HFCL Shares Jump 4% on Andhra Pradesh Land Acquisition Plan

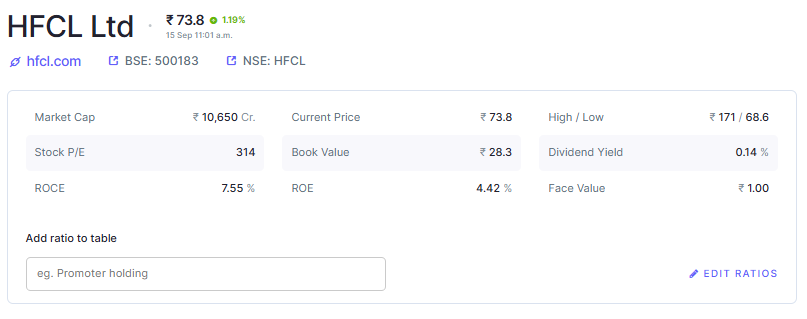

HFCL shares rose nearly 4% after the company confirmed plans to buy land in Andhra Pradesh. The move caught the eye of both investors and market watchers. HFCL, known for its role in telecom and optical fiber solutions, has been part of India’s digital growth for decades.

We see this rise in share price as more than just a market reaction. It shows how investors view the company’s long-term plans. Land acquisition is not only about expansion. It signals confidence, future growth, and stronger market positioning.

Andhra Pradesh has become a hub for industry and infrastructure projects. By choosing this state, HFCL is linking its growth with a region that is eager to attract investment. We know such moves create jobs, bring in technology, and support the government’s push for digital India.

For investors, this development raises fresh questions. What does this mean for HFCL’s revenue stream? Can the company keep up with growing competition? Let’s explore the details, the impact, and what it means for the future of both HFCL and the telecom sector.

Background on HFCL

HFCL is a long-standing name in India’s telecom space. It makes optical fiber cables, networking gear, and system solutions. The firm has been part of major telecom builds and private contracts. HFCL also moved into defence manufacturing in recent years. Its order book shows both domestic and export business. This mix helped its profile among investors.

Details of the Andhra Pradesh Land Allotment

Andhra Pradesh’s State Investment Promotion Board approved allotment of 1,000 acres to HFCL. The land sits in Madakasira mandal, Sri Sathya Sai district. Phase I will hand over 329 acres. Phase II will add 671 acres later. The site is planned for defence manufacturing units. The company mentioned artillery shells, explosive filling units, and other defence products in filings. The allotment was notified in an official exchange filing on September 11, 2025.

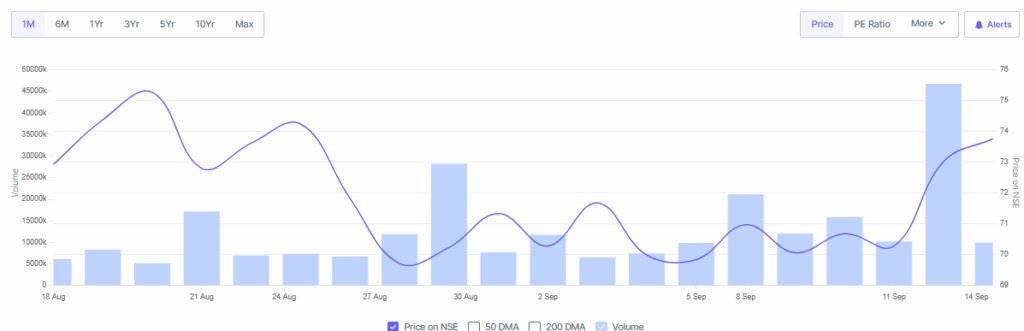

Market Reaction: Share Price Movement

Shares jumped sharply after the news. Markets reacted within hours. HFCL stock rose about 4-5% on the day the allotment was announced. Trading volumes climbed as buyers stepped in. Brokers noted this as a vote of confidence in the firm’s defence strategy. The stock spike also pulled some small-cap defence names higher on trade flows.

Strategic Importance of the Move

This land move marks a bigger push into defence manufacturing. HFCL can now build large-scale plants. That may cut dependence on third-party vendors. In-house capacities can speed up delivery. Local production also fits India’s push for defence self-reliance. The allotment could give HFCL an edge for government tenders. It also opens chances to supply private defence integrators and exports.

Impact on Andhra Pradesh’s Economy

A 1,000-acre defence hub can change the local economy. Jobs will arrive in construction and factories. Local vendors may supply materials and services. Skill training centres may form around the facility. The state stands to gain in tax receipts and industrial activity. Andhra Pradesh has offered land and support to attract such projects.

Expert and Analyst Views

Analysts called the allotment a strategic step. Many said it validates HFCL’s diversification. Some broker notes flagged higher revenue potential in defence. Others urged caution and asked investors to watch execution. Analysts pointed to phased handover and capex needs. They also noted that return on investment depends on contract wins and timely plant commissioning.

Challenges and Risks

Land allotment is only the start. Permits and clearances must follow. Building defence plants needs large capex. Supply chain gaps could slow production. Skilled labour is another constraint in remote areas. Also, defence contracts are competitive and often long-term. Market sentiment may wobble if timelines slip or costs rise. Finally, any local opposition or policy change could delay the project.

What does this mean for HFCL’s Financials?

Capex will rise in the near term. Margins may stay tight while factories are built. Over time, steady defence orders could boost revenue and profit. The company already has optical fiber export wins and recurring telecom income. Adding defence manufacturing may diversify revenue and reduce cyclic risk. Investors should watch quarterly updates and order inflows to judge progress.

Competitive Positioning

HFCL competes with specialised defence firms and larger public sector units. Few private players have such large land allotments for defence. If HFCL executes well, it can move up the value chain. The firm can integrate telecom and defence offerings. This hybrid capability could be a competitive advantage. Still, rivals with deep defence experience will press hard on technology and price.

Future Outlook

If construction stays on schedule, production could start in phases. Early contracts will be crucial to show the plant’s viability. Success could attract more private and public orders. The stock may gain on visible contract wins and clear revenue guidance. However, investors must balance optimism with project risks. Monitor regulatory filings, APIIC (state agency) updates, and HFCL’s investor calls for real signals.

Bottom Line

The Andhra Pradesh allotment is a major step for HFCL. It signals a clear intent to build defence capacity at scale. Markets liked the plan and rewarded the stock in the short term. Long-term gains will depend on execution, contracts, and cost control. Careful tracking of milestones will tell whether this move becomes a growth engine or a heavy investment that needs time to pay off.

Frequently Asked Questions (FAQs)

On September 11, 2025, HFCL shares rose nearly 4% after Andhra Pradesh approved 1,000 acres for defence manufacturing. Investors saw this as growth and expansion potential.

HFCL will use the Andhra Pradesh land to build defence units. Plans include artillery shells and explosive filling plants, supporting India’s push for local defence production and jobs.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.