US Stock Market Today: Futures Slip After Record Highs

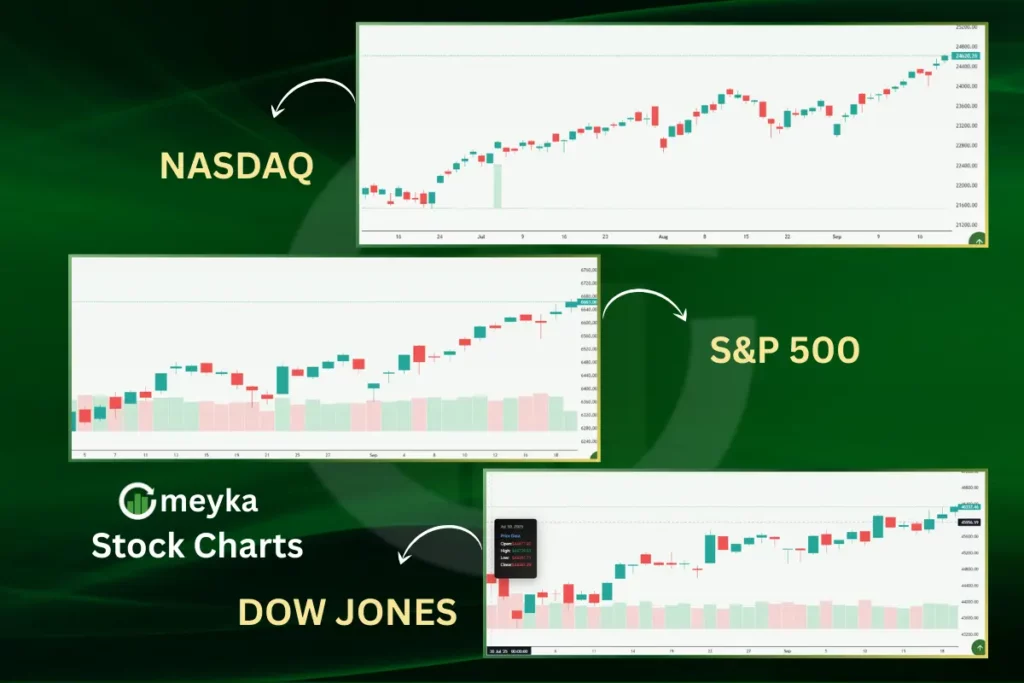

On Monday, September 22, 2025, U.S. stock futures edged lower following a week of record-breaking gains. The Dow Jones Industrial Average and S&P 500 closed at all-time highs last Friday, marking significant milestones in the market’s recovery. However, as the new week begins, investors are adopting a cautious stance. Futures for the Dow, S&P 500, and Nasdaq-100 all declined by approximately 0.3%, which signals a pause after the recent rally.

This pullback comes as traders digest a mix of economic data and corporate earnings reports. The market’s recent surge was fueled by optimism over the Federal Reserve’s interest rate cuts and strong corporate earnings. However, concerns about inflation and potential policy tightening are prompting investors to reassess their positions. Additionally, geopolitical tensions and global economic uncertainties are contributing to the cautious outlook.

As we go through this period of market volatility, it’s essential to stay informed about the factors influencing stock prices and to consider how these developments may impact investment strategies.

Key Market Movements

On Monday, September 22, 2025, U.S. stock futures experienced a slight decline following record highs achieved on Friday. The Dow Jones Industrial Average, S&P 500, and Nasdaq-100 all closed at historic levels on September 19, 2025. However, as the new trading week began, futures for these indices fell by approximately 0.3%, indicating a pause after the recent rally.

The S&P 500, which tracks 500 of the largest U.S. companies, closed at 6,649 points on September 19, 2025, marking a 0.23% decrease from the previous session. Similarly, the Nasdaq Composite, known for its technology-heavy composition, also showed a slight pullback. These movements suggest that investors are taking a cautious approach after a period of strong gains.

Drivers Behind the Slip

Several factors contributed to the dip in stock futures:

- Economic Data: Investors are awaiting the release of the Personal Consumption Expenditures (PCE) price index later this week. The PCE is the Federal Reserve’s preferred inflation gauge, and its data will provide insights into the current inflationary pressures in the economy.

- Federal Reserve’s Monetary Policy: The Federal Reserve’s recent decision to cut interest rates by 25 basis points has raised expectations of further rate cuts. While lower rates can stimulate economic growth, they also reflect concerns about a cooling labor market and persistent inflation.

- Geopolitical Tensions: President Trump’s recent decision to impose a $100,000 fee for new H-1B visas has created uncertainty in the tech sector, particularly affecting companies with significant operations in India. This move has strained U.S.-India relations and added to the cautious market sentiment.

Analyst Insights & Investor Sentiment

Analysts note that the market has learned to thrive in ambiguity, with traders focusing on plausible narratives that fuel optimism, even without clear certainties. Despite the recent pullback, the overall trend remains positive, driven by strong corporate earnings and expectations of continued monetary support from the Federal Reserve.

Specific Stock Highlights

Several stocks have been in the spotlight recently:

- Nvidia: The semiconductor giant announced a $5 billion investment in Intel. This boosts investor confidence.

- Apple: Strong demand for the new iPhone 17 led to a price target upgrade, reflecting positive sentiment in the tech sector.

- Micron: The memory chipmaker has seen its stock rise sharply ahead of its upcoming earnings report, prompting discussions about potential profit-taking.

Market Outlook & Forecast

Looking ahead, the market faces a period of uncertainty. Investors will closely monitor the upcoming PCE data and any developments related to the Federal Reserve’s monetary policy. While the long-term outlook remains positive, short-term volatility is expected as market participants digest new information and adjust their expectations accordingly.

According to Meyka AI, as of September 22, 2025, the S&P 500 ETF (SPY) is trading at $663.70, reflecting a 0.23% increase from the previous close. The Invesco QQQ Trust (QQQ) is at $599.35, up 0.72%, and the SPDR Dow Jones Industrial Average ETF (DIA) stands at $462.94, a 0.08% rise. These movements suggest cautious optimism among investors. Meyka’s AI-driven tools indicate that sectors like technology and industrials are showing resilience, while areas sensitive to interest rates may experience short-term pressure.

Bottom Line

The small drop in U.S. stock futures on September 22, 2025, after record highs, shows a natural pause after big gains. Investors face a mix of economic reports, Fed policies, and global events. Using a USU AI stock research analysis tool can help track trends and adjust strategies, making it easier to handle these changing market conditions.

Frequently Asked Questions (FAQs)

On September 22, 2025, US stock futures slipped after record highs. Investors stayed cautious because of upcoming economic reports, possible interest rate changes, and global events creating uncertainty in markets.

Tech stocks like Nvidia, Apple, and Micron moved differently on September 22, 2025. Some fell slightly from profit-taking, while others stayed strong due to positive earnings and investor confidence.

Investors should watch the PCE inflation report, Federal Reserve policy updates, and earnings announcements. These will show trends and may affect market direction after September 22, 2025.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.