iValue Infosolutions IPO GMP Signals Flat Listing; Subscription at 94%

The IPO market in India has been buzzing in September 2025, but not every issue is making big headlines. One such case is iValue Infosolutions IPO, which opened for subscription on September 19, 2025, and closed on September 21, 2025. The company is a technology distributor with a focus on cybersecurity, cloud, and digital solutions. Yet, the response from investors was far from overwhelming. The issue was subscribed to 94% in total, showing lukewarm demand compared to other recent IPOs.

At the same time, the grey market premium (GMP) has stayed flat. This is a signal that we might see little to no listing gains when the stock debuts. Investors often look at GMP as an early indicator of market mood, and in this case, it reflects caution. Still, the company operates in a growing sector, with rising demand for IT and digital solutions in India. That makes it worth a closer look beyond just listing day.

Company Overview

iValue Infosolutions Ltd was incorporated in 2008. It works as a value-added distributor (VAD) and enterprise technology aggregator. The Company helps companies with cybersecurity, cloud adoption, data centres, and application lifecycle management (ALM). It has tie-ups with over 100 leading original equipment manufacturers (OEMs). This also serves thousands of clients via its system integrator (SI) network. It has offices in eight cities in India. It also works internationally (Singapore, Bangladesh, Sri Lanka, UAE, Cambodia, Kenya).

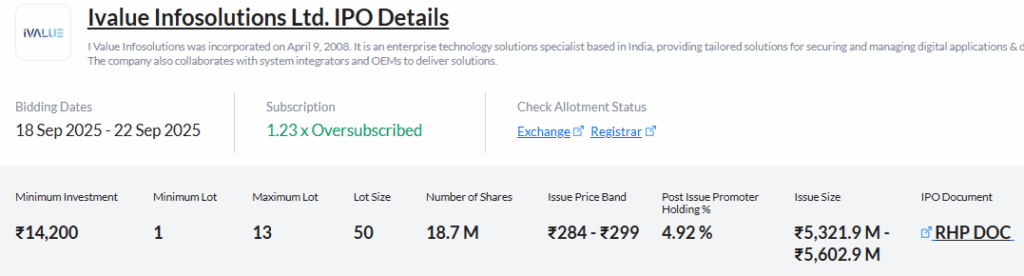

IPO Details

The IPO opened on 18 September 2025 and will close on 22 September 2025. The issue size is about ₹560.29 crore, and it is entirely an Offer for Sale (no fresh equity issue). The price band is set between ₹284 and ₹299 per share. The lot size is 50 shares. The stock will list on both the BSE and NSE. Allotment is expected on 23 September 2025. Listing date is likely 25 September 2025.

Subscription Status

On Day 1 of subscription (18 September), the IPO got about 8% subscription. On Day 2, by 19 September, it reached around 89% of the issue being subscribed. Subscription crossed 1.0×, with retail 1.03× and QIBs 1.22× on day 3 (final day). NIIs (non-institutional investors) remained weak, below full subscription. So the IPO was fully subscribed by the final day.

Grey Market Premium (GMP) Trends

Initial GMP was about 7% on Day 1. It fell to about 5% on Day 2. By Day 3, GMP dropped further to ≈ ₹3 above the upper price band, which equals about 1% premium. This drop shows investor excitement has cooled. Flat or low GMP may hint that listing gains would be small.

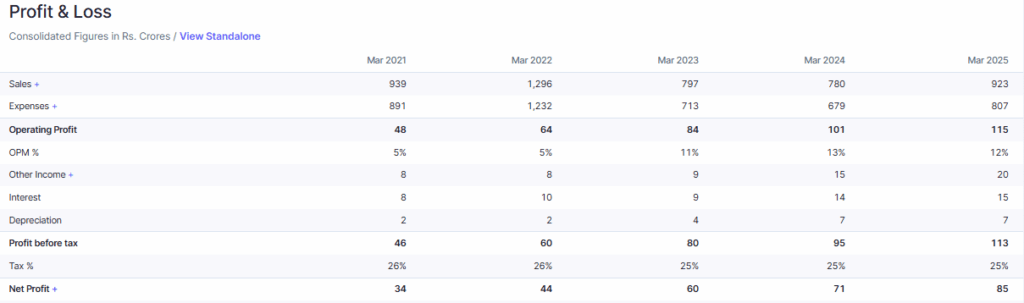

Financial Performance Snapshot

In FY25, revenue from operations was ₹922 crore, growing from ~₹780 crore in FY24. Most of the revenue came from hardware (~₹744 crore), followed by software and support. Services are a smaller part but growing. The company’s growth is steady. Profitability metrics also seem reasonable at the upper price band (P/E ~18.7-19× on FY25 earnings).

Strengths of iValue Infosolutions

A strong OEM and SI network is a big plus. With nearly 804 system integrators in FY25, the company benefits from repeated business. Product portfolio spans high-demand sectors. Cybersecurity, cloud, and compliance are in growth mode in India. Operating presence in international markets gives it some diversification. The issue is backed by Creador (a private equity firm), which adds credibility.

Risks and Concerns

The biggest risk is dependency on top OEMs. About 63% of gross sales came from its top 10 OEMs in FY25. Any disruption there hurts business. The OFS structure means no fresh capital comes in for the company. That means limited ability to raise new funds for expansion via this offer.

NIIs are weak so far. Low interest from non-institutional investors could indicate less retail confidence. GMP has already dropped, signaling that listing upside may be limited. The market is volatile, and the tech sector is sensitive to global headwinds.

Expert Opinions & Listing Day Expectations

Analysts say the valuation at the upper price band (₹299) and P/E ~18.7× is justifiable because of strong growth potential. Some brokers recommend “subscribe” at this price for medium-term investors. But many caution that short-term gains may be small due to flat or low GMP. Investor mood seems cautious.

On 25 September 2025, shares will begin trading on BSE and NSE. Given that the GMP is about ₹3 above the issue price, listing may see around 1% gain if demand stays stable. But if market sentiment slips, it may list flat or even slight decline. Investors hoping for large gains may be disappointed.

Long-Term Investment View

India is pushing hard on digital transformation. Demand for cloud, cybersecurity, and data regulation is rising. Companies like iValue are well placed. It has infrastructure, partners, customer base. The long-term story depends on tight execution. Growth may come from expanding ALM, software, and services pieces. Strong OEM relationships and the ability to maintain supply and delivery will be key.

Bottom Line

The iValue Infosolutions IPO, which closed with a 94% subscription and a flat grey market premium, signals modest listing gains. While short-term investor enthusiasm appears limited, the company’s strong OEM partnerships, wide client base, and international presence highlight its growth potential in India’s expanding IT and cybersecurity market.

Dependence on top clients and market volatility remain risks, but for medium- to long-term investors, iValue offers a promising story if it executes well. The listing on 25 September 2025 will reveal initial market sentiment, but cautious optimism remains the key approach.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.