Defence Stock Apollo Micro Systems Share Rises 4% After MoU Update

The Indian defence sector continues to attract investor attention as government initiatives and private partnerships reshape the future of national security. Among the companies leading this transformation, Apollo Micro Systems Ltd. has emerged as a notable player. Recently, the Apollo Micro Systems share price gained nearly 4% following the announcement of a fresh Memorandum of Understanding (MoU).

Apollo Micro Systems: A Growing Force in Defence Technology

Apollo Micro Systems, headquartered in Hyderabad, designs and develops electronic systems, engineering solutions, and components primarily for the defence, space, and homeland security sectors. With increasing government spending on defence modernization and a push for Atmanirbhar Bharat (self-reliance in defence), the company has positioned itself as a trusted partner in strategic projects.

The recent rise in Apollo Micro Systems share reflects the growing investor confidence in the firm’s role within India’s defence ecosystem. By focusing on advanced technologies, the company is bridging gaps between traditional defence manufacturing and the emerging needs of modern warfare.

Details of the MoU and Market Reaction

The MoU that drove the recent price surge involves collaboration in defence technology and systems integration. While the exact partners and projects are still under wraps, industry insiders believe the agreement will open doors for joint ventures, advanced product development, and possible exports.

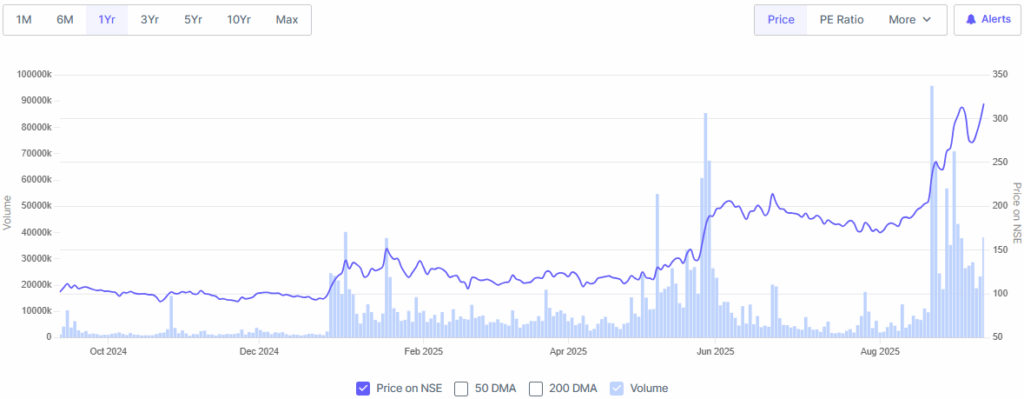

The stock market reacted positively, with Apollo Micro Systems shares gaining over 4% in intraday trading. This reflects not just short-term enthusiasm but also a belief that the company will secure stronger revenue pipelines through collaborations.

Analysts suggest that such agreements often lead to long-term growth, especially in defence and aerospace sectors where projects span several years. The rise in the stock also underscores the growing appetite among investors for defence-related opportunities amid rising geopolitical tensions.

India’s Defence Push and Market Opportunities

India is the third-largest military spender in the world, according to the Stockholm International Peace Research Institute (SIPRI). The government has been aggressively pushing for indigenization of defence technology, limiting imports, and opening more projects for domestic companies.

This policy shift has been a major boost for firms like Apollo Micro Systems. The focus on indigenous development aligns perfectly with the company’s expertise in AI-enabled systems, radar technology, and mission-critical solutions.

Furthermore, the government’s Defence Production and Export Promotion Policy (DPEPP) has set ambitious targets, which could significantly benefit local defence stocks. Such policies provide not only direct contracts but also enhance investor confidence, helping companies attract funding for research and development (R&D).

Why Apollo Micro Systems Share Attracts Investors

The sharp rise in Apollo Micro Systems share price reflects multiple underlying strengths:

- Diversified Portfolio: The company caters to defence, aerospace, and homeland security, reducing dependency on a single sector.

- Government Backing: Defence contracts backed by the Indian government provide stability and visibility in revenues.

- Technology Focus: With increasing integration of AI stocks and automation in defence, Apollo Micro Systems has positioned itself as a technology-forward player.

- Global Potential: As India opens its defence sector to exports, Apollo Micro Systems could leverage MoUs to explore international markets.

Stock Market Outlook for Apollo Micro Systems

Experts believe that the long-term outlook for Apollo Micro Systems share is bullish. The combination of new defence orders, MoUs, and potential international collaborations is expected to improve revenue visibility.

However, investors must also remain cautious. The defence sector is heavily dependent on policy changes, budget allocations, and geopolitical risks. Any delay in government clearances or disruption in global supply chains could impact near-term performance.

Still, the broader stock market is increasingly recognizing the importance of defence stocks as part of a diversified portfolio. Analysts often recommend exposure to this sector as a hedge against global uncertainties.

Comparison with Other Defence and AI Stocks

In recent years, several defence-related companies have shown strong performance, especially those integrating artificial intelligence and robotics into their systems. Apollo Micro Systems fits into this trend, making it competitive not just in India but potentially abroad.

Compared to larger defence manufacturers, Apollo Micro Systems is still a mid-sized player. However, this smaller scale allows it to remain flexible, innovative, and faster in execution. Investors keen on growth stocks with exposure to defence technology often look at companies like Apollo for higher returns.

As AI integration in defence becomes mainstream, firms like Apollo Micro Systems stand to benefit from their early adoption and technological capabilities.

Future Prospects and Strategic Importance

The signing of new MoUs signals the company’s willingness to expand collaborations, innovate, and secure a stronger market presence. Analysts expect more partnerships in the coming quarters, possibly in areas like autonomous systems, cyber defence, and aerospace electronics.

Additionally, India’s defence export policy, which targets USD 5 billion in annual exports by 2025, could provide Apollo Micro Systems with a larger international market. With increasing focus on cutting-edge technology and strategic independence, the company is well-positioned to benefit.

Conclusion

The recent 4% rise in Apollo Micro Systems share is more than just a stock market reaction, it reflects the company’s growing strategic importance in India’s defence landscape. Supported by government initiatives, strong technology focus, and promising collaborations, Apollo Micro Systems is on a path of sustained growth.

FAQs

The price increased after the company signed a new MoU, which boosted investor confidence about future projects and revenue opportunities.

Yes, given its strong role in India’s defence sector, focus on technology, and potential for export growth, analysts view it as a promising long-term investment.

While smaller than giants in the sector, Apollo Micro Systems is agile and technology-driven, making it attractive for investors seeking growth opportunities in defence and AI-linked stocks.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.