Urban Company IPO Allotment Today: How to Check on NSE, MUFG

Urban Company, one of India’s fastest-growing home service platforms, has just completed its IPO. The allotment day is here, and many of us are waiting to see if we got lucky. IPO allotment is the moment when investors find out whether shares are credited to their Demat account or not. It is simple to check, but many people still feel confused about the process. That is why knowing the right steps matters.

Let’s discuss Urban Company IPO allotment. We will see how to check the status on NSE and MUFG, and also explore other easy methods. Along with that, we will talk about what happens if we get the allotment, and what to do if we don’t.

About Urban Company IPO

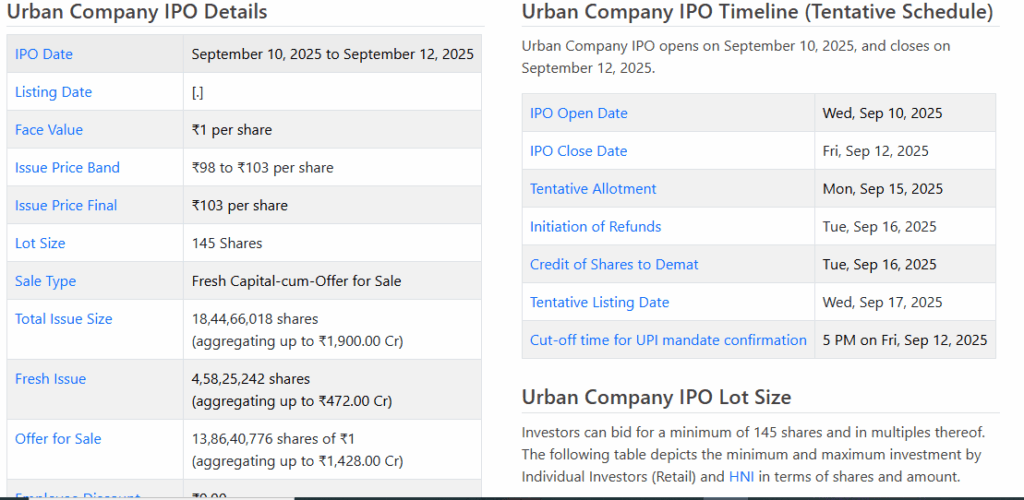

Urban Company is a leading home services platform in India. The IPO size was about ₹1,900 crore. The price band ranged from ₹98 to ₹103 a share. Anchor investors bought a part of the issue before the public offer. Retail and institutional demand surged. The issue attracted massive subscriptions across categories, making it one of the most-awaited listings of 2025.

IPO Allotment Date & Timeline

The basis of allotment was finalised on September 15, 2025. Successful applicants saw shares credited soon after allotment. Refunds for unsuccessful or partial allotments were processed next. The stock was scheduled to list on the NSE and BSE on September 17, 2025. Check the registrar and exchange portals on these dates for final status.

How to Check Urban Company IPO Allotment on NSE?

Open the NSE IPO allotment page. Choose “Equity” as the issue type. From the company list, select Urban Company. Enter the PAN or IPO application number. Hit submit to view the allotment status and number of shares allotted. The page also shows the basis of allotment and the allottee’s details. If the site is slow, retry after a few minutes. The NSE system is the official exchange record for allotments.

How to Check Urban Company IPO Allotment on MUFG (Registrar)

MUFG Intime India handled the allotment for this issue. Visit MUFG’s public issue allotment page. Choose Urban Company from the dropdown. Enter either PAN or the application number to fetch the result. The registrar page displays allotment and credit details. The registrar often updates slightly earlier than brokers. Keep PAN and client details handy for a quick check.

Alternative Ways to Check IPO Allotment

Broker platforms show allotment status in the IPO section of the app. Popular brokers send SMS or email once shares are credited. Demat account statements from NSDL or CDSL reflect final share credits. The BSE allotment page is another official route. If banks blocked UPI mandates, the broker or bank message will mention the refund timeline. Use any one of these methods to confirm allotment quickly.

What Happens If Shares Are Allotted or Not Allotted?

When allotment occurs, shares are credited to the Demat account. The holding shows under holdings or positions in the broker app. The credited shares can be sold on listing day, subject to market hours. Tax rules apply for short-term gains if shares are sold within a short window. The investor receives an allotment intimation and a trade confirmation from the broker and registrar.

If allotment fails, the blocked funds are refunded. Refunds usually appear in the bank account or UPI mandate within a short timeline set by the registrar and bank. For UPI mandates, the block is released. The investor can still buy shares on listing day in the secondary market. Refund timelines vary by bank but are normally completed before listing. Keep the bank transaction reference for any follow-up.

Expected Listing & Market Sentiment

Grey Market Premium (GMP) rose sharply ahead of the listing. GMP indicated potential listing gains of roughly 50-70% over the issue price. Analysts pointed to strong retail demand and the company’s recent profitability as drivers of positive sentiment. Some broker notes flagged a high valuation on price-to-earnings and price-to-sales measures, suggesting caution for long-term investors. Short-term listing pops were widely expected due to heavy retail subscription and positive GMP readings.

Quick Tips for Investors on Allotment Day

Double-check PAN and application number before querying allotment pages. Use the registrar portal for direct confirmation. Keep the broker app open for instant alerts. Review tax impacts before selling on listing day. Consider long-term fundamentals before booking quick gains. If allotment appears delayed, check exchange and registrar notices for updates.

Bottom Line

Allotment day is the key moment after subscription. Use registrar and exchange portals for accurate status. Broker alerts and Demat statements confirm final credit and refunds. Monitor GMP and analyst notes to form an exit or hold plan. Careful checks on allotment day make the listing experience smoother and less stressful.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.