NCC and MIDHANI Stocks Rally on Large Order Wins

We have observed significant developments in the Indian stock market lately. Two companies, NCC (Nagarjuna Construction Company) and Midhani (Mishra Dhatu Nigam Limited), have recently grabbed large contracts. These wins have boosted investor confidence, driven share-price rallies, and improved outlooks for both firms.

- NCC bagged a ₹2,090.5 crore contract from the Bihar Water Resources Department for the Barner Reservoir Scheme in Jamui district.

- MIDHANI, the defence-PSU specialising in superalloys, titanium alloys, special steels, and other strategic metals, won a ₹136 crore contract. This increased its total open order book to approximately ₹1,983 crore.

These order wins have put both companies under fresh investor focus, and their stocks have reacted accordingly.

Why These Orders Matter

For NCC

- The project is large and valuable; ₹2,090.5 crore is a major order that adds significantly to NCC’s order book.

- It involves the construction of critical infrastructure: reservoirs, dams, irrigation channels, etc., which tend to be long-term projects and often see steady cash flows over time.

- The timeline is clear: 30 months of construction followed by a 60-month defect liability period. This gives visibility into project execution, maintenance, and responsibilities.

For MIDHANI

- The ₹136 crore order may be smaller in comparison to NCC’s, but it’s strategically important in MIDHANI’s core sectors: defence, aerospace, and high-performance metals.

- Mid-term order backlog is strong (≈ ₹1,983 crore), giving revenue visibility.

- Profit growth has been impressive: MIDHANI’s profit after tax for Q1 FY26 jumped by 145% year-on-year. Margins and profits improved, and finance costs decreased.

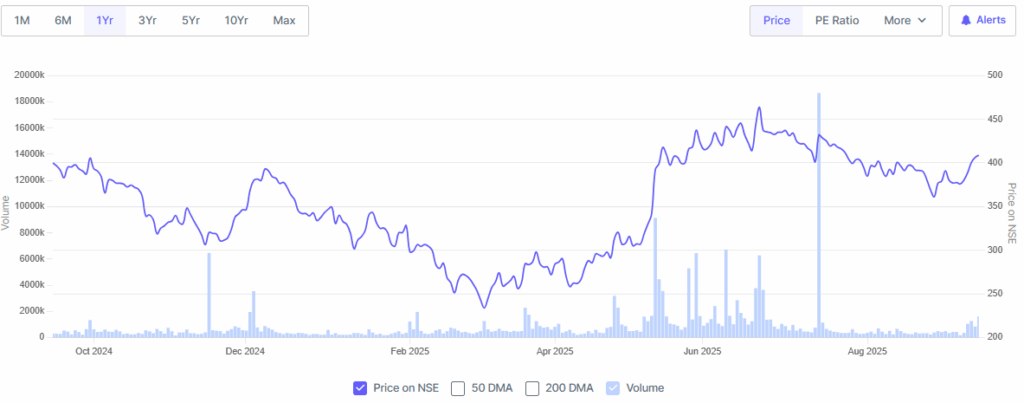

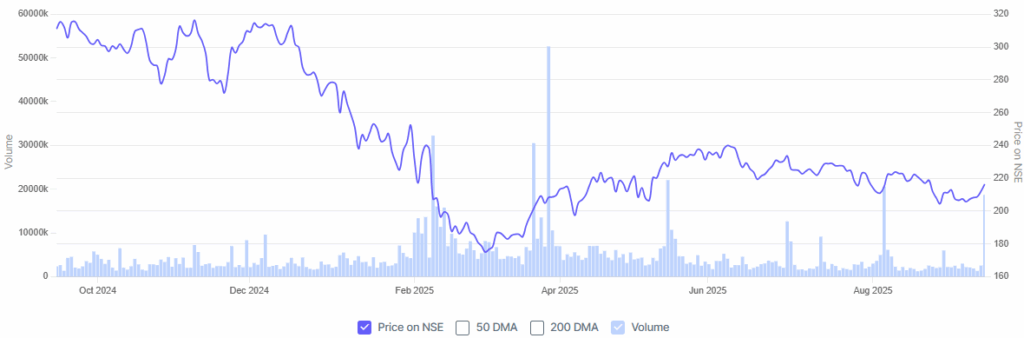

Stock Market Reaction

Both stocks saw strong gains after these announcements:

- NCC shares surged about 5% after winning the reservoir contract in Bihar.

- MIDHANI shares rose over 3% on the day of the ₹136 crore order win.

These are typical investor responses: large orders usually mean future revenues, improved margins, and better utilisation of capacity.

Dry-Statement Financial Highlights

Here are some key financial and operational metrics that put the current order wins into context:

| Company | Recent Orders / Backlog | Profit / Growth Signals |

| NCC | Q1 FY26 performance showed revenue decline year-on-year, but the large orders helped improve future revenue visibility. | Q1 FY26 performance showed revenue decline year-on-year, but the large orders help improve future revenue visibility. |

| MIDHANI | Backlog ≈ ₹1,983 crore; multiple inflows already in FY26; pipeline strong in defence, space, railways, energy. | Profit after tax up sharply; margins improving; finance expenses down; revenue growth modest but steady. |

Implications & Outlook

We believe the order wins for NCC and MIDHANI could have several further effects:

Enhanced Revenue Predictability

These large, multi-year contracts improve the predictability of cash flow for both companies. Investors often reward companies with predictable revenue streams.

Improved Margins Over Time

With large-scale projects, especially in core businesses, there’s an opportunity for efficiencies, better resource utilisation, and perhaps better negotiating power with suppliers. MIDHANI’s recent margin improvements hint at this.

Strategic Positioning in Key Sectors

NCC’s role in large water infrastructure places it at the heart of government-favoured sectors. For MIDHANI, being a supplier to defence, aerospace, and strategic material exports gives it a strong tailwind in national policy. The HAL ₹600 crore order for superalloys is an example.

Risk Factors to Monitor

- Execution challenges (project delays, cost overruns) are especially prevalent for large infrastructure contracts.

- Margin pressure if raw material costs rise. MIDHANI is sensitive to alloy raw material prices.

- Regulatory and environmental approvals for infrastructure projects like dams.

- Competition and tendering risk: new entrants, delays, or cancellation of orders.

How These Stocks Compare with AI Stocks / Tech Sector Momentum

Though NCC and MIDHANI are infrastructure/ defence/ material firms, not technology or traditional AI stocks, there is a growing overlap:

- Some infrastructure/defence projects include high-tech materials, advanced alloys, and precision manufacturing (MIDHANI).

- Digital tools (monitoring, design, engineering) and AI/automation are increasingly part of project management, supply chain oversight, predictive maintenance, etc.

- Investor interest in stock research often compares growth potential: AI stocks tend to get premium valuations. NCC and MIDHANI may lag in valuation multiples, but strong order books make their risk-return profile attractive for those seeking more stability.

Conclusion

We assess that NCC and MIDHANI have successfully turned recent large order wins into positive catalysts for their stocks. NCC naturally appears when discussing the reservoir scheme in Bihar and its implications on infrastructure, while MIDHANI’s rise is closely tied to its defence materials specialization. Both companies are positioned to benefit from national investment in infrastructure, defence, and strategic self-reliance.

For investors, NCC may offer upside if it delivers the large reservoir project on time and within budget, and if its order pipeline continues to build. MIDHANI is particularly interesting for those who believe in India’s push for indigenous defence manufacturing and high-performance metals. From a stock market and stock research perspective, both stocks merit closer scrutiny.

FAQs

A large order usually improves investor sentiment by signalling future revenue, boosting visibility. This often causes a stock price rally, as we saw for NCC (≈5%) and MIDHANI (>3%) on the day their contracts were announced. But short-term moves can also be volatile.

Order backlog is the total value of contracts a company has agreed to but has not yet completed. It gives insight into future work and revenue. For MIDHANI, a backlog of around ₹1,983 crore suggests strong near-term work, helping forecast growth and cash flow.

Yes. Even with large contracts, companies must manage risk: raw material cost inflation, labour or regulatory delays, and execution inefficiencies can squeeze margins. For infrastructure & defence firms, managing these risks is key to realizing the contract’s full benefit.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.