Nvidia Surges on $100B OpenAI Investment, Huang Backs Huge AI Project

We saw something huge on September 22, 2025. Nvidia announced it will invest up to $100 billion in OpenAI. The goal is to build massive AI data centers. We will also see at least 10 gigawatts of computing power powered by Nvidia systems.

This deal is a game-changer. We are on the brink of the next phase in AI infrastructure. Nvidia’s CEO, Jensen Huang, backs this huge project. We can expect the first part of the build, one gigawatt to start in the second half of 2026.

Let’s explore what this means for Nvidia, for OpenAI, and for the future of computing.

Background: Nvidia’s Position in AI

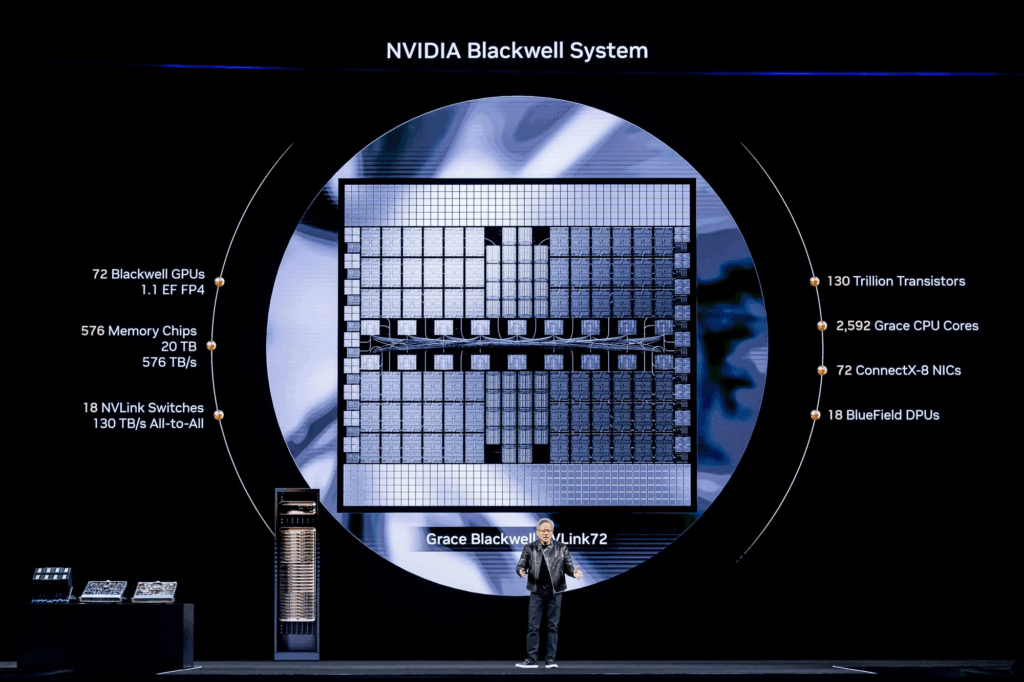

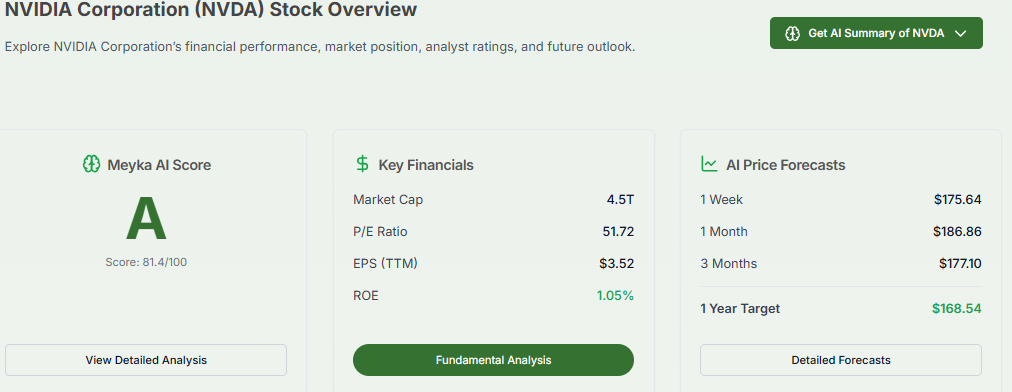

Nvidia has led AI hardware for years. Its GPUs power OpenAI, among many others. Demand for its chips has exploded. The supply chain tightened. Competitors tried to catch up. But Nvidia kept its lead through strong innovation in chip design, efficient manufacturing, and strategic partnerships. This has given it high margins. It also gives it bargaining power in deals like this new one. Analysts often look at Nvidia not just for revenue, but for its ability to deliver scale and consistency in AI compute.

OpenAI’s $100B Investment Plan

On September 22, 2025, Nvidia announced it would invest up to $100 billion in OpenAI. The deal aims to build at least 10 gigawatts (GW) of AI data center capacity. The first gigawatt is set to come online in the second half of 2026, using Nvidia’s upcoming Vera Rubin platform. OpenAI will buy Nvidia’s chips with cash. Nvidia, in turn, will gain non-controlling shares in OpenAI.

Funds will be disbursed progressively. Each phase of deployment unlocks more investment. OpenAI expects that this will let it scale compute in line with its model training needs. Using the USU AI Stock Research Analysis Tool, some projections suggest revenues tied to this computing scale could reach hundreds of billions over time.

Jensen Huang’s Backing & Vision

Nvidia’s CEO, Jensen Huang, called this a “monumental” project. He emphasized that computing is at the heart of AI progress. Huang noted that 10 GW may require roughly 4-5 million GPUs, more than Nvidia will ship this year alone. He described the partnership as another leap forward in intelligence infrastructure.

OpenAI’s leadership, Sam Altman and Greg Brockman, echoed that sentiment. They said this infrastructure is essential for future breakthroughs and plan to scale both models and products. They aim to reach more users, power more applications, and push closer toward artificial general intelligence.

Market Reaction

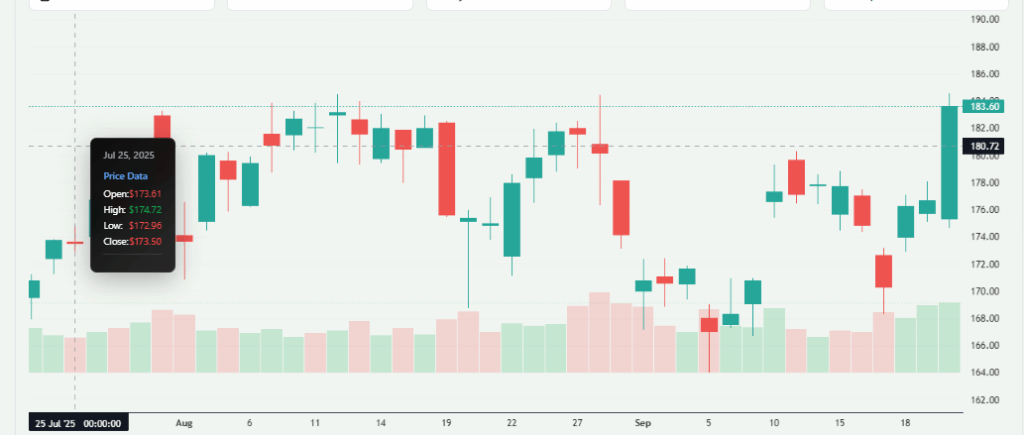

Investors responded fast. Nvidia’s stock rose about 4% immediately after the announcement. The company added tens of billions in market cap. Some reports estimate ~$200 billion in added value in a short time. Analysts praised the move. Many said it cements Nvidia’s dominant position in AI hardware. It also secures OpenAI’s access to future chip supply. Others warned about risks: cost, energy use, and regulatory exposure. But overall sentiment leans positive.

Strategic Implications for the AI Industry

This deal shifts industry dynamics. Nvidia becomes more than a chip vendor. It becomes a co-builder, investor, and critical partner. OpenAI gains more control over its infrastructure. Together, they co-optimize hardware and software. This may pressure rivals like Google DeepMind, Meta, and Anthropic.

Cloud providers also feel it. Microsoft, Oracle, and Amazon will compete harder or partner more deeply. Nvidia’s strategic stake in OpenAI might influence pricing, access, and standards. The deal may change how AI labs negotiate for infrastructure.

Challenges & Risks

Cost is huge. Building data centers, powering them, and cooling them is expensive. The energy demand of 10 GW is enormous. It may strain grids or require new energy infrastructure.

Regulatory risk looms. Non-controlling equity and circular cash flows (OpenAI buying Nvidia chips) will draw scrutiny. Antitrust authorities may examine the deal.

OpenAI must deliver breakthroughs to justify this scale. If models or products don’t perform, or costs escalate, investors might pull back.

Broader Impact on Society & Economy

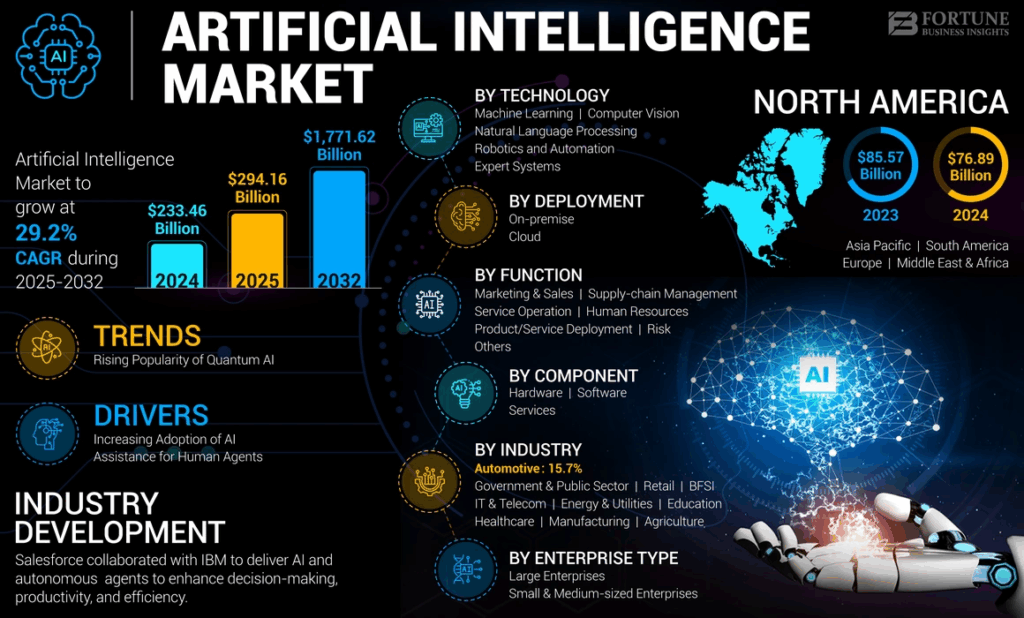

Advances in AI could accelerate progress in healthcare, science, and engineering. Better models may help with disease diagnosis, climate modeling, and automation.

On the flip side, risks to jobs, privacy, and safety grow. With great computing power comes great responsibility. Governance, ethics, and regulation must keep pace.

This mega-investment signals that AI infrastructure is now seen as core infrastructure like power, roads, or networks. Its impact may last decades.

Expert Opinions & Analyst Projections

Some experts estimate that each gigawatt of AI data center could generate $50 billion or more in revenue. That means the full 10 GW may unlock $500 billion in value over the years.

Others caution that margins could shrink. Energy costs, supply chain issues, and competition from custom chips may cut into profitability.

Some analysts believe Nvidia stock might continue to rise if OpenAI delivers. Others warn the investment could be hedged if global economic headwinds hit.

Wrap Up

Nvidia’s $100 billion investment in OpenAI on September 22, 2025, marks one of the boldest bets in tech history. It is more than a financial deal. It is a move to reshape the AI landscape for decades. Nvidia secures its place as the backbone of AI infrastructure. OpenAI gains the compute power it needs to scale its models and push closer to artificial general intelligence.

The stock market already reflects the excitement. Nvidia gained billions in market value within hours. Analysts see both huge opportunities and serious risks. The cost of power, regulatory concerns, and the possibility of over-building cannot be ignored. Still, the long-term potential is vast.

This partnership also signals a new era. AI compute is no longer a support system. It is becoming a global utility, as important as electricity or the internet. If Nvidia and OpenAI succeed, they may set the foundation for trillion-dollar AI ecosystems. For society, it means faster progress, deeper questions, and the start of an AI-driven decade.

Frequently Asked Questions (FAQs)

On September 22, 2025, Nvidia’s stock jumped nearly 4% after it said it would invest up to $100 billion in OpenAI. This shows high investor confidence. Demand for Nvidia’s AI chips and infrastructure is growing fast.

Yes. Nvidia announced a plan to invest up to $100 billion in OpenAI. The investment will be phased in as OpenAI builds AI data centers using Nvidia systems.

Nvidia has invested heavily in AI infrastructure and its own chip platforms. The latest deal with OpenAI $100 billion, stands among its largest AI-related commitments.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.