UK GDP Release Looms as Pound Falls Against U.S. Dollar

The upcoming UK GDP release is one of the most closely watched events for global markets this week. Investors, traders, and policymakers are eager to see whether the economy is showing signs of strength or slipping deeper into weakness. At the same time, the British pound has been losing ground against the U.S. dollar, reflecting uncertainty and cautious positioning.

The results of the GDP report will not only guide the Bank of England’s next moves but also set the tone for stock markets, currencies, and international investors.

Why UK GDP Matters

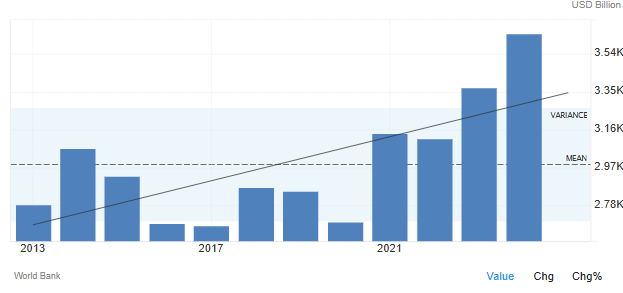

UK GDP is a key measure of the economy’s performance. It reflects the total value of goods and services produced in the country. A strong reading signals expansion, while a weak one raises concerns about slowdown or recession.

For the UK, GDP numbers carry extra weight because the economy has been battling inflation, rising interest rates, and global headwinds. Markets see the data as a guide to what the Bank of England might do next with monetary policy.

Pressure on the Pound

The British pound has been under pressure in recent days. Against the U.S. dollar, it has weakened due to stronger U.S. economic data and investor preference for the dollar as a safe-haven asset.

If the GDP figures come in weaker than expected, the pound could fall further. This would raise import costs and potentially add to inflation concerns in the UK. On the other hand, a stronger reading might stabilize the currency and provide relief to businesses and households.

Bank of England’s Dilemma

The Bank of England has been raising interest rates to combat inflation. However, high borrowing costs risk slowing down growth even further. This is why the GDP data is so critical.

If the economy shows resilience, the BoE may continue with its firm stance. If growth is weak, policymakers may face pressure to pause or ease rate hikes. Either way, the data will play a major role in shaping the bank’s next decision.

Impact on Businesses

Businesses across the UK are feeling the strain of high energy prices, weak consumer spending, and global uncertainty. For manufacturers, exports have become harder due to supply chain issues and currency swings.

Retailers and service providers are also facing challenges as households cut back on spending. A weak GDP number would confirm these pressures, while a stronger result could boost confidence in the near-term outlook.

Investors and Stock Market Trends

For investors, the GDP release is more than just an economic update. It helps shape expectations for the stock market and specific sectors.

Domestic equities may react sharply depending on the numbers. If growth surprises to the upside, bank stocks and financial services could benefit. On the other hand, if GDP contracts, defensive stocks might gain more attention.

Technology and AI stocks remain an interesting area, as global demand in this sector may help offset local challenges. Investors who rely on stock research will be watching closely for opportunities or risks that the data may reveal.

Global Comparisons

The U.S. economy has shown relative strength compared to the UK and Europe. With solid job growth and stable consumer activity, the U.S. dollar has stayed strong.

This divergence puts the pound at a disadvantage. Investors seeking returns are moving capital toward the U.S., which supports the dollar while weighing on sterling. Unless the UK GDP data delivers a surprise, the pound may continue to struggle.

Currency Volatility Ahead

Currency traders are bracing for volatility once the GDP report is released. A better-than-expected number could lift the pound quickly, while a weak reading may drive further selling.

This volatility creates both risks and opportunities for businesses involved in trade and for investors with international portfolios. Companies that rely heavily on imports will be particularly sensitive to any big currency moves.

The Broader Economic Picture

The UK economy is balancing multiple challenges. Inflation remains high, consumer spending is under pressure, and global demand is uncertain. Energy costs and housing market weakness are also weighing on growth.

At the same time, there are areas of resilience. The services sector, in particular, has shown some stability, and certain industries continue to invest in innovation. The GDP report will provide clarity on which parts of the economy are holding up and which are dragging overall growth down.

Market Reactions to Watch

When the GDP data is released, investors should pay attention to three main reactions:

- Stock Market Response: Domestic equities may rally or decline depending on growth signals.

- Currency Moves: The pound will likely see sharp movements against the dollar.

- Policy Speculation: Analysts will quickly adjust their expectations for the Bank of England’s next steps.

These reactions can shape sentiment not just in the UK, but across global markets.

Looking Ahead

The next few months will be critical for the UK economy. If growth shows improvement, confidence could return, easing pressure on the pound. If the numbers disappoint, recession fears will intensify, and the Bank of England will face even tougher decisions.

Investors and businesses alike will need to stay alert and flexible. The combination of inflation, interest rates, and global uncertainty means conditions could shift quickly.

Conclusion

The UK GDP release is not just a domestic concern; it is a global event. With the pound already sliding against the U.S. dollar, the data will set the tone for markets in the weeks ahead.

Whether the numbers point to recovery or weakness, the results will influence central bank policy, investor sentiment, and business strategy. As uncertainty continues, careful planning and close monitoring of the data will be essential for navigating the challenges ahead.

FAQs

It shows how the UK economy is performing and helps shape decisions by the Bank of England, investors, and businesses.

Stronger GDP supports the pound by signaling growth, while weak GDP puts downward pressure on the currency.

Financial services, technology, and AI stocks could see gains if the economy shows signs of recovery.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.