NSE Today: New Investor Additions Drop 18% in August

The National Stock Exchange (NSE) recorded a sharp 18.3% fall in new investor registrations in August 2025. Only about 12.3 lakh (1.23 million) new investors joined in this month. We from the markets feel this fall speaks volumes. It shows how global events, policy changes, and investor mood are shaping Indian equities. Behind the number lies caution. Behind the caution, many questions: why, what next, and who is affected.

Snapshot of August Investor Data

- In August, 12.3 lakh new investors registered on NSE.

- This is 18.3% lower than July’s additions.

- Among the financial year 2025 (from Feb to Aug), the average monthly addition is about 11.9 lakh.

- That average is much lower than the same span in 2024, when ~19.2 lakh new investors were being added per month.

- Total registered investor base with NSE by end-August 2025: 11.9 crore. We are now close to the 12-crore mark.

Reasons Behind the Decline

We believe several factors are working together to cause this drop:

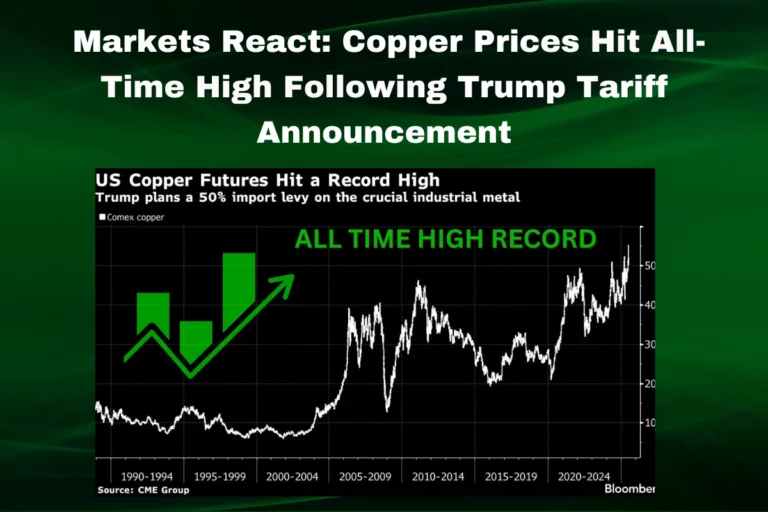

- Tariff shocks: New or threatened tariffs overseas are making investors uneasy.

- Foreign capital outflows: Many foreign investors are pulling money out because of global risks. This lowers overall confidence.

- Global uncertainties: Inflation, changes in rates by large central banks, and supply chain issues. All these add pressure. The environment feels risky.

- Market mood: When markets swing up and down, many new investors choose to wait. They prefer to see stability before joining.

Historical Context & Growth Trend

- Over the past few years, NSE has seen very strong growth in the investor base. For example, NSE crossed 10 crore investors in August 2024.

- Soon after, by January 2025, it crossed 11 crore investors.

- So, adding each extra crore was becoming faster, with just months between major milestones.

- But since early 2025, we have seen a tapering: fewer new joins. The momentum is slowing. Still, the base continues growing overall.

Segment-Wise Impact

- Retail/new investors are the most impacted. Lower registrations in August show many of them paused.

- Younger investors likely among those waiting. Investment fears are stronger among those without much prior exposure.

- Institutional investors (mutual funds, foreign institutions) are more stable. Their behaviour influences overall trading, but doesn’t show in new account numbers.

- There is also a pattern by region: earlier reports showed some states adding many new investors in July. But August looks weaker across most states.

Comparison with Global Trends

While India is seeing a dip in new investor additions, similar patterns appear elsewhere:

- Internationally, when global uncertainties rise (tariffs, inflation, political risk), retail investors often pull back.

- In many emerging markets, equity fund inflows are dropping. Investors shift to safer assets like gold, bonds, or stay in cash.

- India still remains relatively attractive due to its growth prospects, but downside risks are causing a wait-and-watch mood.

Implications for the Stock Market

We from within the market see several possible effects:

- Liquidity may be reduced somewhat. Fewer new investors means less fresh money flowing in.

- Market volumes might drop or become more volatile. Active trading often depends on new participants.

- IPO activity could slow. If fewer people open new accounts, IPO subscription rates may suffer.

- Investor sentiment is key. News of drops like this can feed more caution. That can slow growth further.

What Could Revive Retail Participation?

We think the following steps or events might help bring investors back in higher numbers:

- Stability in policy and global trade: If tariff tensions ease, foreign flows slow down, and investors might feel more confident.

- Better communication from regulators or NSE about safeguards, protections, and making investing simpler.

- Attractive IPOs & fund offers: New companies with good potential can draw interest. If issues are well-priced.

- Digital tools and education: Helping people understand risk, rewards, and how the market works helps build trust.

Conclusion

August’s 18.3% drop in new investor additions shows we are in a more cautious phase in NSE Today. We see that macro issues, tariffs, foreign outflows, and global risk are not just abstract news. They are changing how many people decide to invest. Still, the long-term growth story remains strong. The investor base is large and growing. What matters next is how quickly confidence returns. If September or the coming months bring stability, we could see registrations bounce back. But for now, caution rules.

FAQS:

Yes, you can buy NSE unlisted shares through dealers of unlisted stocks. These shares are not on the exchange, and the rules make trading less simple.

The market falls because of global tensions, high interest rates, and selling by big investors. Weak earnings and fear about the economy also push prices lower.

The best time to buy stocks is when prices are low, companies show strong growth, and the market mood is stable. Long-term investing often gives good returns.

Disclaimer:

This content is for informational purposes only and is not financial advice. Always conduct your research.