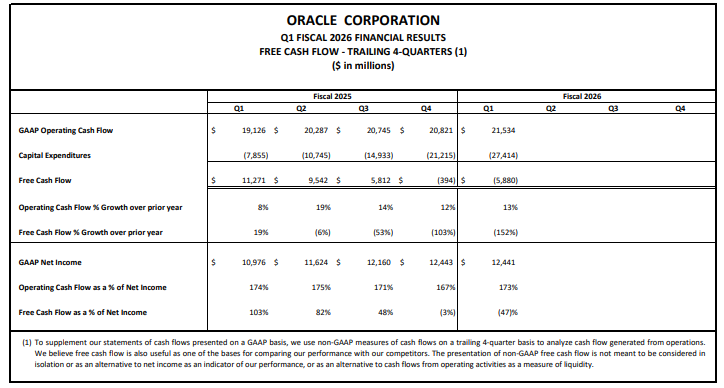

The numbers behind the headline

Beyond the headline, Oracle disclosed a massive swing in remaining performance obligations, or RPO, which reflects contracted revenue yet to be recognized. RPO jumped to $455 billion, up sharply year over year and signaling multi-year commitments from large AI customers.

That backlog gives Oracle unusually high visibility into future revenue streams, and it is a large part of the bullish narrative about Oracle’s AI strategy.

How AI demand is reshaping Oracle’s cloud business

AI demand is changing what enterprises buy from cloud vendors. For Oracle, this translated into strong Infrastructure as a Service consumption, rapid GPU adoption, and expanded use of its database offerings for AI tasks.

Furhtermore, reporting shows Oracle deployed tens of thousands of high-end GPUs and saw GPU consumption spike dramatically, supporting training and inferencing at scale for customers. That increase in infrastructure usage helps explain the steep cloud growth rates and the upgraded guidance.

From training to inferencing

Chairman Larry Ellison emphasized the market shift from training models to inferencing, running models against enterprise data in production. He was quoted as saying, “AI changes everything.”

Oracle’s database-centric approach aims to let enterprises run top models such as ChatGPT, Grok, and Gemini against private data without moving it, addressing security and compliance concerns that matter to industries like finance and healthcare.

That database integration creates a practical path for enterprise AI adoption at scale.

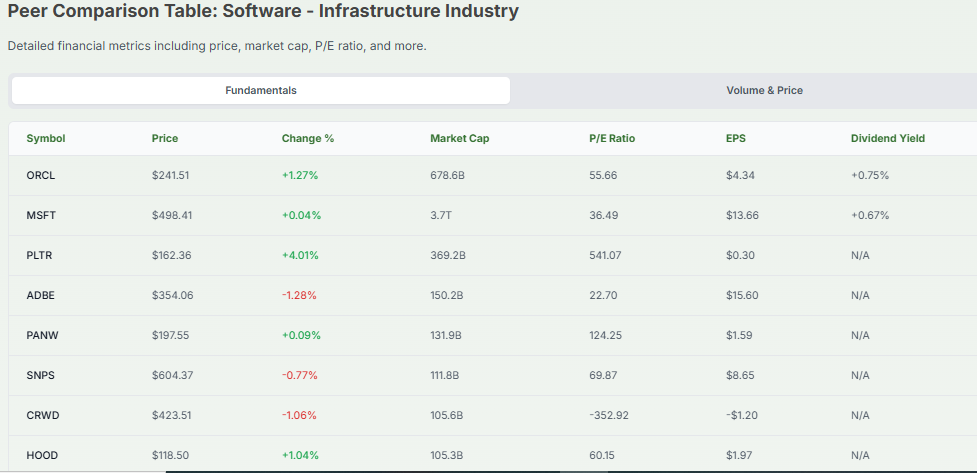

Oracle versus rivals: AWS, Microsoft, and Google

Oracle remains smaller by overall cloud market share compared to Amazon, Microsoft, and Google, but its growth rates in IaaS and OCI consumption have outpaced peers in key quarters. Experts note Oracle is focusing on workload-specific performance and enterprise data integration rather than trying to match hyperscalers on every front.

That creates a differentiated value proposition for customers whose primary concern is secure, high-performance inferencing.

The role of Oracle’s cloud infrastructure and partnerships

Oracle’s capital investments and partner deals are central to its AI push. The company has announced strategic deals with leading AI players and invested heavily in GPU resources to support customers who need dedicated capacity.

Also, Oracle plans product moves such as an Oracle AI Database to let customers use top models on top of the Oracle Database, effectively offering an integrated stack for AI-enabled business applications.

Can Oracle sustain this growth momentum? Execution on capacity, partnerships, and product integration will determine whether momentum becomes a long-term advantage or a momentary surge.

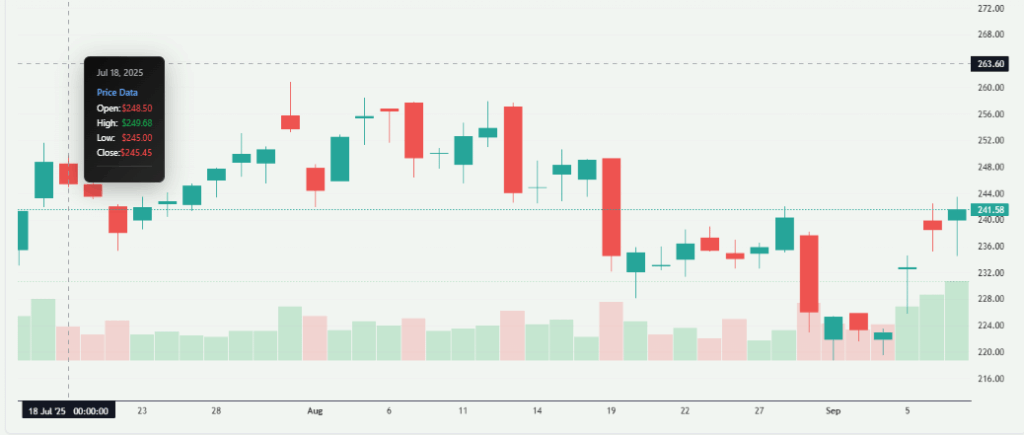

Oracle market reactions and stock performance

Markets cheered the guidance and customer wins, sending the stock sharply higher in after-hours trading and lifting gains for the year. Traders and analysts said the results validated Oracle AI investments and pushed valuation multiples higher, prompting debate about how much growth is already priced into the shares.

Moreover, the rally reflects both enthusiasm about Oracle’s AI investments and the broader investor appetite for AI stories across the tech sector.

Industry experts on Oracle’s AI trajectory

Analysts praise Oracle’s database-first strategy for solving a core enterprise problem: how to securely apply models to private data. At the same time, cautionary notes focus on margin pressure as capital spending rises, and on GPU supply constraints that could limit near-term capacity. L

Long term, experts say the integrated stack could be a durable advantage if Oracle continues to convert its backlog into recurring revenue.

Oracle social media insights and investor commentary

Investor commentary on social platforms reflects a mix of enthusiasm and caution. Some posts celebrate the quarter as proof that Oracle AI investments are paying off, while others urge vigilance on margins and execution. Selected investor posts are linked for context:

What Oracle’s AI growth means for enterprise technology

Oracle’s quarter signals that enterprise AI adoption is moving from pilots to production scale, with implications for software vendors and corporate IT teams.

The database-centric approach lowers the barrier for secure, private AI use cases in regulated industries, and it pressures IT leaders to plan capacity and rethink data architecture to support vectorization and secure inferencing.

Enterprises will need to weigh trade-offs between hyperscaler breadth and Oracle’s database-integrated depth as they build AI-enabled systems.

Conclusion

Oracle’s strong quarter did more than beat estimates; it repositioned the company as a credible top-tier AI player. By combining database centricity, significant GPU investments, and multiyear contracts, Oracle has created a practical route for enterprises to adopt AI at scale.

The central questions ahead are whether supply constraints and margin dynamics allow sustained growth, and whether Oracle can turn a large backlog into steady recurring revenue. For now, Oracle’s momentum is real, and the market is watching closely.

FAQ’S

Yes, Oracle has become a major player in AI, driven by strong cloud growth and heavy investments in GPU infrastructure.

Oracle’s AI strategy focuses on integrating AI directly into its database and cloud, enabling enterprises to run models securely on private data.

Oracle faces challenges like GPU supply limits, rising infrastructure costs, and competing with hyperscalers like AWS and Microsoft.

AI powers Oracle’s cloud services, database automation, and enterprise tools, helping businesses adopt AI at scale with better efficiency.

AI will not replace Oracle developers but will enhance their work by automating repetitive tasks and improving productivity.

Currently, companies like OpenAI, Google, and Microsoft lead in AI research, but Oracle is growing fast in enterprise AI adoption.

Yes, OpenAI has been reported to use Oracle’s cloud infrastructure to support AI training and enterprise workloads.

Oracle’s AI is stronger for database-centric enterprise use cases, but Microsoft, AWS, and Google still dominate broader AI services.

Yes, Oracle has invested billions in GPUs, cloud infrastructure, and AI-driven products to support enterprise customers.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.