Multibagger Stock Jumps 16% on Anticipation of iPhone 17 Sales

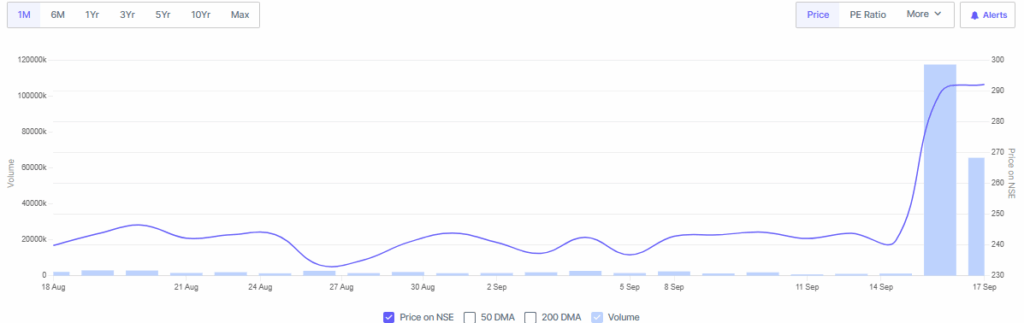

The market loves big stories, and this week we saw one. A well-known multibagger stock jumped 16% in a single trading session. The reason? Growing excitement around Apple’s upcoming iPhone 17 launch. Investors are betting that strong global demand for the new device will benefit Apple’s key suppliers.

We know how powerful iPhone launches can be. Every new model creates a ripple across the supply chain. From chipmakers to component providers, many companies see sales and profits rise when Apple unveils its latest product. This is why the market is linking the iPhone 17 story with the rally in this stock.

The stock in focus is not new to headlines. It has already rewarded patient investors with strong returns in the past. Now, the latest surge has put it back in the spotlight. We believe this rally is more than just short-term hype. It reflects real expectations of higher orders, stronger earnings, and a bigger role in Apple’s ecosystem.

As we explore further, we will see why this stock earned the multibagger tag, how the iPhone 17 adds fuel to the story, and what investors need to watch next.

Background of the Company

Redington Ltd is a leading Indian company that distributes IT and mobile products. This includes smartphones, parts, and business solutions. The company started in 1993 and now works in many markets, especially in India, the Middle East, and Africa. Redington helps global tech brands enter and grow in these regions.

In India, Redington has been a major distributor of Apple products since 2007. Its wide network and strong ties with retailers make it an important part of Apple’s supply chain in the country. This partnership allows Redington to benefit from growing smartphone demand. It has also helped the company maintain steady financial growth.

Over time, Redington has expanded into business solutions and services. It now supports companies with their digital needs. The company’s focus on customers and ability to adapt have helped it stay competitive in the fast-changing tech market.

iPhone 17 Launch Expectations

Excitement is building around the iPhone 17 launch. Both buyers and investors are eager to see what Apple will offer. While exact details are not yet revealed, past iPhones usually come with better performance, improved cameras, and new features.

Apple has a strong history of making high-quality products. This has created a loyal group of customers. Pre-orders and early sales are often high because of this loyalty. The iPhone 17 is expected to follow the same trend. It could attract many buyers and boost sales for Apple and its partners.

Why the Stock is Rallying?

Redington’s stock has risen sharply. The jump is linked to excitement about the iPhone 17 launch. As a main distributor of Apple products in India, Redington can gain directly from higher sales.

The company has a strong network and good ties with retailers. This helps it take full advantage of the expected rise in iPhone demand. Investors see this potential and are buying the stock. Confidence in Redington is growing because of these opportunities.

Financial Performance Snapshot

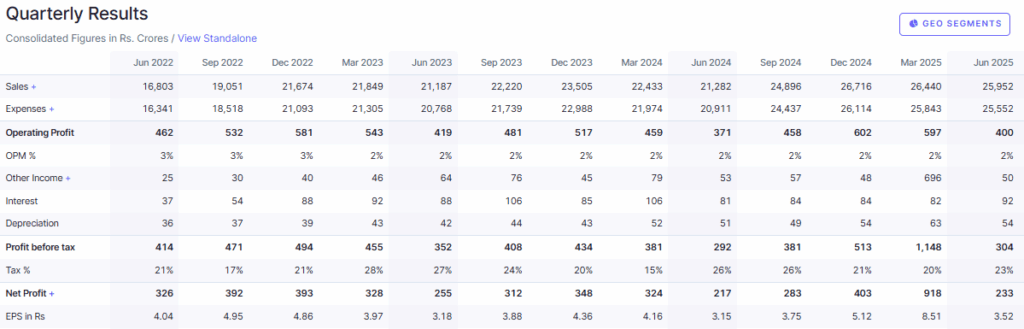

Redington’s financial performance has been strong and steady. Its growth comes from a mix of products and smart partnerships. Revenue from IT and mobile products, along with expanding business solutions, has helped the company keep moving upward.

Exact numbers for this year are not yet available. However, Redington has a history of making profits and managing money well. This gives investors confidence that the company can handle market changes and keep creating value for its shareholders.

Multibagger Stock: Analyst & Market Reactions

Market analysts are positive about Redington’s future. They point to the company’s strong position and close ties with Apple as reasons for growth. The expected rise in iPhone sales could boost Redington’s revenue and profits.

Investors are showing confidence, too. Trading volumes are higher, and the stock is performing well. Redington’s ability to follow market trends and use new opportunities makes it likely to keep growing.

Broader Sector Impact, Risks & Challenges

The iPhone 17 launch affects more than just Redington. Other companies in Apple’s supply chain, like component makers and logistics providers, may see higher demand.

This boost can create positive sentiment across the tech sector. Stocks of related companies could also rise. Investors might take advantage of this trend by including these stocks in their portfolios.

Even with strong prospects, Redington faces some risks. The company depends heavily on Apple, so any changes in Apple’s plans or supply chain issues could hurt it.

The tech distribution market is very competitive. New companies and changing conditions can challenge established players like Redington. Economic factors, such as currency changes and new rules, could also affect how the company runs its business and makes profits.

Investment Outlook & Final Thoughts

Investors should weigh Redington’s strengths against its risks. The company has a strong market position and good growth potential. The iPhone 17 launch could bring short-term gains, but long-term investors need to see if Redington can keep growing and handle industry challenges.

Spreading investments across different stocks can reduce risks. Staying updated on market trends and company news is important to make smart decisions.

Redington Ltd works closely with Apple and is a main distributor of iPhones. This puts the company in a good position to benefit from the iPhone 17 launch. Its strong financial performance and positive market outlook show potential for continued growth.

However, investors should be aware of risks in the tech distribution sector. A careful approach, weighing both opportunities and challenges, is important to make smart investment decisions in this fast-changing market.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.