Latest GMP Update: GK Energy IPO Oversubscribed 6.41x

On September 23, 2025, the GK Energy IPO was oversubscribed by 6.41×. We saw demand far outstrip supply. Investors rushed in. The Grey Market Premium (GMP) shot up sharply. This shows high hopes for GK Energy’s debut.

We need to explain what this means. Oversubscription tells us many people want a piece. GMP tells us how much extra people are willing to pay before the shares even list. Together, they signal confidence. But also risk.

GK Energy works in a high-interest sector. Energy stocks lately attract big money. We are watching this IPO closely, and want to see if the GMP matches the real listing performance. We ask: Will GK Energy’s shares start strong? Will the after-market keep its momentum? Or will the buzz fade?

Let’s unpack the oversubscription, track the GMP trends, and explore what this means for investors like you and me. We share insights. We look for what matters.

Background on the GK Energy IPO

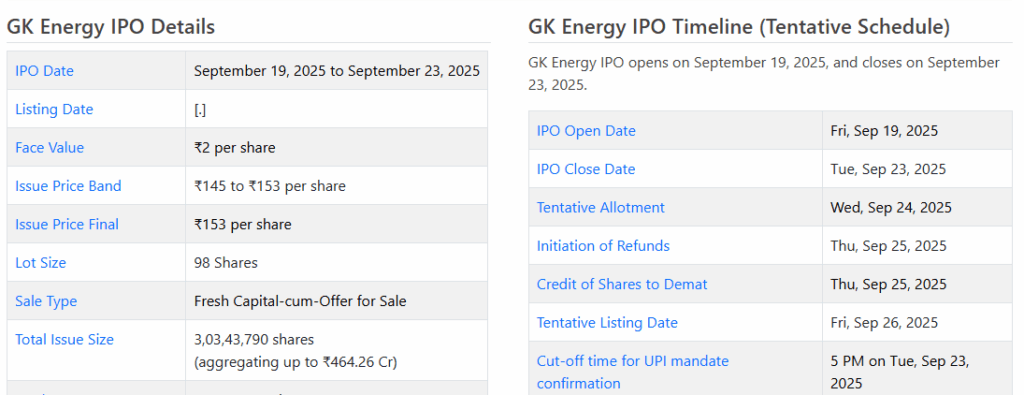

GK Energy is a Pune-based firm that builds solar-powered agricultural water pump systems. The company works as an EPC (engineering, procurement, and construction) provider under schemes such as PM-KUSUM. The IPO opened on September 19, 202,5, and was set to close on September 23, 2025. The price band was fixed at ₹145-153 per share, with an issue size of about ₹464 crore that combined a fresh issue and an offer-for-sale.

On September 22, 2025, the IPO drew strong demand and was reported as subscribed 6.41 times on Day 2. Exchange data showed bids for roughly 14.22 crore shares against about 2.22 crore shares on offer. The filing also noted that anchor investors had taken a slice at the top of the band before listing. These numbers show early, broad interest.

What does Oversubscription and GMP Mean Here?

Oversubscription means more orders arrived than shares available. A 6.41× subscription means bids were more than six times the supply on that day. That usually signals strong demand from retail and institutional buyers.

Grey Market Premium (GMP) is the unofficial price that buyers and sellers quote before shares are listed. A rising GMP suggests traders expect a positive listing. But GMP is not a guarantee. It can move up or down quickly. Brokers often treat GMP as a sentiment indicator rather than a hard predictor. Live market checks during this IPO showed a noticeable grey market premium at various points in the bidding period.

Latest GMP Update and How it Moved?

During the IPO window around September 22-23, 2025, reports placed the GMP in a range that indicated optimism. Some outlets reported GMP levels near 12-26% above the issue price at different times on Day 2 and Day 3. Other live trackers showed a per-share grey premium figure (for example, ₹20 per share on some real-time pages). These variations reflect that the grey market numbers were fluid through Sep 22-23, 2025. Traders watching pre-listing trades used these numbers to form short-term views.

What do the Subscription and GMP Imply for Listing Day?

High subscription combined with a strong GMP usually points to a likely listing gain. It often results in a positive first-day jump for many IPOs. Still, several factors can change that outcome. Market mood on listing day, profit booking by short-term traders, and wider market moves matter a lot.

Investors should expect volatility. GMP can be higher than the actual listing gains. Some IPOs with high GMP gave big listing pops. Others cooled off quickly once formal trading began. Treat GMP as one input. Use fundamental checks and risk limits as well.

Risks and What to Watch?

- Hype vs. fundamentals. Strong demand can be driven by short-term buzz. If business metrics do not support high valuations, prices can fall after listing.

- Market conditions. Broader selloffs or sector weakness on listing day can negate pre-listing optimism.

- Grey market reliability. GMP is unofficial. It lacks regulatory oversight. Values can be inconsistent across platforms.

- Allocation and lock-ins. Retail investors may get only a small portion of the shares applied for. QIB and anchor allocations also shape post-listing supply

Comparison with Similar Recent Energy IPOs

Recent renewable or energy-sector IPOs have shown mixed outcomes. Some solar/energy listings delivered solid first-day returns after strong grey market signals. Others cooled fast because valuations were seen as high. The pattern underlines that strong subscription is promising but not a sure bet. Tools such as an AI stock research tool can help sift through historical listing patterns and risk metrics to form a clearer view. Use such tools only as one element in decision-making.

Market Commentary and Expert Signals

Brokerage notes around Sep 22-23, 2025, labelled GK Energy’s IPO as high-risk but noted long-term potential given its tie-ups with farm electrification programs. Analysts pointed to solid anchor participation and early retail interest as positives. Others urged caution because the business relies on government schemes and component supply chains that can be cyclical. Keep an eye on post-issue financial disclosures and the allotment details.

Practical Takeaways for Investors

- Do not buy solely on GMP. Use company numbers too.

- Decide holding period in advance. Short flips and long holds require different plans.

- Check allotment status and the final listing price. Compare it with GMP, but expect gaps.

- Watch the wider market on the listing day. That often decides the actual listing move.

Final Words

The 6.41× subscription on September 22, 2025, marked a strong early vote of interest for GK Energy. The grey market showed optimism too during Sep 22-23, 2025. However, the listing outcome will depend on actual allotment, market mood, and post-issue trading flows. Monitor the allotment announcement and the formal listing on the exchange to see how sentiment translates into price action.

Frequently Asked Questions (FAQs)

The GK Energy IPO was oversubscribed 6.41 times on September 22, 2025. This means demand was much higher than the shares available for investors.

As of September 23, 2025, the grey market premium (GMP) for GK Energy IPO ranged between 12% and 26% above the issue price, showing positive investor interest.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.