Spirit Airlines to Cut Jobs, Slash Flight Capacity by 25%

Spirit Airlines has announced a major cut. The company will reduce flight capacity by 25% and trim jobs to match. This is a big shift for one of the most recognized low-cost carriers in the U.S. For years, Spirit grew by offering cheap fares and reaching budget travelers. But today, the airline faces rising costs, heavy debt, and growing competition.

We see the airline industry struggling with higher fuel prices and softer demand on some routes. Larger airlines are also capturing more market share, leaving carriers like Spirit under pressure. For travelers, this means fewer flight options and possible fare hikes. For employees, it means real uncertainty about jobs and future security.

This decision does not stand alone. It reflects the wider turbulence in the airline sector. We need to ask: Can Spirit bounce back, or is this the start of deeper trouble? The answer will matter to workers, passengers, and investors alike.

Background on Spirit Airlines

Spirit is an ultra-low-cost carrier. It grew by selling very cheap seats. The airline flies across the U.S., the Caribbean, and parts of Latin America. After a rapid expansion, Spirit ran into higher costs and thinner margins. It was already reorganized earlier in 2025 and then faced fresh trouble this year. Recent filings and memos show leadership has returned to aggressive cost cuts.

Details of the Job Cuts and Capacity Reduction

Spirit’s CEO told staff the airline will cut flight capacity by about 25% in its November 2025 schedule. The memo also warned of job reductions, though a final headcount was not published. The carrier said it will focus on flying in its strongest markets. Fleet size and specific routes are under review. Union talks are planned. Regulators have not been reported as blocking the moves.

Why is Spirit taking this Step?

Multiple pressures forced the change. Fuel and operating costs are higher than earlier forecasts. Passenger demand has weakened on some leisure and short-haul routes. Spirit also carries heavy debt after prior restructuring. Management says a smaller network will cut fixed costs and improve cash flow. Analysts view the cuts as emergency measures to avoid deeper financial distress.

Impact on Employees

The announcement creates immediate uncertainty for staff. Pilots, flight attendants, and ground crews may face furloughs or layoffs. The airline signaled talks with unions, which suggests some roles could be protected or adjusted by agreement. Severance details and timing remain unclear. In past restructurings at other carriers, job reductions often led to voluntary leaves, retirements, and targeted cuts.

Impact on Passengers and Routes

Passengers will likely see fewer flights on smaller or marginal routes. Low fares could become rarer on some city pairs due to lower seat supply. Booking options may shrink, especially for travelers who rely on Spirit’s very low base fares. Customers should watch airline notifications closely, since schedule changes and cancellations can cause chain reactions across connections.

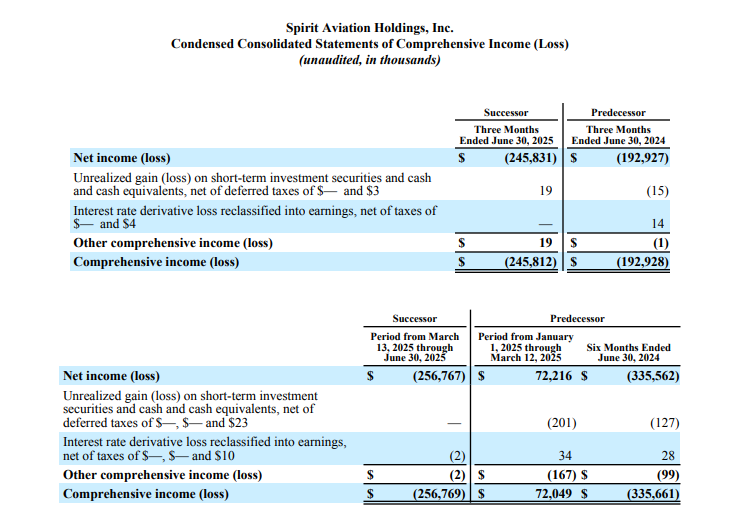

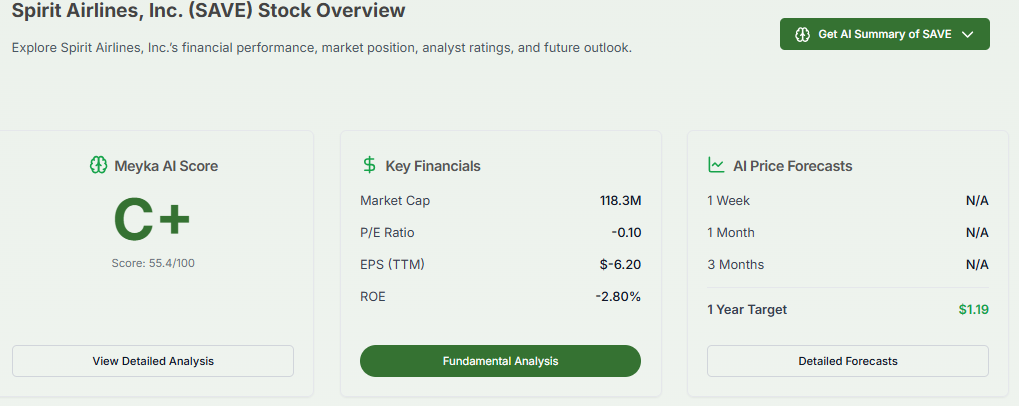

Financial and Investor Implications

Cutting capacity usually lowers short-term costs. But it also cuts revenue. Investors will watch whether the savings outweigh the loss of sales. Spirit has reported steep losses this year and exhausted credit lines at times. The restructuring aims to extend the runway and reduce debt. Market reaction has been volatile, with traders pricing in higher risk for the stock. Creditors and lessors will be key stakeholders in the next steps.

Industry Context: Why does this matter beyond spirit?

The airline sector is moving away from a pure low-fare race. Large carriers are adding premium options and stealing share on profitable routes. Fuel volatility, labor costs, and post-pandemic demand shifts have made ultra-low-cost models harder to sustain. Other budget carriers have also pared schedules or pushed for higher ancillary revenue to stay viable. The Spirit move reflects wider pressure on low-margin operators.

Operational Risks and Shortfalls

The shrinking fleet and schedule pose operational risks. Fewer spare aircraft mean disruptions can cascade. Ground and maintenance teams will face re-timed workflows. There is also reputational risk if frequent cancellations or crowding rise. Regulators and airport partners may need to reallocate slots and gates. These logistics can blunt the expected savings if not handled carefully.

Possible Scenarios Ahead

One scenario is survival: tighter routes, lower staff costs, and some asset sales stabilize cash flow. Another is deeper restructuring, including more fleet exits or asset sales. A third is consolidation: larger carriers could selectively buy assets or routes if court approvals and finances align. Timing will depend on negotiations with creditors, leaseholders, and unions.

What stakeholders should watch next?

Watch official filings and court documents for concrete numbers. Look for union statements and any announced severance packages. Track route maps for cities being cut. Follow the lessor and creditor updates to learn whether Spirit can secure short-term liquidity. Finally, monitor competitor moves; other airlines may add capacity where Spirit retreats.

Wrap Up

Spirit’s 25% capacity cut and warning of job losses mark a tough chapter for the carrier. The shift may protect cash in the near term. But it also shrinks the choice for budget travelers and raises the risk of more savings being needed. The coming weeks will reveal whether these changes stabilize the business or signal deeper restructuring ahead.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.