Canara Bank in Spotlight as Sebi Clears Life Insurance IPO

Canara Bank is once again in the spotlight, and this time it is for its life insurance venture. The Securities and Exchange Board of India (SEBI) has given the green light for the bank’s life insurance company to go public. This is a big step for both the bank and investors. An IPO, or Initial Public Offering, allows ordinary people to buy shares and become part-owners of the company.

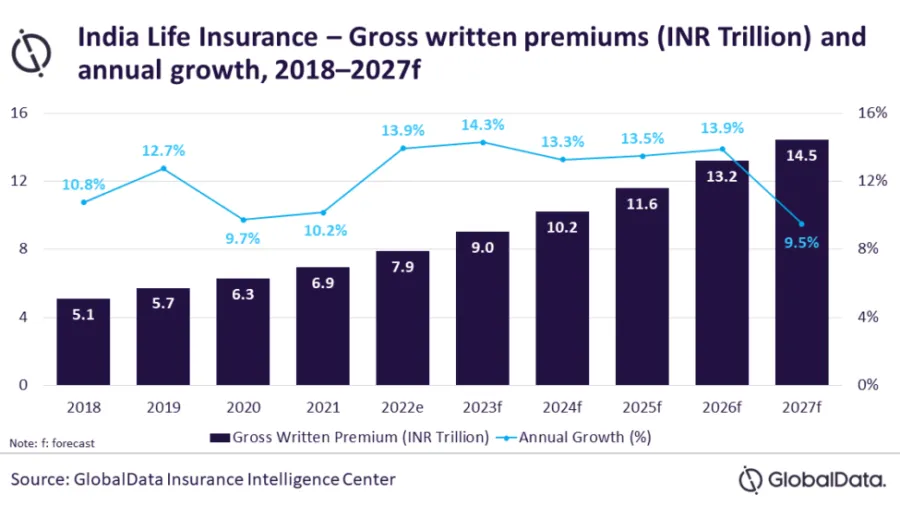

We know that Canara Bank has been a trusted name in Indian banking for decades. Now, with the insurance IPO, it is aiming to strengthen its presence in the financial sector. Life insurance is becoming more important in India as more people plan for financial security.

This move also shows the growing trend of public sector banks expanding beyond traditional banking. Let’s explore what the SEBI approval means, how the IPO will work, and why it matters for investors and the market.

Background of Canara HSBC Life Insurance Company

Canara HSBC Life Insurance Company was established in 2007 as a joint venture between Canara Bank, HSBC Insurance (Asia-Pacific) Holdings, and Punjab National Bank (PNB). The company offers a wide range of life insurance products, including individual and group policies, retirement solutions, and policies under the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). As of March 31, 2024, Canara HSBC Life Insurance held the third-highest assets under management (AUM) among public sector-promoted life insurers in India.

The company has demonstrated significant growth in recent years. Its persistence ratio, a key indicator of customer retention, improved from 74.51% in FY22 to 83.45% in the nine months ending December 31, 2024. Additionally, its Net Promoter Score (NPS), a measure of customer satisfaction, increased from 41 in FY22 to 69 by December 31, 2024.

SEBI Clearance and Its Significance

On September 15, 2025, Canara HSBC Life Insurance got approval from SEBI to go ahead with its IPO. This means the company can now file its Updated Draft Red Herring Prospectus (UDRHP). It is a big step toward becoming a listed company.

SEBI’s approval is very important. It shows the company meets all the rules and regulations. Investors will get clear and reliable information about the company. This approval is likely to boost investor confidence. Many investors may take an interest in the upcoming IPO.

IPO Details and Expectations

The Canara HSBC Life Insurance IPO will be an offer for sale (OFS) of up to 23.75 crore equity shares, with no fresh issue component. The selling shareholders include Canara Bank, HSBC Insurance (Asia-Pacific) Holdings, and PNB. Specifically, Canara Bank plans to sell 13.77 crore shares, HSBC Insurance (Asia-Pacific) Holdings intends to divest 47 lakh shares, and PNB will offer 9.5 crore shares.

The face value of each equity share is ₹10. The price band and lot size details have not yet been announced. The IPO is expected to open for subscription in the second week of November 2025, with the listing anticipated on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) shortly thereafter.

The primary objectives of the IPO are to provide liquidity to the selling shareholders, enhance the company’s visibility and brand image, and facilitate a public market for its equity shares in India.

Impact on Canara Bank and Investors

The IPO will have a big impact on Canara Bank. By selling part of its stake in Canara HSBC Life Insurance, the bank can raise funds. These funds can be used for new projects and growth. The listing of the insurance company may also increase the bank’s value. It can strengthen the bank’s position in the financial sector.

For investors, the IPO is a chance to own shares in a growing life insurance company. The company has a strong track record and steady growth. Its improved persistence ratios and customer satisfaction scores show a solid business. However, investors should be careful. The insurance sector faces risks like new rules and strong competition. It is important to weigh these factors before investing.

Challenges and Risks

While the IPO offers promising opportunities, there are several challenges and risks to consider. The life insurance industry in India is highly competitive, with numerous private and public sector players vying for market share. This competition could impact Canara HSBC Life Insurance’s growth and profitability.

Additionally, the company faces regulatory risks, as changes in insurance laws and policies could affect its operations and financial performance. Economic factors, such as interest rate fluctuations and inflation, may also influence the company’s business dynamics. Investors should conduct thorough due diligence and assess their risk tolerance before investing in the IPO.

Final Words

SEBI’s approval of Canara HSBC Life Insurance’s IPO is a big step for India’s financial sector. The IPO gives investors a chance to buy shares in a growing life insurance company. The company is backed by strong and trusted financial institutions.

As more details about the IPO come out, investors should stay updated. They need to look at the company’s growth, financial health, and risks before investing. The listing of Canara HSBC Life Insurance will be an important event in India’s stock market. It also shows how banking and insurance are coming closer together in the country.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.