Fed Meeting Today: Markets Brace for Key Rate Decision

The Federal Reserve’s meeting today has the attention of every investor, policymaker, and business owner. Interest rates are not just numbers. They shape how we borrow, spend, and invest. When the Fed speaks, markets listen.

We enter this meeting at a time of mixed signals in the economy. Inflation has cooled from its peak but is still above the Fed’s comfort zone. The job market looks strong, yet signs of slowing growth are emerging in sectors like housing and manufacturing. Consumers are still spending, but credit costs are rising. These contradictions make today’s decision more important.

Markets are not only waiting for the rate outcome. They are waiting for the tone, the guidance, and the Fed’s vision for the months ahead. A pause, a hike, or even hints of future cuts will send strong signals across stocks, bonds, currencies, and commodities.

We know one thing for sure: whatever the Fed decides today will ripple far beyond Washington. It will touch our wallets, our investments, and the global economy in ways we cannot ignore.

Background: Role of the Federal Reserve

The Federal Reserve has two main goals: stable prices and full employment. The Fed sets short-term interest rates to meet those goals. Higher rates slow demand. Lower rates support growth. The Fed also uses tools like asset purchases and guidance to shape expectations. Markets watch Fed moves closely because policy shifts change borrowing costs for households and firms. The Fed chair’s words can move markets as much as the rate decision itself.

Current Economic Climate

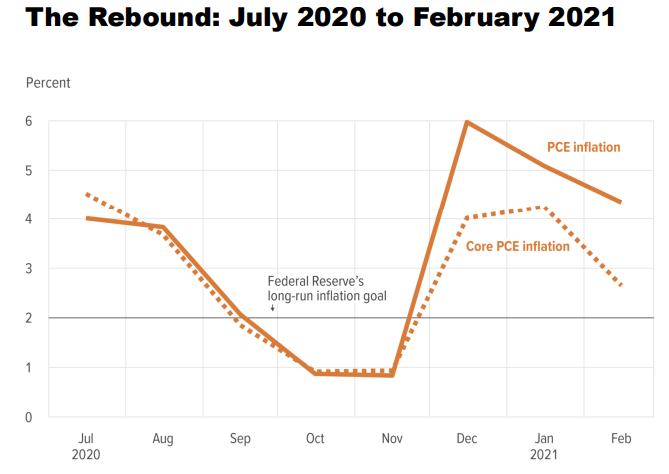

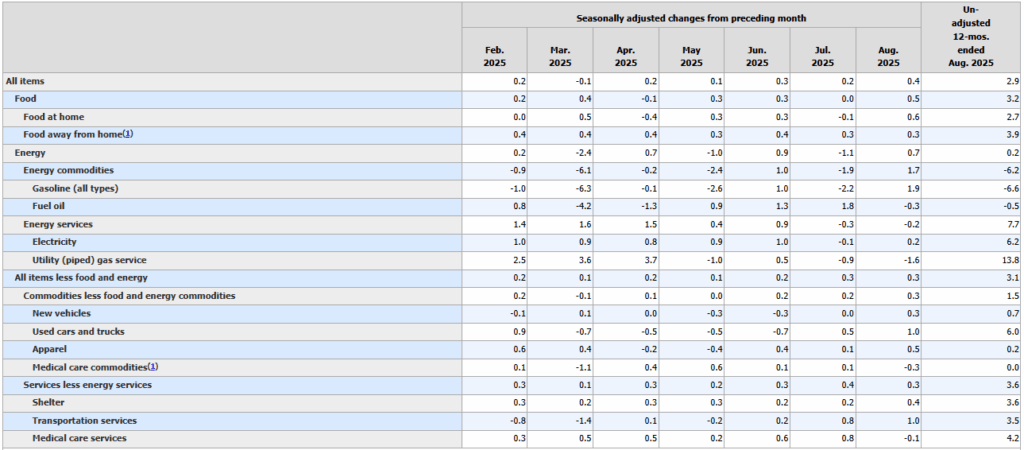

Inflation has eased from its recent peaks but remains above levels seen before 2021. The Consumer Price Index rose 0.4% in August 2025 and is up 2.9% over the last year. That rise shows cooling, yet persistent pressure in some services and food categories. Job growth has slowed sharply. Payroll gains were small in August, and the unemployment rate ticked up to about 4.3%. The mix of soft jobs and modestly higher inflation creates a tricky trade-off for policymakers. Import prices also climbed in August, adding to inflation risks outside core domestic demand.

Market Expectations Ahead of the Meeting

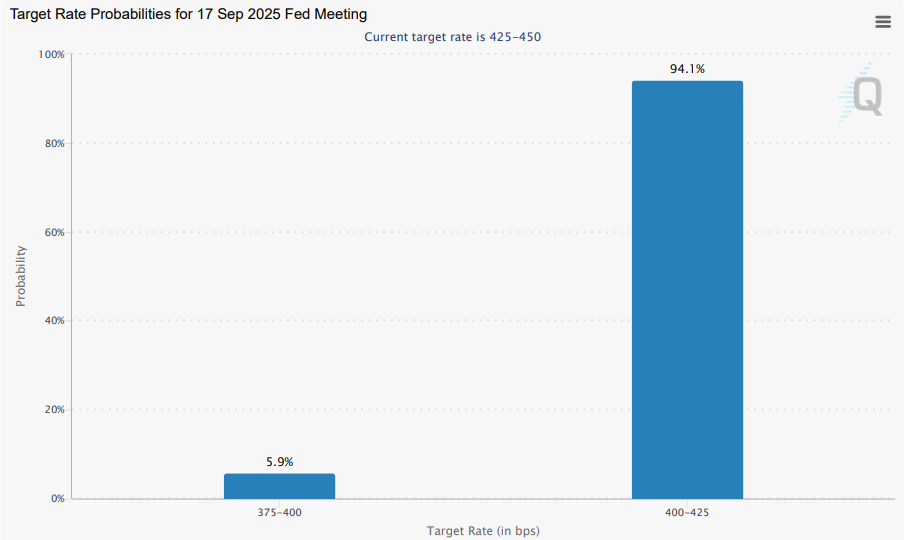

Futures markets price a high chance of an interest-rate cut at this meeting. The CME FedWatch tool shows near-certain odds for at least a 25 basis-point cut. Traders expect the Fed to shift its stance from restrictive to more neutral. Equity markets have priced in modest gains if the Fed signals easing.

Bond yields have already moved lower in expectation of looser policy. Currency markets show a softer dollar in many crosses ahead of the announcement. Still, any hint of divided Fed views or tighter future guidance could trigger quick reversals.

Possible Scenarios and Outcomes

One outcome is a 25 basis-point cut. This would signal that the Fed judges inflation is under control enough to ease. Another outcome is a hold. A hold would suggest the Fed needs more time to verify inflation trends. A third outcome is a cut with cautious language about future moves. That would be dovish but guarded.

The most market-moving element will be the press conference tone. Any sign of internal disagreement or a succession debate at the Fed could amplify market volatility. Reuters and live coverage note that investors are watching both the decision and the Fed chair’s comments closely.

Impact on Financial Markets

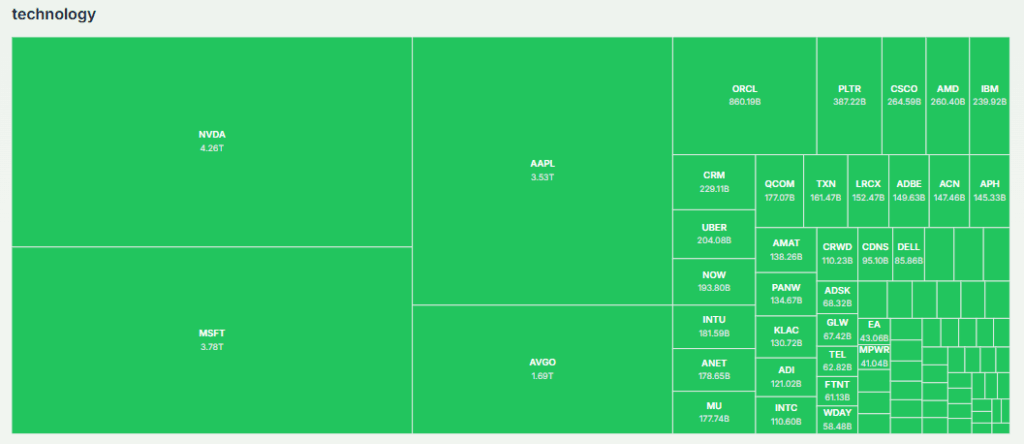

A rate cut usually lifts growth-sensitive stocks. Technology and consumer discretionary shares often benefit. Financial stocks can react in mixed ways. Banks may see net interest margins compress if cuts accelerate. Bond yields generally fall when cuts are expected. That pushes up prices for existing bonds.

The dollar tends to weaken when U.S. rates fall relative to other economies. Commodities respond differently: gold often rises on lower yields and higher inflation risk, while oil reacts to growth expectations and supply factors. Traders will watch the yield curve for signs that markets expect weaker growth ahead.

Broader Economic Implications

Lower policy rates reduce borrowing costs for households. Mortgage and auto loan rates could ease over time. Businesses may find cheaper credit for investment and hiring. For emerging markets, a softer dollar can reduce debt-service stress for dollar-denominated borrowing. But a policy pivot also risks encouraging higher spending that could re-ignite inflation. The Fed must balance support for growth against the duty to keep inflation stable.

Fed Meeting Today: Historical Context

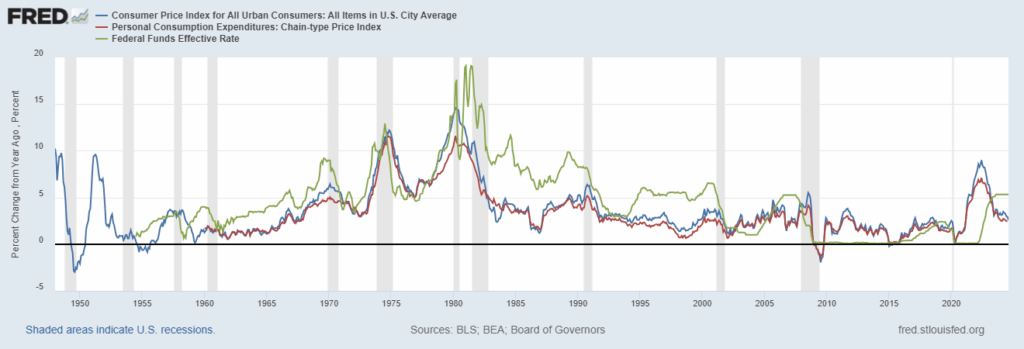

Past Fed cycles show that timing matters. Cuts that arrive after inflation is clearly falling tend to support steady recoveries. Cuts made too early can force the Fed to reverse course, which hurts credibility. The late-1970s and early-1980s experience illustrates how delayed action can require sharper tightening later. More recently, the post-2008 era highlighted how forward guidance and asset purchases became key when short-term rates hit the lower bound.

Investor Strategies Moving Forward

Investors should avoid impulsive moves based solely on one decision. Diversification helps in uncertain policy regimes. Defensive sectors such as consumer staples and utilities can reduce volatility in portfolios. Short-duration bonds limit exposure to rising yields after unexpected hawkish signals. For longer-term goals, focus on fundamentals and valuation rather than short-term rate speculation. Hedging currency exposure can matter for international allocations if the dollar swings sharply.

Fed Meeting Today: Wrap Up

Today’s Fed decision is about more than one rate move. It is about the path the Fed sets for the next year. The outcome will ripple across stocks, bonds, currencies, and everyday loans. Investors and households should watch both the decision and the Fed chair’s tone. Those two things together will shape market direction in the coming months.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.