Billionaires Index: Larry Ellison Briefly Surpasses Elon Musk in Wealth

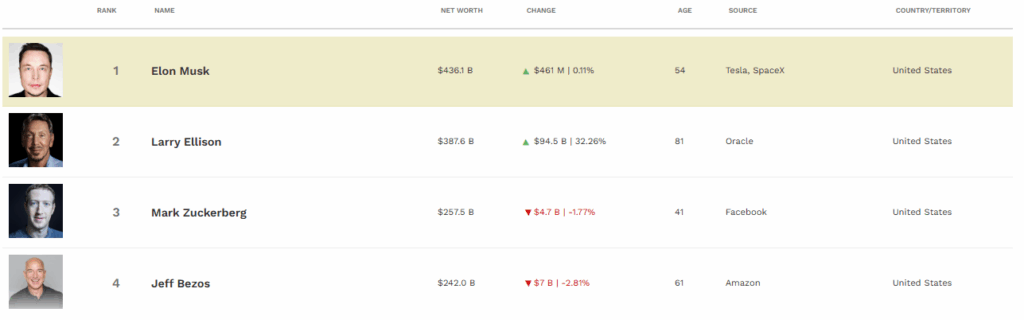

In today’s world, billionaire rankings change faster than ever. One market shift and the list looks different. Recently, Larry Ellison, the co-founder of Oracle, briefly passed Elon Musk in global wealth. This news caught attention because Musk has often dominated the headlines as the richest man alive.

Ellison’s jump shows how quickly fortunes rise when markets favor certain industries. Oracle’s growth in cloud and AI gave it the boost. At the same time, Tesla’s slowdown pulled Musk down. These shifts remind us that wealth is tied to business cycles, not just bold ideas.

When we look more closely, we see two distinctly different paths. Musk bets on risky, future-driven ventures like electric cars and space travel. Ellison focuses on steady enterprise growth in software and cloud services. Both paths shape our world, but the markets decide who leads at any moment.

This short episode is more than a ranking change. It shows us where global tech and money are moving next.

The Billionaires Index: How It Works?

The Billionaires Index tracks the wealth of ultra-rich individuals using public data. It includes stock holdings, private assets, debt, and known valuations. Small changes in a company’s stock can cause large swings in net worth. We see shifts most when tech or cloud companies gain or lose favor in markets. The ranking is also sensitive to quarterly reports. Strong outlooks or large deals tend to push a billionaire’s value upward rapidly. Weak results or guidance can pull it down just as fast.

Larry Ellison’s Rise to the Top

Larry Ellison owns about 41% of Oracle. That stake gave him a huge boost when Oracle’s stock jumped sharply. Oracle reported large cloud contracts and strong AI infrastructure demand. A key metric, Remaining Performance Obligations (RPO), rose 359% year-over-year to about $455 billion. Long-term revenue forecasts for Oracle Cloud Infrastructure (OCI) expect it to hit $144 billion by 2030.

Oracle also won contracts with big AI players. This surge in demand sent Oracle’s stock up over 40% intraday. Because so much of Ellison’s wealth is tied to Oracle stock, its rise translated almost directly into his wealth, gaining over $100 billion in a day.

Elon Musk’s Wealth Fluctuations

Elon Musk’s fortune depends heavily on Tesla stock. When Tesla performs well, his wealth jumps. But this year, Tesla shares fell roughly 14%, which dragged part of its value down. Some of his net worth comes from SpaceX, xAI, and other ventures, but these are less liquid. Because of that, sudden swings in Tesla hit him harder. When Oracle’s surge pushed Ellison ahead, Musk’s value also declined slightly. By market close, however, Musk narrowly regained the top spot as Oracle’s stock gains settled.

Billionaires Index: Comparing Ellison and Musk

Ellison’s wealth is tied strongly to enterprise software, database systems, cloud infrastructure, and AI support services. He moves in realms with large contracts, steady revenues, and infrastructure scale. Musk, on the other hand, operates many mission-driven, disruptive tech projects. Electric vehicles, rockets, and social media each carry big upside and big risk. Ellison benefits when companies invest in cloud capacity, steady growth, and infrastructure. Musk rides volatility in EV demand, regulation, and new technologies. Stability favors Ellison in the short term. Ambition favors Musk, often with larger swings in value.

Market Forces Behind the Wealth Shifts

Demand for AI and cloud services has exploded recently. Companies need infrastructure to train large models and run inference. Oracle’s estimate that OCI will grow 77% this fiscal year to ~$18 billion and then reach ~$144 billion by 2030 reflects that. Big contracts with OpenAI, Meta, xAI, and others pushed Oracle’s RPO and outlook.

Meanwhile, Tesla’s growth has been weaker due to supply constraints, regulatory pressure, and competition. Decline in Tesla stock took away some of Musk’s cushion. Also, analysts’ optimism about cloud and AI tends to favor companies with large infrastructure and existing global scale. Investors reward forecasts and backlog numbers that explain Oracle’s spike.

Symbolism of Wealth Rankings

These billionaire rankings mean more than money. They show which industries are winning in the moment. Cloud, AI infrastructure, software vs. electric vehicles, and disruptive technologies. When Ellison overtook Musk, even if briefly, it symbolized a shift. It suggested the market values infrastructure and enterprise tech stability now more than hype or speculative growth. People watch these rankings as signals. Who leads may indicate where future capital flows will go. It influences startups, investors, and policy watchers.

Broader Implications for Business & Tech

Oracle now looks like a juggernaut in AI infrastructure. Its multi-cloud partnerships (with Amazon, Microsoft, Google) make its cloud reach stronger. More companies may prefer mature, broad cloud providers for AI compute rather than small niche ones. For Tesla and Musk, keeping pace means innovation, cost control, and convincing investors that EV and related technologies are still growth stories. The volatility underlines risk. It also shows that enterprise infrastructure companies may enjoy a comeback in valuation.

For startups, this may shift priorities: steady contract revenue, cloud tools, and AI utilities may now attract more funding. We may see more mergers, cloud capacity investments, and deals in this space.

Wrap Up

Ellison’s brief rise above Musk does more than swap names. It signals how strongly AI and cloud demand are shaping wealth today. Market valuations reward those who secure large contracts and clear growth forecasts. Musk’s businesses remain powerful, but volatility stays in his world. Ellison’s moment shows that stability and infrastructure matter, not just disruptive boldness. These shifts may guide the direction of tech, investment, and business in the upcoming years.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.