US Stock Market Today: Dow, S&P 500, Nasdaq Futures Flat Ahead of Fed Decision

The U.S. stock market opened the week on a cautious note. Futures for the Dow Jones, S&P 500, and Nasdaq are trading flat as investors wait for the Federal Reserve’s next big move. The Fed’s decision on interest rates has become the most-watched event in financial markets. Even small hints from the central bank can shift global stocks, bonds, and currencies.

Right now, we see a market in pause mode. Traders are not rushing to make bold bets. They know the Fed’s words will shape the direction of borrowing costs, corporate earnings, and even global trade. Inflation has cooled compared to last year, but it still sits above the Fed’s long-term goal. That means rate cuts are not guaranteed.

This moment for investors is about balance. They want growth, but they also want stability. The Fed holds the key, and until it speaks, the market holds its breath.

Current Market Snapshot

As of Monday, September 15, 2025, U.S. stock futures are trading near flat in pre-market activity. Investors are awaiting the Federal Reserve’s upcoming interest rate decision later this week.

Dow Jones Industrial Average ETF is currently priced at $459.32, reflecting a 0.57% decrease from the previous close. SPDR S&P 500 ETF Trust (SPY) is trading at $657.41, showing a 0.02% decline. Invesco QQQ Trust Series 1 (QQQ) is at $586.66, marking a 0.47% increase.

Volume was light in some sectors. Tech names led recent gains, while banks and energy moved more slowly. Gold ticked down and oil ticked up in early trade. The dollar held steady against a basket of currencies. Market participants are closely monitoring these developments, as the Fed’s decision could influence market direction in the coming days.

The Federal Reserve’s Role

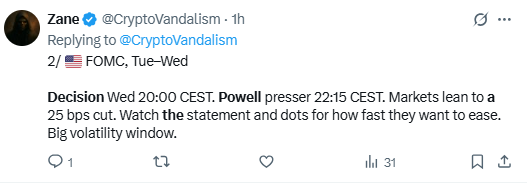

The Fed meets this week to set policy. Markets expect an interest-rate cut. Most traders price a 25 basis-point move. Fed Chair Jerome Powell will give a press briefing after the decision. His tone will guide markets more than the headline rate.

A rate cut lowers borrowing costs. Lower rates usually help stocks. But the Fed also watches inflation and jobs. Any sign that inflation stays high could make the Fed hold off or slow future cuts.

Economic Indicators in Focus

Several data points shaped the Fed’s view. August CPI came in hotter than some forecasts. That adds worry about persistent inflation. At the same time, job market readings showed signs of cooling. Weekly jobless claims rose, and some payroll indicators slowed. These mixed signals make the Fed’s path harder to read.

Retail sales, housing starts, and upcoming jobs data also matter. If growth slows sharply, the Fed may cut more quickly. If inflation re-accelerates, cuts could be delayed. Traders watched the calendar closely.

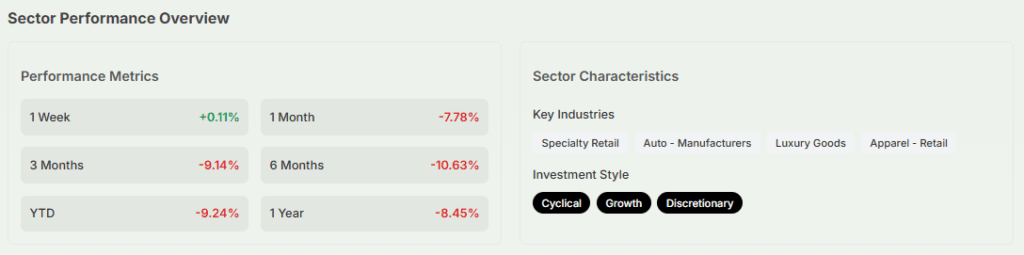

Sector-Wise Impact

Tech stocks are sensitive to rate moves. Lower rates boost the present value of future profits. That helps growth names and the Nasdaq. Recently, the Nasdaq hit record closes before the pause.

Banks face a different test. Falling rates can squeeze net interest margins. That hurts bank profits if cuts happen fast. At the same time, lower rates can lift lending and activity over time. Energy and commodity groups reacted to global news and oil moves more than U.S. rate talk. Gold acted as a haven when uncertainty rose.

Consumer and retail stocks watch credit costs. Lower rates help big-ticket purchases. But if wage growth evaporates, consumer demand can slow. Retail earnings this week will show how much shoppers can keep spending.

Investor Sentiment and Global Context

Sentiment was cautiously bullish. Many investors expect the Fed to start easing. That view lifted risk assets during the summer. Still, caution rose as some data contradicted the easing story. Global central banks also matter. The Bank of Canada and others are signaling moves that can affect trade and capital flows. Geopolitical flare-ups weighed on energy and safe-haven assets.

Foreign markets have climbed, too. Asia steadied near multi-year highs while China’s data stayed weak. That mix creates risk. A Fed that surprises on the hawkish side could trigger a quick global selloff.

Market Scenarios After the Fed Decision

If the Fed cuts as expected, stocks may rally near term. Growth names could see the biggest gains. Bonds would likely sell off a bit, lifting yields. If Powell signals more cuts ahead, risk appetite could rise further.

If the Fed pauses or signals caution, markets could fall. Tech and growth stocks would be most at risk. Treasuries might rally, and the dollar could gain. That path would raise fears about sticky inflation or policy error.

A split scenario is possible. The Fed might cut now, but stress data dependence. That could cause whipsaw moves. Traders could face sharp intraday swings as they react to tone and the dot plot.

Expert Views and Analyst Commentary

Economists broadly expect a cut in September 2025. Reuters and Bloomberg polls show many forecasters predicting at least one quarter-point move. Some analysts see more cuts later in the year if the labor market weakens further. Caution remains about inflation surprises.

Market strategists urge focus on corporate earnings. A Fed cut helps sentiment, but company results still drive stock moves. Short-term traders will watch Powell’s language closely. Longer-term investors should stick to plans and avoid reacting to noise.

What to Watch Next?

Watch Powell’s press conference for guidance on rates and the dot plot. Check the latest CPI and jobs releases for signs of persistent inflation or cooling. Monitor retail sales and major company earnings this week for demand clues. Keep an eye on oil and geopolitical news that can move energy stocks.

Also watch bond yields and the dollar. They will show how traders price future policy. A quick jump in yields could hurt high-growth shares. A stronger dollar can pressure multinational earnings.

Wrap Up

Markets sit in wait. One clear signal from the Fed will reshape near-term flows. Traders will trade on tone, not just the headline. Stay alert to key economic prints and earnings. Plan for a fast move in either direction. The Fed’s words will matter more than expected.

Frequently Asked Questions (FAQs)

As of Monday, September 15, 2025, U.S. stock futures are flat. Investors are awaiting the Federal Reserve’s upcoming decision on interest rates later this week.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.